I don't usually blog at night but this is so exciting that I just have to talk to myself.

Yesterday, I talked about my 1 year T-bill which I purchased with CPF OA money maturing.

This was the available balance in my CPF IA then:

I also said that I transferred the funds from CPF IA back to CPF OA upon seeing the money credited at 5pm.

This was my CPF OA balance yesterday:

DBS online portal said it would take up to 3 business days for the transfer to be done.

That would mean losing another month of CPF OA interest if the money went back to the CPF OA in February.

It is what it is, I guess.

However, I decided to check my CPF account just now just to see if a miracle took place.

Well, a miracle did happen!

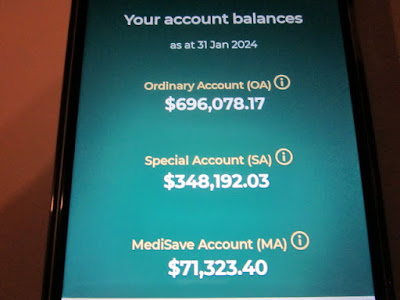

The money is back in my CPF OA which means I would not lose another month of CPF OA interest!

My faith in DBS bank is restored!

Yes, I know.

AK is so shallow.

Bad AK! Bad AK!

I am so happy now.

Losing an extra month of CPF OA interest is a big deal in this instance because the sum is so big.

We are looking at about $1,400 of interest income.

Huat ah!

If AK can be shallow, so can you!

Reference:

CPF account recovery: Thoughts and plan!

Congrats AK for being diligent to initiate the transfer back to OA. Typically at the end of the month DBS will transfer out to square the acct. Do note DBS do give a small amount of interest held in CPFIS acct. $1400 difference is not a small sum.

ReplyDeleteHi

ReplyDeleteIt's a Huat prelude to the CNY next week for you, I guess.

Hi Siew Mun and Yv,

ReplyDeleteSome people wonder I bothered to transfer the money from CPF IA to CPF OA as I plan to buy another T-bill in the middle of February?

I told them that if I were to be unsuccessful in getting that T-bill, at least I would not lose a month's worth of interest from CPF OA. ;p

Very fortunate that the transfer was completed within one business day. :D

LOL, its my money! If I don't get shallow over my wealth management, who else will? :)

ReplyDeleteHi TDT,

ReplyDeleteI like to stay in shallow waters and not risk drowning.

I kiasi. ;p

Hi AK,

ReplyDeleteWould you be considering to do an updated post about your portfolio? I would love to understand how you are structuring it in 2024.

Best,

ZS

Hello AK,

ReplyDeleteWould you be considering to do an updated blogspot about your portfolio? i.e. the % of banks, reits etc. I just wanted to roughly understand the structure of your portfolio and see how I can implement it into mine.

Hi ZS,

ReplyDeleteMy investment portfolio has not changed much since the last update.

So, it is still valid:

Largest investments updated 4Q 2022.

The amount in SSBs and T-bills has increased.

So, that probably has to move to the next bracket but that's about it. ;)