Hello AK,

I've been following your blog closely for up to 3 years now. Your philosophy to investing has helped to influence mine from investing purely for growth to one that invests for income as well. I would like to seek your insights on something that might be beneficial for young parents.

I have an 18 months old daughter and have been considering saving up for her university education. I would like to explore using a monthly savings plan in the STI ETF to achieve this. Using the financial data available, we can calculate the CAGR from its inception in 2009 to 2016 to be approximately 11 percent. But I know that this does not apply for a monthly savings plan. Any idea how I can do that?

Thanks and Best Regards,

R

|

| Source: ASSI |

Hi R,

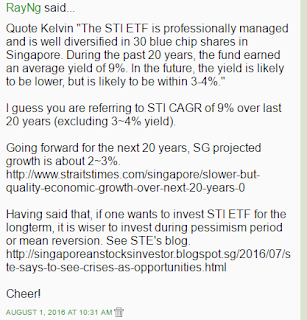

11% is in retrospect. It is unlikely that STI ETF will deliver that kind of performance in future. It is likely to be much lower. Remember that Singapore recovered sharply from a deep recession in 2009.

This option should still do reasonably well and is probably less costly compared to getting an endowment plan from an insurance company.

I don't know how to calculate base on a monthly savings plan but it shouldn't matter. Over a very long term, it is about smoothening performance over time.

Best wishes,

AK

11% is in retrospect. It is unlikely that STI ETF will deliver that kind of performance in future. It is likely to be much lower. Remember that Singapore recovered sharply from a deep recession in 2009.

This option should still do reasonably well and is probably less costly compared to getting an endowment plan from an insurance company.

I don't know how to calculate base on a monthly savings plan but it shouldn't matter. Over a very long term, it is about smoothening performance over time.

Best wishes,

AK

Parents should read this post too:

How to have enough to fund a university education?