The first speaker at the forum was Associate Professor Kalyani Mehta who is the head of the Gerontology Programme in the School of Human Development and Social Services at SIM University. In case you are wondering, Gerontology is the study of social, psychological and biological aspects of ageing. Big word, I know.

The main take away for me here is how people are living longer but they are not necessarily healthier. So, we have longer life expectancy (LE) today but what is also important to note is healthy life expectancy (HALE) and this might not match up. Take a look at the slide below:

So, on average, a male would be unhealthy (i.e. needing medical and maybe even palliative care) for 6.6 years while a female would be so for 6.8 years before saying good-bye to this world.

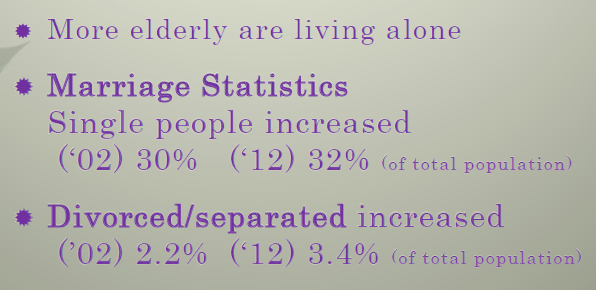

There will also be a growing number of aged who are single or divorced. They could be childless. So, there would be more elderly who stay alone in future.

We always say that family is the first line of defence but for these elderly people, the State will have to take a more active role in providing the necessary care.

What do I think?

Well, it is true that life expectancy has risen as nutrition and hygiene standards improved over time. Medical science has also improved. These factors help to promote longevity.

So, as people live longer, they will need more money for a longer time and healthcare costs will be a big burden if they are not well prepared. I like how our government has come up with Medishield Life to provide coverage for all Singaporeans for life, including those with pre-existing medical conditions. That is fantastic and I can't wait for it to be implemented because it will help people like my father who has pre-existing medical conditions and is almost 70 years old.

More importantly, we have to accept the fact that there will be more elderly people who are without children in future and if they happen to be financially disadvantaged at the same time, how can the government help them to meet their needs in their old age?

The CPF is a system that rewards employees. For those who were not gainfully employed for most of their lives for various reasons, what then? For these people, the CPF will not figure largely in their retirement plans, if at all. Those in such a situation who did not plan for retirement at all would be in dire straits.

The CPF is a system that help people who are able and willing to help themselves.

See slides: here.

Related post:

AK attended forum on CPF.