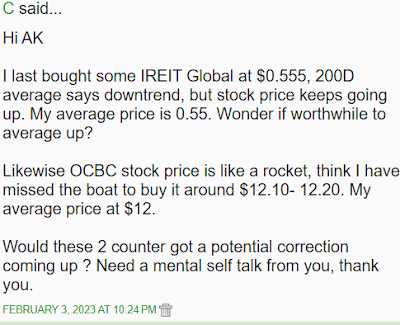

This blog is in response to a reader who asked if he has missed the boat for OCBC and IREIT Global?

It feels like it has been some time since I had a blog like this.

Very rare.

If you like such blogs, hope you enjoy this one.

AK says to reader:

OCBC's chart shows a strong upward momentum in the MACD but the MFI shows that it is borderline overbought. Testing resistance now at $13 and if it fails to break resistance, the immediate support is at $12.50 which is provided by a rising 50 days moving average.

A stronger support is the longer term 200 days exponential moving average which is now at $12.15 but as it is still rising, at this point, this support price will move higher over time.

|

| OCBC's chart. |

Likewise, IREIT Global's chart shows a strong upward momentum in the MACD but the MFI has dipped and is no longer in overbought territory which gives it a bit more room to move higher with less resistance.

Unlike OCBC, however, IREIT Global's 200 days moving average is still declining but very slightly so which means it is unlikely to be a strong support although this is where IREIT Global's price is currently sitting.

In a relatively buoyant market, to be fair, even a weak support is more likely to hold.

If this support breaks, then, the rising 50 days moving average should provide the next support which, at this point, is at 52 cents.

As this support is rising, it is likely to be relatively strong even though it is a shorter term moving average.

It is also interesting to note that the 50 days moving average formed a golden cross, a bullish crossover with the flattening 100 days moving average in the middle of January.

|

| IREIT Global's chart. |

In summary, both OCBC and IREIT Global's charts show that they have emerged from their multi months bottoming process and they are unlikely to retest their October 2022 lows anytime soon.

As usual, remember that technical analysis is about probability and not certainty.

More importantly, mental AK is just talking to himself, as usual.

Recently published:

1. Bankruptcies & property auctions...

1. Bankruptcies & property auctions...

6 comments:

AK, excellent talking to yourself. Looks like IREIT can buy a bit more if it retrace to around $0.52-0.53. A big If. But at 0.56, assuming dividend at 4.5 cents (from IREIT website), still about 8% yield, still better than FD, SSB or T bills. Though they are different asset class, but I see IREIT as an insurance of sorts.

A bit worry for my Wilmar ( due to India Adani issue) and CDG ( rising costs, losing bus tender to competition) holdings. Hope it won't be too bad, no one knows.

Hi C,

Mental AK talking to himself makes you happy?

Like that also can? ;p

A 7% distribution yield from IREIT Global would make me quite happy.

That is pretty good from a REIT with a very strong balance sheet in today's environment. :)

Adani Wilmar is only one part of Wilmar's sprawling business empire. I am not too worried.

CDG could retrace to test its lows but I think the bottom is in.

Famous last words? Maybe. ;p

I must be mental to read your blog for past 10 years.. next up , should be averaging up for my IREIT but will pace out my purchase. Think I need to meditate some for my Wilmar and CDG.. Your self talk reduce my own anyhow talk..cheers :)

Hi C,

Always a pleasure to meet mental people.

Makes me feel that I am normal. ;p

10 years? Wow!

Come to think of it, this is my 13th year blogging.

I am glad talking to myself has been helpful to you too. :D

Dear AK

Thank you

The ten year yields are rising a bit and if the fed speak reverses to a tougher stance, both OCBC as well as the REITS will feel the recessionary heat

I will be adding banks plus IREIT and others - waiting

Wilmar is again gently dropping and becomes a buy at around these levels

Regards

Garudadri

Hi Garudadri,

I have found out over the years that it is very hard to account for Mr. Market's mood swings.

Just have to stay invested in good income generating businesses, hold some fixed income with decent yields to smooth out the volatility and keep a meaningful emergency fund.

Peace of mind is priceless. :)

Good luck to us all. :D

Post a Comment