It has been quite a while since I tinkered with the CPF website.

I remember how I used to visit the website very often back in the days when I was actively plotting how to make full use of the CPF system.

Anyway, as I close in on 55 years of age, I decided to revisit the CPF website.

That is when I get a Retirement Account set up.

I thought it would be a good idea to check on how much my Full Retirement Sum would be by then.

This was what I found:

|

| Source: CPFB |

So, it would be $220,400 for me.

My CPF-SA has more than that right now and it will continue to grow based on interest earned yearly alone.

Therefore, it isn't a worry for me.

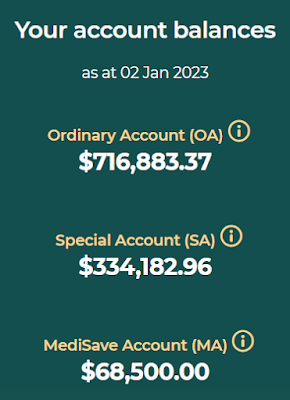

This was how it looked at the beginning of the year:

Then, I checked how much I would get when CPF LIFE kicks in for me at age 65.

For this, I used the CPF LIFE estimator: HERE.

I had to tell the AI that I am 55 years old now in order for it to work and then input the FRS for my age group.

It is a fun calculator to use because I was able to use sliders to change the payout age and also the amount of funds involved to see how things would look like.

Anyway, if I just stuck with the FRS of $220,400 and had the payout start automatically at age 70, I would be paid $2,380 monthly.

If I should request for payouts to start at age 65 instead, I would be paid $1,760 monthly.

Back in 2014, I published a popular blog post that has received almost 50,000 pageviews by now.

It was "To retire by age 45, have a plan."

In that blog post, I said that I wanted to retire by age 45 and thought I would be quite comfortable with $2,500 a month in passive income.

I accounted for inflation and by age 65, I would need $5,081 a month in passive income.

I calculated the required monthly passive income till age 75.

If you are interested to see all the numbers at various ages, please go the blog post and I have hyperlinked the title earlier.

So, what is the point I am trying to make?

For me, at least, the Full Retirement Sum is not enough to retire comfortably on.

At age 65, there would be an estimated shortfall of $5,081 - $1,760 = $3,321 a month.

Please don't get me wrong.

I think that the CPF LIFE is a very good idea because many people are not very good with money and even worse at planning for retirement funding.

So, with CPF LIFE, at least there is some kind of minimum safety net.

However, that is what it is.

A minimum safety net.

In case you are wondering what triggered this blog post, it was a news article on how Singaporeans are falling behind in savings and more can only afford basic expenses.

See article in The Business Times: HERE.

"More Singaporeans can afford only basic spending, don't have enough savings, a survey by OCBC found."

"Most do not have sufficient "emergency funds" or enough savings to meet their families' needs over the next year."

We really want to take action early to help ensure retirement funding adequacy.

During good times, don't become complacent because bad times could hit us when we least expect them to.

Always have a crisis mentality.

It might not be fun but we should do better than those who don't.

If AK can do it, so can you!

Note: Numbers are based on CPF LIFE Standard Plan.

Recently published:

3.75% p.a. cut-off yield for T-bill.

It's case of "never enough" and "just a little bit more"

ReplyDeleteOn this topic of RA55, FRS and SA shielding. Would be nice if you can talk to yourself again on this topic?

Look at doing the CPF hack. SA is above FRS and OA is racing to reach FRS. So, before 55th BD, I do a hack to clean out the OA + $40k from SA. SA to be unshielded the next week after BD, park the SA back. These questions that ran thru my mind:

1. If RA is FRS, can I withdraw the SA interest to top up the RA?

3. So at 65, it's time to collect CPFLife. Other than MA, there is no other account to top up ?

4. At 65, the SA has steadily given interest to fund the RA top-up. It cannot withdraw or do anything else? This part I can't seem to get a direction. A pile of $ in SA, can only give interest withdrawal for pocket $. This is assuming that the principle > the prevailing FRS

Hi SnOOpy168,

ReplyDeleteNot too long ago, CPFB said that CPF shielding was not something "orthodox" and there was talk that this might not be possible anymore in future.

So, I have decided not to think about it until the year I am turning 55. ;p

See:

No more shielding of CPF soon?

As for your questions:

1. I believe we have to choose if we want BRS, FRS or ERS when we turn 55. If we have yet to hit the FRS in the RA, we are still allowed to top up the RA.

2. As for topping up the RA at age 65, my mom is topping up her RA constantly and she is in her 70s but it cannot be topped up beyond the FRS for her age group.

3. Money in the SA and the interest earned can be withdrawn at age 65 but we can choose to withdraw only the interest earned and leave the SA principal intact, of course.

Hi AK

DeleteI'm passed 55 and did SA shielding.

For point #1, FRS was transferred to RA on my BD automatically. We don't have to decide. If we want BRS, need to write in to CPFB. If we want ERS, need to manually transfer from SA to RA. I'm not sure if anything has changed now.

For the SA shielding, I think there's no plan to scrap it, from somewhere I read. CPFB basically said there are risks of capital loss and advise members to proceed carefully. I did made a small loss of 0.5%. Was born in the wrong month. Lol. But recovered it after 6 months of IR differentiate.

"Money in the SA and the interest earned can be withdrawn at age 65".

ReplyDeleteThis is what I am hoping to clarify. Thanks

I see the SA as another source of emergency funds in addition to the SRS funds. Feared that we might need more support for the medical side of things.

I hope I still have the FIRE and ZEST to keep the $ intact and grow it.

I am topping up my RA to jtr prevailing year ERS as long as I am gainfully employed so that I can enjoy a higher payout at 65 or later

ReplyDeleteHi SnOOpy168,

ReplyDeleteThat is a good way to look at the SA and also the OA.

Another pool of emergency funds. :)

Hi Siew Mun,

ReplyDeleteYou are a good role model! :)

Not like unemployed AK! ;p

Hi AK,

ReplyDeleteCoincidentally a friend said : "one cannot depend on CPF. The payout is peanuts!" When I asked him is $140K payout a year enough? He replied :"thats luxurious!" See how the perspective change?

The CPF is a unique savings scheme where you get out what you put in. It is a reliable and safe way to save for retirement. With the CPF one can safely (& quite accurately) project far into the future how much our savings can grow to and how much we can get out from it in retirement. We cannot do the same with stocks nor with property nor with other investment.

My wife and I have built up six income taps to support our lifestyle in retirement. And we ranked them according to their reliability, stability and durability.

No surprise that the most reliable, stable and enduring income taps are from our CPF savings. We called them our gold taps. With this knowledge we have thus been bulking up our CPF savings aiming for 4M65 as a couple. We topped up our RA to the ERS each & every year.

Our next most reliable income taps are our SRS and Medisave taps. We called them our silver taps. Our SRS funds are deployed into single premium insurance products, SSBs and T-bills. Why silver and not gold taps? Because our SRS and the MA, though reliable & stable are not enduring. We planned to drawdown our SRS over 8 to 10 years.

The least reliable and least stable income taps are our dividends and rental taps. We called them our bonus taps. We will use these income to pamper ourselves, buy a car, travel and gifting. These are good to have but we can live without them.

This is how we will draw on the six income taps in our retirement:

From now (62) to 69

Gold tap 1 (interest from OA & SA): $68K pa

Silver tap 1 (SRS drawdown): $53K pa

Bonus Tap 1 (Dividend) : $88K (achieved in 2022), $96K (expected 2023)

Bonus tap 2 (rental): $42K pa

Total cash flow per year : $259K

70 and beyond

Gold tap 1 (interest from OA & SA): $68K pa

Gold tap 2 (CPF Life): $72K pa

Bonus Tap 1 (Dividend) : $100K (projected)

Bonus tap 2 (rental): $42K pa

Total cash flow per year : $282K

As you can see the two gold taps (from CPF) could provide us $140K pa. Certainly not peanuts to us. As I am still working, we have not turned on the taps but letting the savings compound.

I would thus encourage people to build up their CPF to as much as possible before taking on other investment where the returns and capital are not protected nor guaranteed.

See how we build up our six income taps here : https://t.me/CPF_Tree

Hi MSI,

ReplyDeleteThanks for sharing in such great detail.

This blog post is just to show how relying on CPF LIFE alone is probably insufficient.

After all, it is inspired by a news article on how more Singaporeans can only afford basic spending and are falling behind on savings.

For sure, if we want a comfortable retirement, we need to have more than CPF LIFE.

You are another good role model.

Not like unemployed AK. ;p

Hi AK71,

ReplyDeleteSince you have a big gap for FRS, will you be considering going for ERS instead?

Will you be going for Escalating Plan, Standard Plan or Basic Plan?

Do you prefer to start from 65 or 70?

Regards,

MSA

Hi AK, I am a long time reader of your blog and comments. Always thankful that you share and remind us of these schemes that can help us.

ReplyDeleteOn another note, I noticed the commenter secretinvestment MSI a number of times. He is obviously a successful person, congrats to him. His sharing usually seems to want to get people to view his telegram sharing and explicit in telling how much he has, how many taps he has etc. Sir, you are absolutely successful and can be branded as wealthy. Must be in the top few %, congrats again. 4M65, superlative cashflow per year, not many can reach that.

We have so many different types of role models and I hope to one day emulate AK, being unemployed and money working hard for me =PpP

I am contemplating between opting for FRS or ERS (providing ERS criteria is met).

ReplyDeleteDoes going for ERS is a no brainer given it higher payout?

If you are a CPF believer, I guess the pragmatic option is to go for ERS?

The difference between the sum of FRS/ERS vs the annual %payout is easily 8%++

The rate is difficult to match for any other investment.

The downside is of course it’s not liquid.

Or go for FRS (even if you can hit ERS), and use the cash balance for other investment?

Any further thought from readers out there?

Hi MSA,

ReplyDeleteIf I do not need the money, I would probably let CPF LIFE auto start at age 70 to pay me a monthly income.

That would mean getting a monthly payout of more than $2,000 a month with FRS.

As for ERS or FRS, I think I will stick to FRS.

I blogged about it before:

CPF FRS or ERS?

Hi Seberus,

ReplyDeleteI don't know if you watch anime but your name reminds of the powerful head butler in "Overlord." ;p

As for MSI, I agree that he is financially very well off.

When high income earners are good savers, being conservative when it comes to investments would be enough to yield good results. :)

Oh, please don't follow lazy AK's footsteps.

Some people tell me I should be ashamed of myself, remember? (TmT)

Hi GreenOcean,

ReplyDeleteERS is viable, for sure.

However, I am probably sticking with FRS, partly for the reasons you mentioned.

I have provided a link to the relevant blog post in my reply to MSA above. :)

Hi Henry,

ReplyDeleteAlways good to hear from someone who has done it!

Thanks for sharing your experience as I am obviously mistaken. ;p

What did you do to shield your CPF-SA and did you do it a month or two before turning 55, if you don't mind sharing? :)

Hi AK

ReplyDeleteApologise for my late reply.

I bought the Nikko AM Short Term Bond Fund for shielding, one month before my 55 BD. And sold it on my BD after checking that the RA has been created and the FRS has been moved there.

Allow me to kaypoh a bit on another interesting topic, FRS or ERS. I agree with you on just having the FRS. I don't see the need for ERS because at 55, we are already allowed to withdraw all the fund after meeting the FRS. Prefer to leave it in the SA; earn the same 4% interest as RA but has the flexibility to withdraw any balance amount anytime.

Hi Henry,

ReplyDeleteThanks for sharing. :D

I shall archive this for future reference. ;)

As for ERS, good to hear your affirmation as I like to think I am just being rational.

Any amount above FRS does not get paid a higher interest, like you said.

Having more liquidity is good, just in case. :)

Hi AK, and Henry,

ReplyDeleteAppreciate the input. Understand every individual has different needs and situations. But what Henry mentioned make a good sense (couple with the shielding).

Thank you!

why do we need shielding SA? I thought we can withdraw or leave the balance (after FRS) in SA. May be I am wrong?

ReplyDeleteHi AK

ReplyDeleteIf the below a possible solution if I would like to do Dividend Investing

BUT do NOT have the expertise/time to do my own due diligent

Share your thoughts...

https://financialhorse.com/how-to-get-up-to-6-p-a-dividend-income-as-a-passive-investor-united-sg-dynamic-income-fund-review/?fbclid=IwAR2WJxj4327-bfhcnP4rIjxxvo9getTkVoqrDHMHTA26ITK_Hu7Vv4Oheng

Thank you

Hi GreenOcean,

ReplyDeleteI always like to hear what people who have already done it have to say.

All credit goes to Henry. :D

Hi Tun,

ReplyDeleteWe don't have to do SA shielding.

Like you said, we can withdraw all our excess CPF savings once we can fulfill the FRS and the BHS at age 55.

SA shielding is something people who would like to continue leaving their CPF savings intact to enjoy the risk free rate offered by the SA can consider doing once they turn 55.

Hi Busybody,

ReplyDeleteI have given up on managed funds donkey years ago. ;p

For people who do not have the time nor inclination to do stock picking, a simple solution is to buy into an STI ETF consistently.

Nikko AM STI ETF is one option.

See:

OCBC Blue Chip Investment Plan.

Hence the game plan for me, months before turning 55

ReplyDeletea. Liquidate all CPF IS investment. This will skip the minimum OA $20k & SA$40k requirement.

b. Do SA shielding using Nikko AM Short Term Bond Fund

c. On 55th Birthday, let CPF form the RA and see them transfer OA to RA till FRS

d. Liquidate the Nikko AM Short Term Bond Fund and return the funds to SA.

e. Move funds from SA to RA, until RA hits ERS. Thereafter, every new year's January, transfer from SA/OA to RA, up to the prevailing ERS. As the CPF hotline explained, for any withdrawals or transfers, it will be funds from SA 1st, then funds from OA.

I am unsure if the interested earned on RA will count towards the ERS for this top-up calculation.

f. Will still top up to prevailing full BHS annually.

okok. enough of day dreaming. Back to work now. Comments on the above welcome.

Hi Snoopy 168

DeleteFor item a, the $20K & $40K requirement are mandatory. Cannot invest or withdraw them at all. Or maybe I misunderstood you ?

Hi SnOOpy168,

ReplyDeleteThanks for sharing in such great detail. :D

Sounds like a very good plan to me.

Topping up the BHS annually is a must for me too.

I will probably stick to to the FRS, as I like the flexibility that having money in the SA gives me. ;p

@henry

ReplyDelete"Liquidate all CPF IS investment." If I don't use CPF OA or SA to invest, there is no need to set aside the $20k & $40k requirement.

https://www.cpf.gov.sg/member/growing-your-savings/earning-higher-returns/investing-your-cpf-savings

Sayang that I have to take profits or bite the paper loss on some of my investments, but the objective is to fund the RA to ERS.

If there is still a generous balance left in the SA, the annual interest gained, will either be used to top up RA to the new year's ERS and withdraw some, to top up the new year's BHS. I wish the interest earned in MS, can be retained in MS instead of overflow into OA.

Snoopy168 - Hence the game plan for me, months before turning 55

ReplyDeletea. Liquidate all CPF IS investment. This will skip the minimum OA $20k & SA$40k requirement.

Not sure what do you mean by "skip"?

looking back, the idea was to avoid leaving any amount in OA. But as I need to do SA shielding, the 20 & 40k minimum is still required. So, cannot siam. Hmmm....

ReplyDeleteSo, to push RA to ERS, it will be either a cash top up or push from SA to RA. Trying not to touch SA leh

From skip to siam. Lol.

DeleteBefore 55, no. System is locked.

At or After 55, can. Empty SA first skip/siam that $40K. Then Empty OA, skip/siam that $20K. Achieve your objectives.

Hi Grand Admiral AK,

ReplyDeleteObserve DBS has been trending downwards now below $32. What would be an attractive price to collect some? Can you talk to yourself about this? Would love to hear your opinion !

Hi Rellangis,

ReplyDeleteI nibbled at $31.80 which was the support I identified in one of my YouTube videos. ;p

You might be interested in this video:

PREPARE for 2024! DBS, OCBC and UOB! How to reduce RISK? Diversify!

Hi

ReplyDeleteI got into my first DBS tranche at $32.1 before it went further south

Hi Yv,

ReplyDeleteCongratulations on getting your foot in the door at a fair price.

Uncle Buffett says it is better to pay a fair price for a good company than to pay a good price for a fair company. ;p

Snoopy168 said

ReplyDeleted. Liquidate the Nikko AM Short Term Bond Fund and return the funds to SA.

e. Move funds from SA to RA, until RA hits ERS. Thereafter, every new year's January, transfer from SA/OA to RA, up to the prevailing ERS. As the CPF hotline explained, for any withdrawals or transfers, it will be funds from SA 1st, then funds from OA.

-----------------------------------------------------------------

If your RA is empty after CPF transfer fund from your SA to RA and if

your intention is to hits ERS, maybe you can move funds from OA to RA before you liquidate the Nikko AM short term bond fund. This will help you to have more fund in your SA.

That's what shielding is for. OASA is 1/8. Lol. I also blur. Lol.

DeleteHi ruby,

ReplyDeleteThanks for sharing.

I am taking notes too. :D