I was vested in E-pure when it was 20c a share thereabouts. This was back in early 2009.

I was convinced that China's drive to keep its economy humming in the wake of the Lehman Brothers crisis would benefit the water infrastructure businesses.

I was also heavily vested in Hyflux Water Trust at that time from 30c for the same reason.

Read related blog post here.

E-pure was a Chinese company and was likely to be favored over Hyflux in China while Hyflux Water Trust was a business trust with zero gearing treating water for Chinese industrial estates and had a yield of about 17% at a unit price of 30c.

I divested E-pure completely by the time it neared 60c a share and watched dumbfounded as the share price went on to form new highs, almost doubling from my sell price of close to 60c.

Hyflux Water Trust was, of course, privatised a few months ago.

Read related blog post here.

I have been wondering if I should re-invest in E-pure which has been renamed SoundGlobal for some time now.

It remained on my watchlist but I simply refused to buy any of its shares at prices higher than 60c.

That's just the memory effect working and, in this case, it seems to have paid off. Related post here.

I just told myself that if the price did not come down to more reasonable levels, there are always other investments out there.

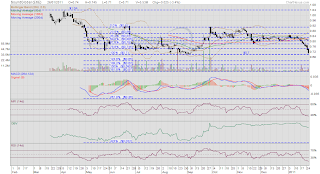

Since hitting a high of $1.04 on 7 April 2010, this counter has not formed a higher high. It is currently hugging the lower Bollinger band as it fast approaches the lows of early September 2010 at 70c a share.

The obvious difference is that the low of early September 2010 was part of a bottoming process and the MACD was getting ready for a bullish crossover with the signal line.

The MACD is now declining rapidly in negative territory as its distance with the signal line widens. This is very bearish.

Having said this, both the MFI and RSI are in oversold territories and 70c, being a low that was the price of a successful bottoming process could provide some support.

Whether it would hold up is another question. I would not speculate on the strength of the support here.

When to accumulate?

We want to look out for possible positive divergence between price and the momentum oscillators or volume.

We want to look out for the downtrend halting and clearer signs that price is breaking out of downtrend.

I like to use Fibo lines in such an instance to see how low price could go in case support breaks. Support is, of course, at 70c.

Looking at the chart, the three golden ratios are at 62c, 59.5c and 57c. Buy some at those levels?

I might if the other signs are encouraging.

8 comments:

Hi AK,

I think the recent downtrend came after the CFO resign. It might be a good opportunity to accumulate some shares if you are bullish about SG growth prospect.

Personally, I think Sinomem remains as one of the cheapest water stock listed here. I think it looks poised to earn over SG$30 million this year as more BOT projects turns operational. United Envirotech also has pretty good prospect with its recent projects award. Whats your view on these stocks ?

Cheers,

Nick

Hi Nick,

My research on SoundGlobal was done during its Epure days. At that time, I looked at Sinomem as well. Epure was 20c and Sinomem was 10c.

Then, I decided to invest in Epure and not Sinomem because of the former's size, track record and larger customer base. Sinomem had a niche at that time with services to the pharmaceutical sector.

Epure did very well but Sinomem has been really stellar. I did not foresee Sinomem diversifying its services and customer base back then. Just one of those things.

As for how they are looking now, I am assuming that SoundGlobal is much stronger now than its E-pure days. This is why I am looking to invest in the company again. Of course, I really should spend some time updating my FA. Will see. ;)

Hi AK,

Thanks for the quick reply.

Sound Global is the largest of the 3 Mid Cap water companies here in terms of earnings and NAV. All 3 are in a net cash position though SG has convertible bonds which may dilute earnings if converted. SG has earned over $36 million while Sinomem has earned $26 million in the 9M 10. I guess it is safe to safe that SG is around 40% larger than Sinomem.

I noticed that Sinomem has been divesting its downstream assets and focused on its more lucrative water treatment segment. Its annualized PER is 7.7 while SG PER is 19.5. United Envirotech is somewhere in the middle !

Not sure why Sinomem is trading at such levels ???

Any views ?

Nick

Hi Nick,

Thanks for sharing the FA snapshot on the 3 companies.

As to their valuations, I guess there is always a premium placed by the market on larger companies in a sector. For example, when I compared Hyflux and Epure many moons ago, I told myself I would really like to buy Hyflux but only if it was cheaper. ;)

I believe that Sinomem is trading at such level because

- firstly, it is regarded as an S-chip,

- secondly, it is not a pure water treatment play with one-third of the company contributed by downstream products (as definedby the company itself)

- thirdly, there are quite a few high profile water play listed on SGX

- Lastly, and most importantly, it lacks coverage by the brokerages in such a small market like Singapore, like Vickers covers only Epure (but they are a shareholder of Sinomem if I am not mistaken)

So we can only wait till they divest their downstream business and recycle the money into water treatment, and hopefully a dual listing would take place.

Vested.

Hi Kelvin,

Thank you very much for sharing your views here. Much obliged. :)

A reader's email on Citic made me take a walk down memory lane. Read only if you are interested in some history and how I used TA back then.

Reader says...

citic envirotech... very cheap stock 11x pe,

Rev growth almost 100% p.a.

Bottom line much slower

Major customer think 80% prc govt.

I too had sound global, unfortunately stuck with suspension. Cant avoid fraud😢

AK says...

I got into Sound Global during its E-pure days and was fortunate to make some money.

Like I said, I haven't touched S-chips since my time with China Minzhong.

I don't know if we can take comfort in Citic having the Chinese government as a major shareholder if we remember China Aviation Oil...

Chen's company announced it had lost US$550 million in oil derivatives trading, forcing it to seek court protection from creditors.

Derivatives are contracts whose value is tied to another security, such as a stock, bond or commodity. Energy derivatives include futures on oil and oil-based fuels and related options contracts.

Shortly after the disgrace was exposed to the public, Chen was suspended from his post by CAO's Beijing-based parent company, the State-owned China Aviation Oil Holdings Corp (CAOHC), which ordered him to return to China.

On December 1, Chen left Singapore for China. His departure sparked outrage among investors, who demanded he return to the city state to undergo investigations from the Singaporean authorities.

http://www.chinadaily.com.cn/english/doc/2004-12/23/content_402605.htm

Post a Comment