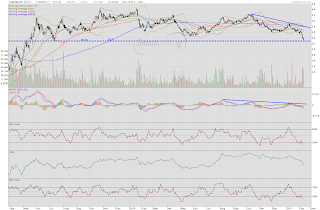

Is the bear losing strength or just taking a breather? It could be interpreted as the bulls are getting stronger or the short sellers are simply covering their positions. Whatever the case may be, closing lower by 5c at $3.34 after touching a low of $3.30 means that the bears have again emerged the victors.

Volume is, once again, very high although it has been in decline for three sessions in a row. Selling is still very much alive. Notice how the distance between the declining MACD and the signal line has widened. The MACD now approximates the low of 1 Dec 10. It does not seem likely that a higher low would form. The OBV suggests a continuation of intense distribution while the MFI and RSI are both deeper in oversold territories.

However, unless the low of July 2009 at $3.28 breaks, there is little incentive for short sellers to continue selling down the stock. For people who are thinking of cutting losses, the time for cutting losses could have come and gone. Remember that prices move down a river of hope. Cut loss when there is a rebound, not when price is testing supports.

Is AK71, therefore, hinting that the downward movement could be near its end? No, he is just wondering aloud which is something he is prone to do.

Related post:

Capitaland: Time to buy more?

2 comments:

general consensus now is there's going to be limited upside for property counters (esp developers). SG government has time and again come up with measures to prevent property prices from going up. until the economy picks up and the government starts loosen measures on SG prop, i think it's better to avoid all such counters in the near future

Hi Journalist,

I am also giving this counter a wide berth despite suspicion that a technical rebound could be on the cards given such a large magnitude movement downwards last week.

Thanks for sharing your assessment. :)

Post a Comment