I have three things to say.

Since I am lazy, might as well put them all in one blog post.

1. Two thirds of Singaporean consumers expect an economic downturn.

There is plenty that is not well in the world and this is probably not unexpected.

However, if we end up just feeling worried about how life could get tougher, then, that is a waste of energy.

I would shore up my cash position even more aggressively.

Make sure I have an adequate emergency fund.

Fill up my war chest and be prepared to buy from Mr. Market when he feels depressed.

I have blogged about such topics many times before and many blog posts are consolidated in this one blog post:

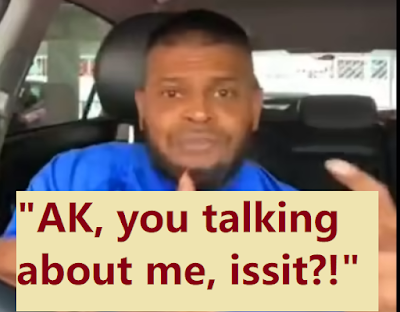

2. Fake news on CPF!

A Tik Toker has been spreading fake news about the Singapore election system and the CPF system.

POFMA has been served to him twice.

Yet, he is stubbornly sticking to his views.

If he is looking for fame, this isn't the way not only because he harms himself and possibly his family.

He is also harming ignorant Singaporeans who watch his clips and believe what he says.

I like to help people but some people are beyond help.

Like what I said before in this blog post:

3. I made a lot of money buying distressed REITs before.

I recently published a new video on how Manulife US REIT could possibly be an opportunity to make a lot of money.

It reminds me of the time when I bought Saizen REIT and AIMS APAC REIT when they were in distress donkey years ago.

If you are not subscribed to my YouTube channel, here is the link to the video.

Be prudent, patient and pragmatic!

If AK can do it, so can you!

18 comments:

Hi A K

Is Ireit in distressed now

Hi Seb,

Watch my latest YouTube video. ;)

IREIT Global & Wilmar International.

You might want to subscribe to my YouTube channel for timely updates. :)

Hi AK,

Been a while. Not sure if you still remember StocksCafe. We chatted several years back.

Anyway, I see that you are now active on Youtube. I want to get your permission to display your link your Youtube contents in StocksCafe (e.g. https://stocks.cafe/stock/blogs/D05/dbs?exchange=XSES). Would that be fine with you?

Thanks,

Evan

ps: I am sorry for reaching out this way but I tried using the email we chatted several years back but it is inactive. I can still be reached via the same email. Thanks.

Hi Evan,

It has been a while. :D

Good to know that StocksCafe is thriving! Congratulations! :D

Sure, since you have already linked my blog, naturally, it is OK to link my YouTube channel too. :)

I decided to do away with email exchanges and also Facebook a few years ago which gave me more time for other pursuits.

Strange how things have turned out now that I have found a new outlet in YouTube. ;p

Hi AK,

Thank you for the quick response!

Not thriving lah. Just surviving :)

Thanks for your permission. To easily pull your contents, I would need your channel_id that can be found here -> https://www.youtube.com/account_advanced

Example: This is StocksCafe YouTube RSS link -> https://www.youtube.com/feeds/videos.xml?channel_id=UCv-lMahkCfXzmNzk8uijT8A

Sorry for the trouble but this might also be useful for your readers.

Thanks,

Evan

ps: Of course, you can also email me if you prefer. Thanks!

Hi Evan,

Always learn something about IT from you when we chat. LOL.

UCOL4g1rWWt-vyGr3gkDDxjA

Is this what you need? :)

Hi AK,

Yes, that is correct! I will work on linking it and update you again :)

Cheers,

Evan

Hi Evan,

Hurrah! AK took another step away from being an IT dinosaur. :D

As for your other comment, I am not very keen but I will let you know if I change my mind. :)

You are probably half expecting this since you are so right about AK being lazy! LOL! ;p

Hi Evan,

Thanks for making an effort to explain to me but I am really low tech.

I actually enjoy recording my dividends using pen and paper.

If I enjoy something, it isn't tedious to me.

I always tell people I am mental and many don't believe me.

See, more evidence to show. LOL. ;p

Power. Respect :)

Hi Evan,

You understand AK!

That's real power!

Respect! :D

Hi Evan,

I appreciate your reaching out to me and I have enjoyed our chat.

Totally unexpected and it was a pleasure. :D

So, no apologies please. :)

Hi AK,

Will like to hear your view on OUE Commerical REIT. Trading at 0.4x P/B and 8.75% yield and the assets are pretty solid in my view.

Hi Forex Guru,

Someone in my YouTube channel asked the same question. ;p

@mkyee5951

@mkyee5951

3 hours ago

What is your thought of OUE Commercial REIT? Can this be an opportunity? Trading at 8.75% dividend yield and 0.4x P/B. Assets look good.

@A.Singaporean.Stocks.Investor.

@A.Singaporean.Stocks.Investor.

3 hours ago

I hear OUE, I think of Riady. I think of Riady, I think of Lippo and First REIT. 😅 my plate is full. Not looking. 🤭

Hi AK, I've read from DBS' CEO presentation slides that they state: "2Q dividend increased to 48¢ per share, bringing 1H dividend to 90¢ per share. In line with guidance for baseline annual increase of 24 cents per share, with upside depending on business conditions and macroeconomic outlook." My interpretation of this statement is that as long as DBS is doing well, their dividends will increase by an additional 24 cents per share every year. May I pls know whether my interpretation is correct?

Hi Learner,

That sounds correct.

However, I would not base my investment decision on that statement since there is no guarantee that the good times for DBS would go on forever leading to DPS increasing year after year.

DBS trades at a rich premium to book value compared to OCBC and UOB, and I remind myself that it wasn't always the case.

Thanks for your quick and clear reply, AK! :-)

Hi Learner,

AK was just talking to himself, of course. ;p

Post a Comment