Dear AK,

How are you, hope you're in good health.

I have 2 questions.

1) what do you think of investing in ETFs, eg. SPDR and the

2) such ETFs' dividend yields compared to buying single stocks.

For retail investors who don't really have very much appetite for volatility and time to do a lot of research. Yet still hope to invest safely. Hope it's not a silly question.

Hope you have a nice day.

Thanks and regards,

S

Hi S,

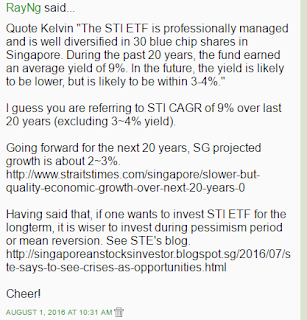

Putting money regularly in an STI ETF is good for someone who would like to participate in the growth of Singapore's economy but who has no time nor inclination to research into individual stocks.

There is less risk of a total capital loss but, still, be prepared for volatility as the ETF will track the ups and downs of Singapore's economy.

Best wishes,

AK

Related post:

Risk averse and putting money in STI ETF, REITs or stocks?