Singaporeans are pouring money into the Iskandar region in Johor, buying up real estate.

"Singaporeans make up 74 per cent of foreign home buyers in the Nusajaya township in Johor's Iskandar region, according to Malaysian property developer UEM Sunrise."

Read story: here.

(Added in November 2016.)

Anecdotal evidence shows that most are buying for investment, hoping to rent out their properties or to sell for a profit later on.

Few are entertaining the possibility of staying there.

I have spoken to friends in Malaysia and some of them stay in Johor.

They told me that the optimism is just scary and they really cannot see how Johor would have so many renters to rent from enthusiastic (and, in their words, naïve) Singaporean landlords.

One told me that he now stays in one of these new townships and the neighbourhood he is staying in is not even 50% occupied.

Yet, there are new neighbourhoods being constructed around his.

"This is not Kuala Lumpur. You Singaporeans are crazy."

I think people are optimistic about property in the Iskandar region because of the proximity to Singapore.

So, if anyone is thinking of buying a property there for investment, it makes sense to buy one that is close to the proposed link to Singapore's MRT line.

A train ride to Singapore's city centre then could take no more than 40 minutes assuming that there isn't a jam at the Customs checkpoints.

Am I interested?

Well, there are too many optimists amongst Singaporean buyers now.

I will wait until a time when they are mostly pessimists before looking.

I could miss the boat but it is of no consequence to me.

I rather miss it and still have my money than to join the crowd, buy in a mad flurry only to regret later on if I lose money.

(February 2014.)

|

| 2 February 2017 |

Disastrous property investments!

64 comments:

I do know people (2) who bought property in Iskandar. One of them even committed to two properties, but not sure if Singapore banks were involved in extending the loans. I did not manage to get more details like LTV and potential rental yield.

From what I can see, the supply seems to be greater than the demand. If I wanted to stay there, why don't I just buy a new unit instead of purchasing a resale unit? Also, if it's affordable to buy a place, why would I want to rent one? And even if I wanted to rent one, with all the incoming supply, what rental yield would I get?

A lot of pertinent questions to ask before you put your money (and faith) into such an investment.

Could the money get stuck? Definitely. Property by nature is not liquid and in a foreign country it may be even more illiquid. Along with laws that may change at a whim (according to the Malaysian Government) and the fervour now, I'd pass.

Regards.

Hi MW,

Your paragraph 2 holds very good questions. I think you are a property investor in the making. ;)

Indeed, I wonder what the real rental yield is going to be like. Well, time will tell. :)

A related post:

To rent or to buy: Rule of 15.

Well, ask any property agent & they will tell you they are making $$$ selling foreign properties, from Malaysia (iskandar & KL) to Manila, Thailand and India. Singaporeans are snapping these up because there is no buyers' stamp duty, with little thought if there is demand for rent in the first place.

Not wise, but that is the way it is. When the tide draws back, we will know who's swimming naked.

Hi Ana,

People are all hunting for higher yields. How realistic are these? I have no idea but perhaps some who have been successful in this area could educate us?

Well, do you think there is a ready rental demand in makati? Or Bangalore? Both areas I have seen agents claim foreign properties are selling like hot cakes. The quantum is probably small..... but it may just be better bet throwing the money into sph or something like that........

Hi Ana,

Well, unless the net rental yields in such places are in the high single digits, I rather invest in stocks like SPH or NeraTel too. Shucks, or just invest in an S-REIT. ;p

Old Wong selling melons...

When the tide draws back, SG properties will still remain more attractive than iskandar in terms of ease of renting out. so the downside risk is higher for iskandar... therefore a no no for me.

Hi Ong,

Intuitively, I also think that properties in Singapore are probably easier to rent out compared to those in Iskandar.

I have read of cases where whole families (especially) expatriates who have moved to Iskandar because they could not afford to rent large houses with big open grounds in Singapore but they could in Iskandar. So, to me, the advantage Iskandar has over Singapore is really space.

However, if we are talking about apartments which are being developed almost as quickly as mooncakes are being produced in recent weeks, there are plenty of apartments in Singapore.

Of course, there is the advantage of price. It is cheaper to buy and rent in Iskandar but will it make sense to a renter without a big family who works in Singapore to stay in an apartment in Iskandar? How much would he be saving? Is it worth the hassle of commuting between countries on a daily basis?

Like investing in stocks, we will feel more at ease if there is a track record we can look at. There is too little to go on now in that department. Those who are buying now are buying into a promise. We will have to see if Iskandar delivers on that promise.

Back in 2007, I was doing recruitment for an MNC opening a new plant in Senai which isn't that far from Iskandar. The management was sold on using the area as an expansion for the facilities in Singapore and believed they could easily recruit people with the support of the local state government.

Problem is no one in Singapore will be willing to relocate there. And if someone within Malaysia would to relocate to work in Johor, why not make that extra 30mins of effort and work in Singapore earning double instead?

From what I know, things are not much different today as it was 6 years ago. I won't say the situation is forever but if someone sold me that idea (of Iskandar) 6 years ago, I would be really depressed today. I hope those who get in today won't be in 6 year's time.

Well, there are those who are simply buying a second home, not for investment. It's like Shenzhen HK, it takes little time to travel from LoWu to central HK in under an hour (I've tried), but not all - particularly singles- take the bait. More so families, live in SZ, commute to HK.

Don't forget, Singaporeans (or non Malaysians) don't have the right to live in Malaysia, other than a tourist visa. The authorities are pretty lax now, because they want the investment monies, and will that change?

Will the authorities one day, stop a commuter from entering Malaysia multiple times on tourist visa?

Of course, I'm just a scaredly cat, who has missed out on the gains from the iskandar craze - after all even Peter Lim is sinking his OWN money... just sour grapes , perhaps, on my end?

Hi AK,

Follow what WB do, when people rush in, we should be very cautious. When people rush out, we should be very liberal. LOL...

Best Regards,

Steven

Hi Patty,

Thanks for sharing first hand experience. :)

There is definitely a lot of optimism regarding Iskandar now and, of course, the media is giving it a lot of coverage. Most of the news is positive. It seems like a no-brainer to invest in properties in Iskandar.

Well, back when news flow was all negative and people were all pessimistic about S-REITs, that was the time to buy but few did...

Time will tell (again). :)

Hi Ana,

Indeed, the brave could be well rewarded. People also become braver when they think there is safety in numbers. ;p

At the end of the day, none of us have perfect knowledge. We just have to act on our own beliefs.

I am old enough to have experienced CLOB and remember how I lost some money then. The way things work in Malaysia is quite different from how they work in Singapore.

Things could easily flip flop in Malaysia. An example:

Iskandar intra-city rail line plan scrapped.

The RM1.23 billion intra-city rail line for Iskandar Malaysia in Johor, as proposed by a private party, will be scrapped, said people with first hand knowledge on the matter.

This is because the government wants to focus on the high-speed rail system linking Kuala Lumpur and Singapore, which will likely

have a stop in Iskandar Malaysia, and the Rapid Transit System from Johor Baru to Woodlands, Singapore.

Source:

The Business Times, 26 Aug 2013.

This was going to be the equivalent of a MRT line within the Iskandar region which is going to be as big as Singapore. Kaput.

Hi Steven,

Words of the wise. Of course, it also depends on who are the people we mix with. ;p

@Ana..

Peter Lim is sinking his own money as a developer... u go buy from him is "holding the baby" for him hehehe. Home owners and investors will be holding all the risk, not him or the developers who has already made their money.

From my past experiences in Msia properties, my advise is DO NOT invest in there.

There are a lot of hidden costs that investors do not know, for eg, do you know that the income tax for foreigners is a staggering 28%? After deducting all other expenses, I still have to pay 28% tax? And then, convert your net rental into S$ (with the depreciating RM$). By then, the amount is so pathetic that you wonder why you even invest and waste so much time and effort on it in the first place.

Capital appreciation? Again, forget it as possible gains may be wiped out by the depreciating RM$.

And mind you, the properties that I have rented out are in KL, where at least there is some demand. I'm really sceptical about Iskandar. When I can, I'm ready to cash out of KL and never touch msia properties ever again!

Hi Cheryl,

I know what you mean. My parents invested in a K.L. condo donkey years ago when the RM was much stronger, they lost a lot of money when they finally decided to bite the bullet and sold two years ago as the unit was giving them a lot of headaches. Quality worse than our HDB flats.

For a 1,000 sq ft, 2 bedroom apartment, they were getting about RM 1,000 in monthly rental or a bit more. For a RM200,000 investment, you would think that's a good yield of 6% but you are right about all the costs that came in. Nightmare!

Hi AK,

What I heard was indeed different? There are a significant number of businessman relocated to Klang Valley, i met many of them from KL to Klang, from those are doing interior design to pet business. To those who ever heard of the success story of Somerset Seri Bukit Ceylon (developed by UMLand, former unit of Capitaland), the gain was nothing less than terrific, both yield and appreciation. Imagine buying at RM280k with 80% loan in RM, surprised by how easy it was rented

out at RM4000 per month! The property transacted price has since increased to rm650k for the similar unit. The investment is no longer so attractive nowadays, having said that the yield at KLCC area is still among the highest in the region. There are however advices for potential investor. 4 rules: understand how Malaysian

property work, invest in glamourous area only, different post code fetch different prices. Understand the risk of currency fluctuation, maximize leverage with local currency. Understand how influential is the developer in potential capital appreciation (Mah sing, SP Setia); Understand how the government tax works.

Do your homework and manage your expectation. Property investment is normally less complicated than stock investment. Like share investment, do not invest if you are not willing to do homework.

Invest in yield -> look for area with high population of foreign expats or students (KLCC, bukit bintang), Invest

in capita appreciation -> look for unbeatable view and prestigious developer (E&O, Capitaland). Just my simple opinions.

Hi Casey,

It could be the case that my parents did all the wrong things. LOL. I think the developer of the condo they bought was the Berjaya Group.

Anyway, bygones. They would only invest in Singapore now. :)

Hi AK,

Berjaya.... One must really do their homework if you are not staying there....

Most of the Singaporean investors i know, invested in KLCC area, renting to expats, collecting rental punctually. They know which developer to go with. Location? it has to be KLCC, Embassy Row, or Bukit Ceylon. Bangsar is another safer place to invest. Beware of fringe area, unlike SG, KL expats are very particular on who their neighbors are and very selective! Never heard of rental lower than 2k at this areas also.

Homework, homework and homework.

It is always easy to say, when it is cheap one will buy, But when you see it cheap, you become too scare to buy. Sam as in stock.

Easy to say, but hard to implement.

Hope u do not mind.

Hi Casey,

I think doing homework is important anytime. :D

Well, that property was bought when I was still an undergrad or younger. Memory not so good liao. Donkey years ago. My parents bought it at a Berjaya road show in Singapore.

In those days, the RM was much stronger and RM200k was equivalent to about S$150k, iirc. So, my parents' experience is considered dated.

However, their experience selling the condo is relatively recent. About two years ago. The selling experience was also quite stressful for them. Not as clean and efficient as Singapore's.

Anyway, there are always good investments around and we don't have to make a beeline for properties in Malaysia. ;p

Hi Unknown,

I cannot speak for others but when I see something cheap, I buy (if I have the money).

I think the more important question to ask is whether we know for sure it is cheap or if we suspect it is cheap. In the case of the former, I think we would buy.

So, this is where a more thorough knowledge of the investment subject comes in. If I am absolutely sure, based on what I know, that a certain stock is undervalued, I would buy a lot more. If I don't have that knowledge, then, I could start wondering if I should. :)

If one is to buy property in Malaysia, you have got to understand and accept the following risks :-

1. Foreign investments in Malaysia is low and the number of expats community is very small, more so in Johore.

2. incidents of break in steeling and cutting of copper wires and other things in the house/ office is not unusual.

3. Security issues

4. Law and order is very different from Singapore,

remember the Clob case, when the government just close the Clob share market

5. It may be cheap as compared with the properties in Singapore. Will the ringgit go further down ?

6. One must have the faith about the efficiency of Government of the country if we want to invest in the country

I think you guys miss up big pie . Go and check out what is Horizon Hill and all the condo launched in Nusajaya last year . Majority of them have risen 100% . We are talking about sub-sale market . Whether you have so many bad stories , irony fact is 100% returns had been achieved .

Hi Ak71,

Sorry for borrowing your blog to express my view in this issue. If one is investing in Iskandar, he has to manage his expectation very well, I do not think that there could be any attractive yield (the prospect is probably even lower than Penang, 1-2%). Horizon Hill has no doubt appreciated more than 100%, but it is supported by the fact the landed property in major cities of Malaysia has escalated so significantly recently, lead by the Klang Valley and Penang island due to very limited supply. But do remember, there is very low yield for such property even in klang valley. Iskandar? I do suspect rental yield even exist for higher end landed property like Horizon Hill and East Ledang.

Due to the worsening public security, more and more

people prefer to live in fully guarded and gated condominium or service residence that is accessible with security card only to each floor.

Although I have totally no interest to invest in Iskandar, except those seafront property for own stay. I do think that the scenario developed now is a bit similar to HK-SHZ.

Finally, according to those who have invested in KLCC area, Bangsar and Bukit Bintang, the areas where expats live and party, they do have a plan. How much do you think the price for a world class property like Troika, Marc Residence or Binjai on the Park, with Mandarin Oriental, St. Regis, Ascot Residence and Traders Hotel as your neighbour? from RM1300psf - RM2400psf. For those located in the heart of the CBD porsh area, the price is among the lowest in the region. Hence, i would say, it is definitely an investor grade property and it is being used for investor to park their money. Okay, there is oversupply in the area now, but see carefully, it there any more land left? This the risk still high? Knowing the currency fluctuation, are you still leverage the property with SGD? Investment is for investor who has a plan, who has studied the situations, and knowing what is his next move, who has built his partnership with local experts, It is not really so complicated comparing to stock market (except REITS).

It all boils down to the property cycle. Early movers everywhere, even in Timbuktu, can tout impressive returns.

For instance, a parking lot in Macau costs MOP700,000 (SGD117,000), more than their one-bedder apartment. Different locations command a different premium but prices of parking lots have gone up 10 to 20 times in a matter of a few years.

Based on 'track record' and historical data, we should all now flock to Macau and buy up all their parking lots!

Hi Casey,

Hey, why apologise? I welcome all genuine and constructive comments. I keep saying that I don't know everything and I mean it. So, the more readers share, the happier I am. :)

I don't have any experience investing in Malaysian properties and I have only applied some common sense in the writing of this blog post. So, I really appreciate hearing balanced comments from obviously experienced investors like yourself. ;)

I remain sceptical about property investments in the Iskandar region at this point in time. I could be wrong but if yield is almost non-existent, how high could prices go? There are only so many people who would pay inflated prices, I believe. Also, chances are the property cycle is peaking.

Yes, Johor is possibly like Shenzhen and this idea has been around for a long time. When I was an undergrad, I remember studying the region of SIJORI, Singapore-Johor-Riau. So, it is not new but this big push for rapid development is more recent.

Who knows? One day when I am older and retiring, I might do so in the Iskandar region. For now, if in doubt, stay out. To me, this is a good thing to remember. :)

Hi Endrene,

It is the same thing in Hong Kong. Parking lots are great investments for income! Better than apartments. Amazing!

Hi AK,

Your comment 'For now, if in doubt, stay out. To me, this is a good thing to remember.' resonates.

Remember HCMC, Vietnam was a hot spot for property investment some years back. Look how much has the Dong depreciated. Nobody talks about it now. Was there on a business trip last year and locals shared that hot money had pulled out, all gone to Cambodia. Those who jumped onto the bandwagon were left holding onto the hot potato which might just see it rotting some day.

We should manage our greed or be prepared to lose it all when the tide recedes. I share your experience in the CLOB shares. I hope those who have great faith in the Malaysia system won't be wrong this time.

Hi Endrene,

I think I have a friend who invested in some land or property in Vietnam who bit the bullet and took a lost too.

I certainly do not wish for anyone to lose money in their investments and I hope those who are buying properties in the Iskandar region even now would make some money. :)

I just met a property friend from ERA who told me he sold alot of Iskandar units, but he didn't even want to buy one. And he told me his colleagues are not buying either - they are only interested in selling, because the developers are rushing to sell off all their units. In fact, the developers have already made money and they are not looking for flip-flopping Iskandar properties.

Not sure how useful is this information, and anyway, it's just a coffee talk and he might be bluffing me afterall too.

Hi Willie,

The buyers could have succumbed to herd mentality and the property agents are the ones helping with the herding.

"If you don't buy now, you will regret it."

If more people buy, the agents would obviously benefit more and it is the best kind of benefits because they are benefits without risk. I won't be surprised if many agents have been enriched by the Iskandar region. There is nothing wrong with being paid to do a job, of course.

However, someone who buys an apartment in Iskandar now might or might not benefit from it. He is taking on some pretty big risks. He is buying into a promise really.

Hi AK71,

Just sharing a discussion that may be food for thought. When Mahathair was PM, there was suggestions and developments to construct another bridge between Woodlands and JB. And the business also entails related people (hint hint) who might benefit from this business.

However, when Najib became the PM, the project was stopped and this time, Najib promoted Iskandar project. And who are the involved parties in this project (hint hint again).

Well, going by this trend, what will happen after Najib step down from PM, I think it's something I can't answer but left for much imagination (final hint hint).

:)

Hi Willie,

I think you are referring to "cronyism" which is a mainstay of Malaysian politics. After Mahathir was Badawi, by the way. ;p

Hi AK,

Hahaha... ya, cronyism is the risk. Great vocab.

Yup, after Mahathir was Badawi. I was talking about the real risks of cronyism happening again, after Najib.

Well, I guess I am saying all these, because I may be having sour grapes. lol.

Hi Willie,

With Malaysia's spotty track record, I would not be surprised if something untoward should happen again.

Well, some might say I am also a purveyor of sour grapes. ;p

People's development. What is this?

-------------

The Johor state government will levy a processing fee on foreigners who buy properties in the Malaysian state from next year.

Mr Abdul Latiff said proceeds from the processing fee will be used for projects and programmes towards the people's development.

Source:

http://www.channelnewsasia.com/news/business/foreign-property-buyers/840134.html

The Monetary Authority of Singapore (MAS) on Wednesday (May 21) warned citizens of the risks attached to buying properties overseas, after data showed a surge in Singaporeans' investment in real estate abroad.

MAS said local real estate agencies had handled overseas property deals worth S$2 billion last year - a 43 per cent rise since 2012.

"MAS would like to remind potential investors to be mindful of various risks associated with overseas property purchases," the central bank said, citing foreign exchange and interest rate risks as examples, along with less stringent rules governing foreign property developers.

"Risks are more difficult to assess or manage when investors are unfamiliar with conditions in overseas markets, such as the prospects for oversupply of properties, or of a deterioration in economic conditions," it added.

MAS said it was closely monitoring overseas purchases "with a view to ensuring financial stability as well as financial prudence among Singaporeans".

http://www.channelnewsasia.com/news/business/singapore/mas-cautions-on-foreign/1116054.html

"Darren Chin gave up a 15-minute train journey to his office in Singapore for a two-hour drive with a stop at passport control. The reason: By commuting from Malaysia, he can afford his own two-story home and car.

“It’s worth it,” said the Malaysian financial adviser, who leaves his house before 6:45 a.m. to get to his job at Oversea-Chinese Banking Corp. on time. “I’m saving on rent and I’m paying for my own house.”

"Chin, who used to lease a room for himself in a Singapore public-housing block and now has a four-bedroom house, the benefits are worth the inconvenience.

“I’ve got more control on where I want to go,” he said. “I couldn’t afford a car in Singapore.”

Source:

http://www.theedgesingapore.com/the-daily-edge/business/48591-cut-price-luxury-homes-fuel-singapore-tri-nation-sprawl.html

A 2 hours drive one way means 4 hours each day spent on the road ... -.-"

"In China for instance, debt has ballooned over the past five years and is now equivalent to 71% of GDP. In Malaysia it’s 68% of GDP, according to Morgan Stanley. “When a country increases its debt as a share of GDP rapidly, it always leads to economic trouble. And the operative word here being always,” said Ruchir Sharma, Head of Emerging Markets Equity and Global Macro at Morgan Stanley at an investment conference recently.

"Oxford Economics has now rated Malaysia as “risky”, even more so than Indonesia, because of its high level of public debt, rising external debt and shrinking account surplus."

The EDGE

"When The Straits Times visited the Johor Baru Customs, Immigration and Quarantine (CIQ) Complex at 12.35am on Friday morning, it cost RM9.70 (S$3.80) to get into Johor with a private car, up from the previous RM2.90.

"There was also an extra RM6.80 charge when leaving Johor. Previously it was free."

Source:

http://www.straitstimes.com/news/asia/south-east-asia/story/johor-raises-vehicle-toll-charges-20140801

UEM Sunrise Bhd, considered a bellwether to Iskandar, this week slashed its sales target for 2014 to RM2bil from RM3.2bil, citing weakness in the market for homes in the economic corridor south of Johor.

This comes as a slew of high-rise apartments – many of them from the China developers, and many of them on the waterfront – are set to flood the market.

And things could get worse before they get better.

It is believed that about half of the condominiums in Country Garden Danga Bay remain unsold, and the Guangdong-based property giant is now looking increasingly desperate to unload its stock by either hiking discounts of dropping prices, although the exact quantum is unknown.

The Danga Bay project was launched with much fanfare last year at an average of RM900 per sq ft.

Most of the real estate firms in Johor Bahru have been roped in to sell homes for Country Garden Danga Bay, and it is dangling commissions of up to 8% versus the typical 2%-3% as an added incentive, brokers tell StarBizWeek.

Source:

http://www.thestar.com.my/Business/Business-News/2014/08/30/Property-slowdown-more-evident-in-Johor/

Malaysia's Real Estate and Housing Developers' Association has flagged concerns about the property market in Iskandar Malaysia, particularly in the Nusa Jaya and Danga Bay areas.

Speaking at the KPMG Global Real Estate and Construction Conference in Singapore on Monday (Sep 29), the association's president Mr FD Iskandar said developers may be introducing more residential units there than the market in Johor can handle.

Source:

http://www.channelnewsasia.com/news/business/singapore/concerns-over-oversupply/1388244.html

The Singapore dollar rose against the Malaysian ringgit on Tuesday (Jan 20), briefly crossing the psychological 2.70 ringgit level as Prime Minister Najib Razak cut the country's 2015 economic growth forecast and said the fiscal deficit will be larger than previously estimated.

The Singapore dollar traded around 2.6827 ringgit at the end of the Asian trading day, up from 2.6773 early in the session, according to Bloomberg data. The level is the highest since 1981 when the data became available on the system.

Reuters data showed the Singapore dollar hit an intraday high of 2.7019 around 5 pm.

Source:

http://www.channelnewsasia.com/news/business/singapore/ringgit-falls-to-new-low/1603322.html

New condos keep being delivered to the Johor Bahru market and this will be continue for the next few years. The supply seems to be swamping the demand for luxury condos.

In Bukit Indah, Sky Executive Suiteswere delivered (in early 2014) and many units seem to still be looking for tenants.

If you are looking to rent you should be able to find good deals if you bargain (prices are set too high given the huge vacancy rate, in my opinion, they seem priced based on every increasing sales prices not based on the rental market). It sure seems the market is just has far too many vacancies to justify increasing rents; and is going to get worse for those seeking to rent out their luxury condos.

Source:

http://johor-bahru-real-estate.com/

The property oversupply situation in Iskandar Malaysia, Johor, is "likely to get worse before it gets better", said Maybank Investment Bank's research wing in a report, with property values in an increasingly crowded development space possibly declining over the medium term.

In a research note issued by the Malaysian bank on Tuesday (Apr 14) urged investors to be cautious about the region, noting that property transactions and prices in Iskandar have been dropping.

The research note said that Malaysian developers have scaled back their launches and shifted their product mix to avoid direct competition with Chinese developers, and have lowered sales expectations for their projects at Iskandar.

"Judging from the number of approved high-rise projects, the Iskandar property market could be hit by too much supply of high-rise mixed development projects if there is still no coordinated planning and control - this will induce price volatility," Maybank analyst Wong Wei Sum said in the research.

"The oversupply situation will be exacerbated by the huge incoming supply in 2015/2016, where units under construction have risen 18 per cent year-on-year in 2012 and 2013, respectively."

As such, the bank said it remains cautious on property exposure in Iskandar, instead preferring developers with exposure in the Klang Valley and Penang.

Klang Valley, in particular, is preferred because of the upcoming KVMRT and LRT lines, and potential KL-Singapore high-speed rail project, which will end at Bandar Malaysia, Maybank said.

More importantly, the strong population growth potential in Greater KL and Klang Valley - a possible 40 per cent increase to 10 million by 2020 - offers more sustainable demand for properties, it added.

Source:

http://www.channelnewsasia.com/news/business/international/caution-advised-on/1790094.html

Doris Tan, JLL head of international residential properties, noted that while the imposition of the additional buyers' stamp duty prompted some property investors to look outside of Singapore, that initial rise had receded since TDSR practically "killed the whole market". Even in the popular London market, investors are taking a wait-and-see approach pending the UK general elections in May, she observed.

Once a hot overseas market for Singapore property investors, Malaysia is also losing its lustre given the negative spin from concerns of oversupply in Iskandar, said Getty Goh, director of property research and consultancy firm Ascendant Assets, which partners agencies on research work to pitch to potential buyers. He noted that Singaporeans are also keeping away from Iskandar due to a lack of a resale and rental market now. Both London and Malaysia have imposed their own "cooling measures" to rein in prices, he added.

Source:

http://www.businesstimes.com.sg//companies-markets/singaporean-demand-for-overseas-properties-continues-to-wane

FOLLOWING a marked slowdown in demand for property in Iskandar Malaysia, property players expect further signs of a slowdown in the second half of the year, when marginal investors begin to take delivery of their units, especially those in the high-rise luxury segment.

Source:

http://www.businesstimes.com.sg//real-estate/johor-property-slowdown-expected-to-bite-harder

Something worrisome from today (26 May 2015).

http://callingthetop.blogspot.sg/2015/05/major-iskandar-project-aborted.html

Pundits continue to sing praises about the growth potential of Iskandar. In a drive around Nusajaya last month, we observed that the pace of construction seemed slow, with several projects that were fully sold years ago still under construction. One large billboard proclaimed “Akan Datang” and “Coming Soon” above a construction site hoarding for a luxury condominium project that failed to launch after the 2013 peak of the Iskandar hype. Needless to say, construction has not started.

As for the completed condominiums, banners displaying “For Sale” and “For Rent” are commonplace. A casual count estimates 10 per cent of the apartments are furnished with curtains. A medical centre that was launched with much fanfare was opened for business in late 2015. As of July, no more than a quarter of the clinics in the medical centre have been taken up by specialist doctors.

Some developers in Iskandar have dropped prices to move leftover apartments, adding downward pressure on valuations. Buyers who took deferred payment plans and paid down less than 10 per cent of purchase prices are walking away from their investments.

Source:

TODAY, 12 August 2016

http://www.todayonline.com/business/avoid-malaysian-property-especially-iskandar

“These Chinese players build by the thousands at one go, and they scare the hell out of everybody,” said Siva Shanker, head of investments at Axis-REIT Managers Bhd. and a former president of the Malaysian Institute of Estate Agents. “God only knows who is going to buy all these units, and when it’s completed, the bigger question is, who is going to stay in them?”

The scale of the projects is dizzying. Country Garden’s Forest City, on four artificial islands, will house 700,000 people on an area four times the size of New York’s Central Park. It will have office towers, parks, hotels, shopping malls and an international school, all draped with greenery. Construction began in February and about 8,000 apartments have been sold, the company said.

It’s the biggest of about 60 projects in the Iskandar Malaysia zone around Johor Bahru, known as JB, that could add more than half-a-million homes. The influx has contributed to a drop of almost one-third in the value of residential sales in the state last year, with some developers offering discounts of 20 percent or more. Average resale prices per square foot for high-rise flats in JB fell 10 percent last year, according to property consultant CH Williams Talhar & Wong.

JB is not Shenzhen. The billions poured into the economic zone in southern Guangdong in the 1980s and 1990s by Hong Kong and Taiwanese firms was soon dwarfed by Chinese investment as factories sprang up all along China’s coast.

In Malaysia, investment growth is slowing, slipping to 2 percent year on year in the third quarter, from more than 6 percent in the previous quarter. The value of residential sales in Malaysia fell almost 11 percent last year, while in Johor the drop was 32 percent, according to government data.

Source:

Bloomberg, 22 November 2016

http://www.bloomberg.com/news/features/2016-11-21/-100-billion-chinese-made-city-near-singapore-scares-the-hell-out-of-everybody

I had been to some of these developments and i find something that i like. The locations are very attractive with seaview, lake view, theme park and lush greenery. That feeling was like when i see my first property Bayshore Park (Block Aquamarine) facing the sea. That feeling had stayed with me but Bayshore Park is beyond my reach now.

If i buy maybe for this reason alone and personal enjoyment.

Note: I am not from developer, just personal experience and current owner of a property behind Legoland which i bought around RM650.

Hi seefei,

A friend who got a unit at Bayshore is cursing at Costa Del Sol every day. Losing his sea view also means losing quite a chunk of resale value. -.-"

If we are buying a unit in Iskandar as an owner-occupier, I think it does make sense especially if we are thinking of retiring there. It beats renting an apartment long term. I feel that this is the only reason that makes sense. For investment, the region lacks quality tenants and there is more than ample supply of new condominiums.

The massive developments happening in Johor could become ghost towns when they are completed, reported Free Malaysia Today, which interviewed a property veteran with 40 years of experience in the industry.

According to Chartered Surveyor Ernest Cheong, he is worried that there would not be enough residents and tenants to fill up the thousands of homes and commercial buildings being built in the state.

“Just Forest City alone is estimated to be able to house some 700,000 people,” he said. “Who will take up these houses? Johoreans? That is unlikely. There are fewer than two million locals in Johor Bahru, and that’s a generous estimate. Many of them already own houses.”

As for the Chinese nationals and Singaporeans who are expected to relocate there, Cheong is skeptical that a sufficient number would do so.

“Singaporeans who are rich wouldn’t want to move to Iskandar as they can live anywhere else around the world. Those who aren’t wealthy may not find it feasible to move to Iskandar and commute across the island every day, as it’s costly and time consuming.”

Source:

http://www.propertyguru.com.my/property-news/2017/1/145295/large-projects-in-johor-may-become-deserted?utm_source=pgmy-newsalert&utm_medium=edm&utm_campaign=dailynews-25Jan2017&utm_content=links

The high-rise residential market in Johor’s Iskandar Malaysia has softened in 2016 with lower transaction prices in the subsale market.

The outlook for the market segment looks challenging with higher vacancy rates expected in 2017, according to CBRE | WTW Johor.

“High-rise residential units from the high-end segment may be transacted at about 20% lower from their launch prices.

“This is mainly because many owners have purchased these properties from the primary market through DIBS (Developer Interest Bearing Scheme),” said CBRE | WTW Johor branch director Tan Ka Leong.

It is unlikely to see a dip in prices among units in the affordable high-rise residential segment, where their launch prices were below RM600 psf, he told TheEdgeProperty.com.

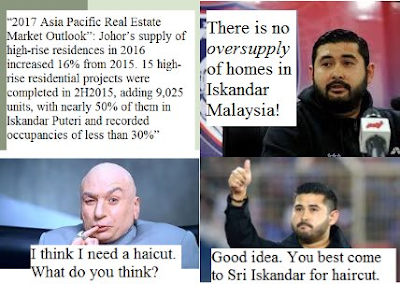

In the real estate consultancy’s report “2017 Asia Pacific Real Estate Market Outlook: Malaysia”, it stated that Johor’s existing supply of high-rise residences in 2016 stood at 43,898 units, an increase of 16% from 2015.

“Our in-house survey found that about 15 high-rise residential projects were completed in 2H2015, contributing 9,025 units to the market, with nearly 50% of them in Iskandar Puteri.

“All these newly completed developments recorded fairly low occupancies of less than 30%,” said the report.

On the subsale market, the average transaction value for this segment stood at RM370 psf in 2016, about 11% lower than 2015. Transaction volume had decreased by 50% from the previous year.

“The highest transaction price recorded in the subsale market was for units within KSL City D’Esplanade, with a price of RM730 psf, followed by Sri Samudera and Zenith Suites with units transacted at about RM460 to RM470 psf,” the firm noted in the report.

The report also noted that more than 13,000 units of the mega development Forest City by Guangzhou-based developer Country Garden Properties Sdn Bhd have been sold of which 75% of them were purchased by Chinese buyers. Prices for the condo units are from RM1,200 onwards.

2017 will see about 19,000 units of high-rise homes coming into the Johor market.

Source:

http://www.theedgeproperty.com.my/content/1055637/johor%E2%80%99s-new-high-end-high-rise-homes-may-dip-below-their-launched-prices-year

Remember that no one cares more about our money than we do and remember don't ask barbers if we need a haircut.

Dennis Wee Realty (DWR) has been fined a record S$66,000 by the Council for Estate Agencies' (CEA) disciplinary committee for not highlighting to investors the risks involved in buying overseas properties.

DWR was also banned from transacting or marketing properties abroad for 12 months with effect from Nov 24, 2017.

Its fine is the largest penalty meted out thus far to a property agency for failing to abide by regulations on the sale or marketing of properties abroad.

Source:

http://www.straitstimes.com/business/property/dennis-wee-realty-hit-with-s66000-fine-12-month-ban-for-not-warning-of-risks-in

Malaysia will not allow foreigners to buy residential units built at the US$100 billion Forest City project in Johor, Prime Minister Mahathir Mohamad said on Monday (Aug 27).

The project has been wracked by uncertainty since Mahathir's coalition scored a shock victory at a May general election, as developer Country Garden Holdings Co looks to revive faltering demand for its plans to build a city that would be home to 700,000 people.

"One thing is certain, that city that is going to be built cannot be sold to foreigners," Mahathir told reporters at a press conference in capital Kuala Lumpur.

"We are not going to give visas for people to come and live here," he added. "Our objection is because it was built for foreigners, not built for Malaysians. Most Malaysians are unable to buy those flats."

Source:

https://www.channelnewsasia.com/news/asia/malaysia-forest-city-off-limits-to-foreign-buyers-mahathir-10656208

Joe Kow says...

Wait...foreigners cannot buy, locals cannot afford unless prices drop significantly, developer will be squeezed and/or early buyers suffer capital losses....not to mentioned the already poor rental. Jialat indeed.

Hogan Yeo says...

Wonder who buy?

Scarly developer see no profit n scrap the idea too.. lol

Joe Kow says...

become ghost town

abandoned project

CH CH Ng says...

Nobody is going to invest in MY due to flip flop policy..🙄

Kenichi Xi says...

ppty price will drop without demand.

rental will not increase due to excess supplies too

You must remember that you are putting investments on Malaysian soil and at the stroke of a pen they can take it over.

Who said this? Who? Who?

CH CH Ng says...

CLOB under the same guy beware

AK says...

I remember being clobbered by CLOB. :(

Loke Oilin says...

He is also killing the chicken to scare the monkey.Siao horse.

AK says...

🙈🙉🙊

Sau Yee Fong says...

I respect him for doing the right thing for his citizens

Siew Mun Kwan says...

Investors are pretty much screwed

Post a Comment