If you can't convince yourself "When I'm down 25%, I'm a buyer" and banish forever the fatal thought "When I'm down 25%, I'm a seller," then you'll never make a decent profit in stocks. (Page 246, One Up On Wall Street)

If you can't convince yourself "When I'm down 25%, I'm a buyer" and banish forever the fatal thought "When I'm down 25%, I'm a seller," then you'll never make a decent profit in stocks. (Page 246, One Up On Wall Street)

If we are holding stock of a good company and if the price should decline, the logical thing for us to do is to buy more since the stock has become cheaper, especially if there is a good margin of safety.

Why sell?

Remember that Peter Lynch is all about FA and I have no doubt that TA practitioners will be able to explain why selling might be a good idea based on chart action.

Peter Lynch doesn't believe in stop loss, by the way.

I think, as retail investors, we have to take the middle ground.

We probably do not have the financial muscles of a fund manager like Peter Lynch and to do what he advocates, we must always have a war chest ready.

How to have a war chest ready?

How to have a war chest ready?

Well, we should save as much of our earned income as we could from employment, for a start.

However, this could be painfully slow.

So, we have to be pragmatic and take some money off the table when prices run up significantly once in a while.

We have to grow our war chests ourselves since we cannot get fresh funds from new unit holders like fund managers can.

This way, we would be able to buy even more if prices were to plunge significantly for some strange reasons.

Obviously, there are always two sides to a coin. We could decide to sell and prices could go higher after we have sold.

Prices could also go lower after we have bought more. Well, that is the way Mr. Market is.

He doesn't care what we have done. He will do what he will do.

This is why many people focus their attention on asking what might be or could be happening in future.

They try their best to guess what Mr. Market will do.

Indeed, questions in the form of "Will the price fall/rise in the next month/quarter/year?" are quite common in some quarters.

To me, the important thing to know is "What should I do?" given a certain set of circumstances.

So, what should I do when I'm down 25%, for example?

Related posts:

1. How to be "One Up On Wall Street?"

2. A common piece of advice on saving.

3. When to BUY, HOLD or SELL?

4. Be prepared for war!

5. Risks and rewards: TA and FA.

6. Where did I go wrong?

PRIVACY POLICY

Featured blog.

1M50 CPF millionaire in 2021!

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

Past blog posts now load week by week. The old style created a problem for some as the system would load 50 blog posts each time. Hope the new style is better. Search archives in box below.

Archives

Pageviews since Dec'09

Recent Comments

Get this Recent Comments Widget

ASSI's Guest bloggers

- ENZA (3)

- EY (7)

- Elsie (1)

- Elvin H. Liang (1)

- FunShine (5)

- Invest Apprentice (2)

- JK (2)

- Jean (1)

- Kai Xiang (1)

- Kenji FX (2)

- Klein (2)

- LS (2)

- Matt (3)

- Matthew Seah (18)

- Mike (6)

- Ms. Y (2)

- Raymond Ng (1)

- Ryan (1)

- STE (9)

- Serejouir (1)

- Solace (13)

- Song StoneCold (2)

- TheMinimalist (4)

- Vic (1)

- boon sun (1)

- skipper (1)

Resources & Blogs.

- 5WAVES

- AlpacaInvestments

- Bf Gf Money Blog

- Bully the Bear

- Cheaponana

- Clueless Punter

- Consumer Alerts

- Dividend simpleton

- Financial Freedom

- Forever Financial Freedom

- GH Chua Investments

- Help your own money.

- Ideas on investing in SG.

- Invest Properly Leh

- Investment Moats

- Investopedia

- JK Fund

- MoneySense (MAS)

- Next Insight

- Oddball teen's mind.

- Propwise.sg - Property

- Scg8866t Stockinvesting

- SG Man of Leisure

- SG Young Investment

- Sillyinvestor.

- SimplyJesMe

- Singapore Exchange

- Singapore IPOs

- STE's Investing Journey

- STI - Stocks Info

- T.U.B. Investing

- The Sleepy Devil

- The Tale of Azrael

- TheFinance

- Turtle Investor

- UOB Gold & Silver

- Wealth Buch

- Wealth Journey

- What's behind the numbers?

What should I do when I'm down 25%?

Sunday, September 22, 2013Posted by AK71 at 12:45 PM 11 comments

Labels:

FA,

investment,

savings,

TA

Manchester United Football Club's Asian snack!

Saturday, September 21, 2013

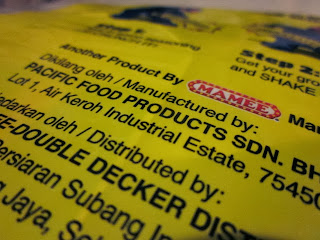

I went and bought one of my favourite snacks today and I found out that it is actually a Global Snack Partner of Manchester United Football Club's!

So, which snack is it? You might be amazed:

Really! No kidding. Then, I decided to check on the manufacturer which is based in Malaysia.

Unfortunately, it is a private company.

Oh, well, I tried. Time for a snack. Have a break, have a Mamee. Sedap!

Posted by AK71 at 11:54 PM 2 comments

Labels:

meal

Subscribe to:

Comments (Atom)

Monthly Popular Blog Posts

-

It has been a while since my last blog. Hope everyone is doing well. Instead of revealing the numbers at the end of the blog, I have put it ...

-

Time for another update. First, on the personal front, I have been spending more time on other stuff in life as I have been feeling that too...

-

I took down this blog post after it was put up for only slightly more than an hour at 8am this morning. In that short period of time, it...

-

Been a while since my last blog post. Hope everyone is staying calm as stock markets crash around the world. I produced a video last night w...

-

My investments in S-REITs are holding up nicely which gives credence to my strategy to overweight S-REITs in my portfolio. Their relative pr...

All time ASSI most popular!

-

A reader pointed me to a thread in HWZ Forum which discussed about my CPF savings being more than $800K. He wanted to clarify certain que...

-

The plan was to blog about this together with my quarterly passive income report (4Q 2018) but I decided to take some time off from Neverwin...

-

Reader says... AK sifu.. Wah next year MA up to 57200... Excited siah.. Can top up again to get tax relief. Can I ask u if the i...

-

It has been a pretty long break since my last blog. I have also been spending a lot less time engaging readers both in my blog and on Face...

-

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...