For readers who do not follow my YouTube channel, I produced a new video yesterday.

It was a video about investing for income.

I covered a few things in the video like what to focus on when investing for income?

I also gave a brief explanation on why I sold my investment in SATS and Centurion Corp.

You might want to subscribe to my YouTube channel for free and timely notifications.

This is the link to the said YouTube video, produced and voiced by AK himself.

AK's YouTube video:

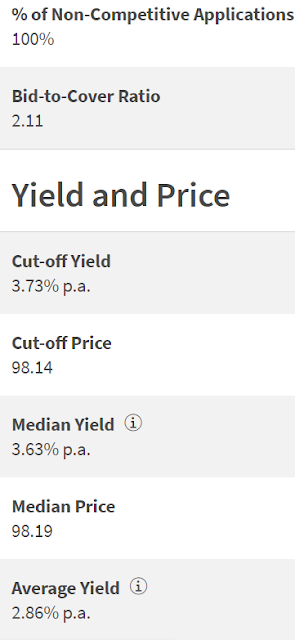

Another 6 months T-bill auction closed today.

Cut-off yield is 3.73% p.a.

Can't complain.

This is much higher than what DBS, OCBC and UOB are offering for their 6 months fixed deposits.

I increased the quantum in my non-competitive bid and I am pleased to get 100% of my application filled.

Getting some income from risk free and volatility free fixed income investments isn't a bad idea.

This is especially when interest rates have become much more interesting in the last year and a little more.

I am sticking to my plan to stay invested in income producing businesses while also strengthening my income producing T-bill ladder.

This way, I continue to get paid even as I wait for Mr. Market to go into another depression.

AK cannot predict when Mr. Market might go into another depression.

However, AK can certainly prepare for it, and fill up his war chest in the meantime.

If AK can do it, so can you!

hello AK, what happens if ur money is stuck in T-bills that haven't matured and Mr Market goes to sudden depression and u miss liao ar

ReplyDeleteHi asd,

ReplyDeleteThis is why I agree with a reader that we should also have some money in high yielding savings accounts like UOB ONE or CIMB.

See my YouTube video on this topic:

UOB ONE account + CIMB Fastsaver account a good combo for some of us!

The T-bill ladder would still help because Mr. Market's depression usually lasts for a few months.

I also have some fixed deposits and SSBs which I can break to access more funds quickly.

Thanks for the great question which I have been waiting for someone to ask! ;)

Centurion is good company, it used to be undervalued. I didn't hold it because I hold big position S REIT ETF. Centurion is in also real estate business, it is similar to REIT. I am lasier than AK, I love ETF more than individual stocks. My goal is lower than AK also, I just wanted to beat inflation, make sure my yield is higher than fixed income in the long term.

ReplyDeleteHi MilkTeaBro,

ReplyDeleteCenturion is running a good business but I don't know if it is a good company.

Not after what happened during the pandemic and immediately after.

Didn't strike me as being shareholder friendly.

Anyway, I still hold a small investment after reallocating most of the funds from divestment into OCBC and UOB.

Rather not have to deal with the possibility of not getting dividends again. ;p

Hi AK,

ReplyDeleteAny thoughts about the recent high share price of Centurion?

https://www.straitstimes.com/business/companies-markets/centurion-in-pole-position-as-workers-dorms-may-be-a-top-investment-for-10-to-15-years

Would you continue to hold given such positive news?

Thanks

Hi Spotlessmind,

ReplyDeleteI reduced exposure significantly some time ago and used the funds to invest in DBS, OCBC and UOB.

I talked a little bit on why I did this in the video I produced yesterday:

INVEST with CONFIDENCE! What should we be mindful of?

If I still have a significant investment in Centurion, I would be cutting exposure.