Regular readers know that I have been doing voluntary contributions to my CPF account every year.

I consider the CPF a special investment grade bond that is risk free and volatility free while paying relatively attractive coupons of 2.5% and 4%.

The plan was to continue doing maximum voluntary contributions till I turn 55.

In my age bracket, a bigger percentage of my voluntary contribution would go to my SA which enjoys a 4% interest rate.

Approximately, 31% of my voluntary contribution would go into the SA while the rest goes into my OA.

What about the MA?

My MA is usually maxed out while my SA has already exceeded the Full Retirement Sum (FRS) and, so, what is supposed to go into my MA would flow into my OA instead.

However, with interest rates rising, I have been keeping an eye on the Singapore Savings Bond.

The effective interest rate for my voluntary contributions to my CPF account for the next few years is about 3% per annum which is an averaging of the interest rate for the OA and SA by contribution proportion.

It is a no brainer that if I am able to get more than 3% from another risk free and volatility free instrument, it would trump the CPF even for my age bracket.

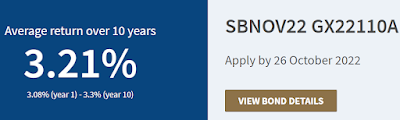

SSB is now offering 3.21% per year.

Even if we were to hold for only 1 year, it will pay 3.08%

|

| Source: MAS. |

So, I will be applying for the SSB closing on 26 Oct for a sum of $38,000 or a rounding up of $37,740 (i.e. the CPF annual contribution limit) which has been earmarked for voluntary contribution to my CPF account in the new year.

As I expect the level of interest in this SSB to be rather high, my application is probably only going to be partially filled.

In such an instance, I will use the refunded money for future SSB applications if the coupons remain higher than 3%.

Again, what about the MA?

The plan is still to do a top up to my MA in the new year to hit the new Basic Healthcare Sum (BHS) as that enjoys a 4% interest rate.

However, if the SSB coupon should exceed 4% before then, I will channel the money earmarked for my MA to the SSB instead.

So, it seems that I will either be making a smaller contribution to my CPF account in 2023 or not at all.

The big picture really has not changed.

I am still growing the risk free and volatility free investment grade bond component of my portfolio.

However, the interest earned in the SSB is not retained and compounded unlike the CPF.

I must be prudent and put the interest earned to work and not consume it.

So, CPF or Singapore Savings Bond?

Same, same but different.

References:

1. 2022 CPF contribution and top up.

2. $1.1m in CPF savings!

18 comments:

Hi AK, how about the 6mth SGS Tbills?

Hi AK,

This post came at a very opportune time as I was deliberating whether to make a voluntary housing refund to CPF or to apply for SSB or T-bill, just to make the extra cash work harder.

Thanks for sharing your thoughts on the comparison between CPF contribution vs putting into SSB.

CK

Hi Yv,

I am looking for an equivalent instrument to replace the CPF.

It isn't just the interest rate I have to consider but also how long I can hold it for.

So, the 6 mths T-bill being short term doesn't fit the bill. ;p

Hi CK,

I am glad you find the blog helpful. :)

Just talking to myself, of course. ;)

Ak

Clct at 10% nao

Hi SgFire,

If CLCT should offer a 10% distribution yield, I might buy more, all else being equal.

That would offer adequate compensation for the risks that come with investing in China now.

Annualizing 1H 2022 DPU gives us 8.26c.

So, 82.5c a unit? ;p

Hi AK, if you go for SSB, wouldn't that miss out on the SA portion?

As you said, in your age range, the allocation for SA is actually higher than before 50 or after 55. I reckon one would want to do VC3AC from 50 to 55 and maybe stop after 55 due to the above reason.

All of us need a risk free, volatility free investment grade bond component in our portfolio.

The CPF does this job perfectly for me and the SSB fits the bill too now that it offers more competitive coupons.

See my largest investments in 2022:

Largest investments in 2022.

Hi TASM,

The answer to your question (i.e. missing out on the 4% SA interest) is in the blog. ;)

Hint:

Look for "an averaging of the interest rate for the OA and SA by contribution proportion."

Thanks AK71! Trust you to have done the complicated maths =p

Hi TASM,

Beyond addition, subtraction, multiplication and division, Math is as esoteric as Greek to me. ;p

So, I appreciate readers who poke me from time to time to check my numbers.

Kamsiah you plenty plenty. :D

I am foresee the same issue like you on SSB or CPF this year and early next year. thanks for the article.

Hi Cory,

It seems that the plan is to hike another 1.25% by end of the year which means we are likely to see higher interest rate in Singapore as well.

So, in such an instance, I would continue to channel money earmarked for the CPF to SSBs.

Of course, things could change as the global financial system seems to have cracked under the pressure of the Fed's rapid rate hikes what with the Yen, the Pound and the Euros' rapid decline, just to name a few.

Well, when elephants fight, the grass gets trampled.

We just have to try not to be trampled (too badly.)

Hi ASSI

What do you think of using your CPF OA to invest in one year t-bill

If the interest for it is 3.33 percent and you invest 500k,

The return is about 4150 minus 1042.

The 1042 is the interest you will lose for one month for the transaction month.

CPF pay interest monthly if I am not mistaken.

Thanks.

Hi Aa,

With T-bills, we cannot be sure what is the return we will get since the yield is determined by auction.

However, it does seem more likely now that the return will be higher than 2.5%.

I am just too lazy to go visit a bank to submit the application form for this. ;p

Hi AK,

Comfort Delgro share price has dropped.

Can you share your thoughts about it?

Thanks

Hi Rookie,

Oh, that's an easy one.

ComfortDelgro's common stock was cheap and it is even cheaper now. :)

References:

1. ComfortDelgro or SIA?

2. Investing for passive income and stock prices.

Hi EX,

Oh, for FDs, I just stick to UOB and OCBC mostly because I have existing accounts with them.

It is too much hassle for me to go switching banks for a little bit more interest here and there.

Yes, AK is very lazy.

As for how I invest or store my money, that is an easy one.

See:

Investors eat crusty bread with ink slowly for peace of mind.

I think you might have seen that coming from lazy AK. ;p

In such uncertain times, it is probably not a bad idea to be more conservative and have a larger portion of our wealth in risk free and volatility free options.

See:

How to store your money?

Post a Comment