Hello AK,

I've been following your blog closely for up to 3 years now. Your philosophy to investing has helped to influence mine from investing purely for growth to one that invests for income as well. I would like to seek your insights on something that might be beneficial for young parents.

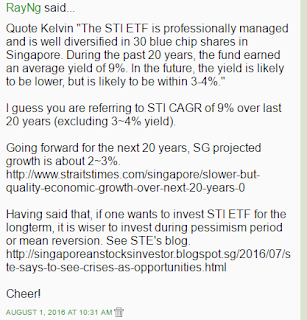

I have an 18 months old daughter and have been considering saving up for her university education. I would like to explore using a monthly savings plan in the STI ETF to achieve this. Using the financial data available, we can calculate the CAGR from its inception in 2009 to 2016 to be approximately 11 percent. But I know that this does not apply for a monthly savings plan. Any idea how I can do that?

Thanks and Best Regards,

R

|

| Source: ASSI |

Hi R,

11% is in retrospect. It is unlikely that STI ETF will deliver that kind of performance in future. It is likely to be much lower. Remember that Singapore recovered sharply from a deep recession in 2009.

This option should still do reasonably well and is probably less costly compared to getting an endowment plan from an insurance company.

I don't know how to calculate base on a monthly savings plan but it shouldn't matter. Over a very long term, it is about smoothening performance over time.

Best wishes,

AK

11% is in retrospect. It is unlikely that STI ETF will deliver that kind of performance in future. It is likely to be much lower. Remember that Singapore recovered sharply from a deep recession in 2009.

This option should still do reasonably well and is probably less costly compared to getting an endowment plan from an insurance company.

I don't know how to calculate base on a monthly savings plan but it shouldn't matter. Over a very long term, it is about smoothening performance over time.

Best wishes,

AK

Parents should read this post too:

How to have enough to fund a university education?

7 comments:

the screen capture gt his name leow.

R neber enuff details (age/income), but can consider putting 7k/yr in his own/wife SA. 18 yrs later, the dotter enter uni, if he/or wife's can hit minimum sum then, can withdraw excess as uni fees. he/she doesnt have to be 55 when the dotter is 19... she can take tuition loan 1st, then start paying after graduation (usually interest free during study, i think) so in theory... suitable for parents aged (55 - #yrs to uni) +- 4 yrs. If just nice 55 yr old b4 entering uni, withdraw $ and put in dotter's CPF (provided she go local U)

DCA in STI, can work as well, but what if 18 yrs later, is another GFC... or super bull run? so need a determined decision to sell then, even if delaying it by 1-4 yrs later(same as above).

imho, its gd to let the dotter know what is debt, or the "feel" of having to repay a loan. and same same as explain in flight emergencies, take care of yourself 1st, then can better care for kids. i noe ... heartless

Eh, nt qualified financial planner... and no kids... so just provide an idea n c feasible mah

Not tree

eh... did i use my company gmail acct just now? if yes, pls dont publish... haha

Hi Not Tree,

Haha... Lucky. Not company gmail acct. ;)

R is not RayNg. Another name starting with R. :)

Enjoyed listening to you talking to yourself. ;p

Hi AK,

Please pardon my noob question.

I have heard that investment in ETF is cheaper but buying ES3 incurs the same minimum brokerage of $28. May I find out the other options in investing in ETF and the kinds of brokerage fees to expect?

today suddenly free in ofc, read ak blog... eh... gt frens chit chat abt tis b4 so... tell them same thing... some say i so heartless one... "bcos u single ==> no kids, u dun noe", but if i gt kids i also do same plan wat...

so shun bian post comments... vent a bit bit...

signed off as "Not Tree" bcos dun want u to confuse u with Tree. haha... but ok... can stick with it.

Hi Brian,

There are probably various options available. Just find one that you are comfortable with which makes sense for you. I won't say more on this. ;)

Hi Not Tree,

Want to try signing off with another nick? ;)

Simi is heartless?

I always say unless we are rich, it is better to be pragmatic than romantic. ;p

Post a Comment