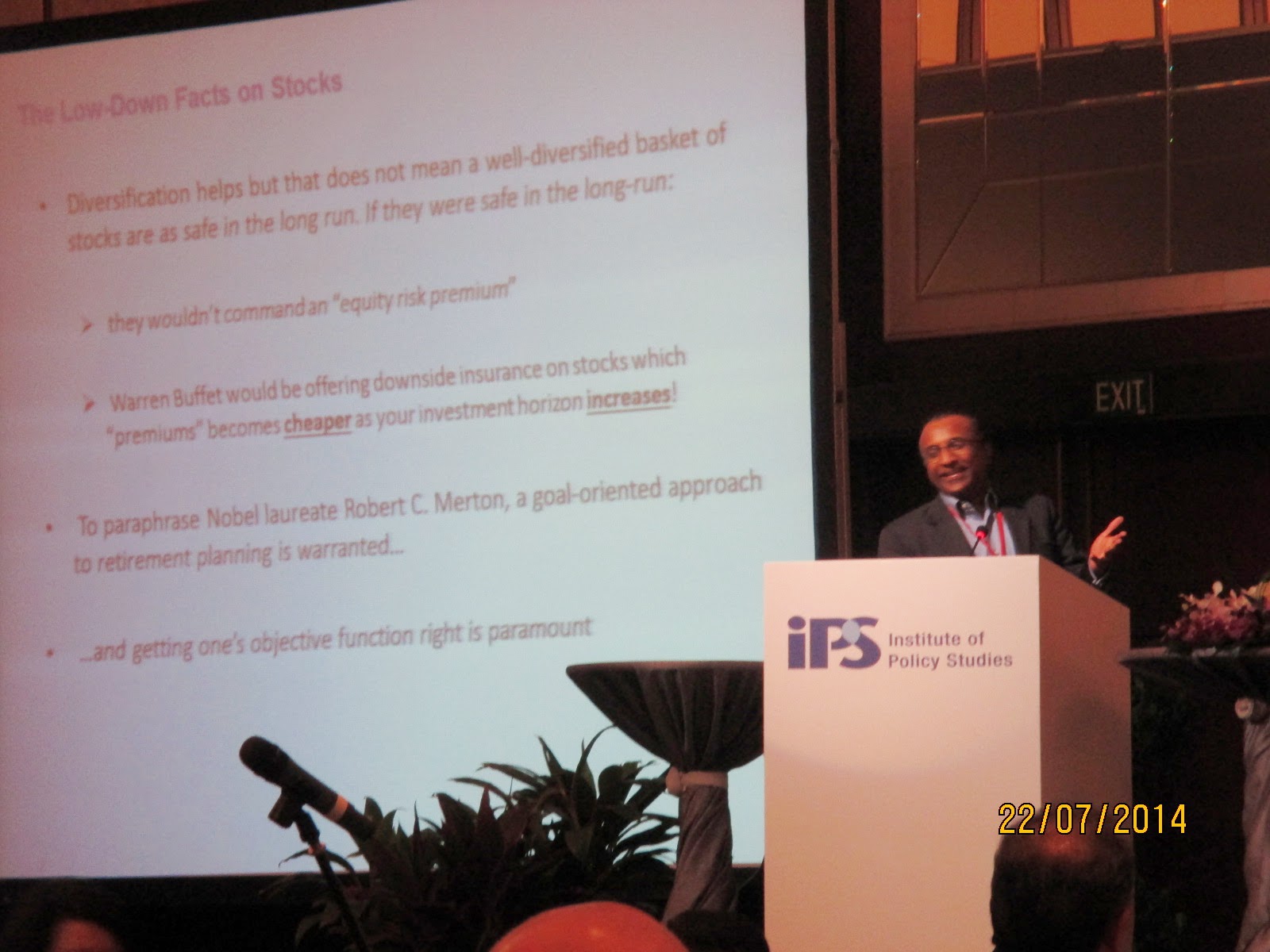

The second speaker in the afternoon session was Professor Joseph Cherian who is the Practice Professor of Finance and Director at the Centre for Asset Management Research and Investments in NUS.

Prof Cherian listed three fundamental concerns about retirement funding:

1. That retirees receive a reasonable level of payout every month.

2. That the payouts should last for as long as one lives.

3. That the payouts should be indexed to inflation.

This is where the CPF Life comes in and although it promises to give a monthly payout for life, the payout is not indexed to inflation. So, for the same person, $1,000 at age 65 is probably very different from $1,000 at age 75, for example. This is a very good point.

He went on to share some myths surrounding the CPF and inflation in Singapore. His slides are very good and I will share them here:

|

| Click to enlarge. |

Prof Cherian also raised the point about how the private sector should not be allowed into the reverse mortgage business of HDB flats because they are only interested in charging exhorbitant rates like what happened in the USA. This should be the government's responsibility.

Lastly, some might remember that in my open letter to the Prime Minister, I said that not enough has been done to communicate issues regarding the CPF clearly to Singaporeans. Prof Cherian said that we have to keep the messages simple and that we should conduct communication programs on retirement and the importance of the CPF. I agree wholeheartedly.

See slides: here.

(I highly recommend that you go through Prof Cherian's slides which are very detailed and also entertaining.)

Related posts:

1. AK attended forum on CPF.

2. An(other) open letter to the PM.

3. We do better managing our savings than the CPF does.