This blog is a continuation of my blog published last night titled:

March dividends & SSB 3.15% p.a.

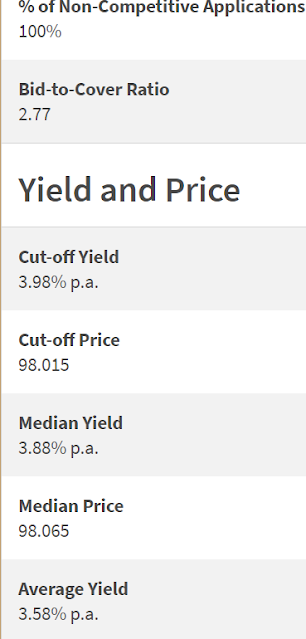

The latest 6 months T-bill auction's numbers are in.

Cut-off yield: 3.98% p.a.

In a recent blog, I said that the US$ has strengthened against the S$ and yields have also moved higher on the front end of the curve.

My expectation was for a higher cut-off yield for the 6 months T-bill and the auction did not disappoint.

I applied for the T-bill, putting in a non-competitive bid with some SRS money raised from the sale of my investment in SATS in early February.

That was fully allotted.

I also put in a competitive bid with some CPF-OA money.

Why a competitive bid in that instance?

I did not want to tempt Murphy's Law with a non-competitive bid when the CPF-OA pays 2.5% p.a. risk free.

My bid yield was very close to 4% p.a. and, fortunately, my competitive bid was also fully allotted.

3.98% p.a. is only a bit higher than the 3.88% p.a. offered by OCBC's FD promotion using CPF-OA funds.

(That offer by OCBC ended on the 28th of February and their new offer of 3.55% p.a. for a 5 months tenure looks relatively unattractive.)

If we take into consideration that the "interest earned" is paid by T-bills at the beginning of the duration and not at the end, however, then, the cut-off yield for this T-bill looks more attractive.

The "effective interest rate" actually exceeds 4% p.a. and it is closer to 4.05% p.a. which, at face value, is even better than what the CPF-SA is paying.

We should also remember that the "interest earned" stays in the CPF-OA where it will continue to generate passive income for me at 2.5% p.a. for the T-bill's 6 months duration.

So, what's not to like?

To me, using CPF-OA money, it really is win and win again with this T-bill!

The T-bill will mature on 5 Sep 23 and I have made a note on my calendar so that I will remember to transfer the funds from my CPF-IA back into my CPF-OA when that happens.

This is so as not to lose interest income which would be paid by the CPF for the month of October.

There are two more 6 months T-bills on offer this month in March with auctions happening on the 16th and 30th.

The plan for me is to place non-competitive bids in both auctions with money in my SRS account.

Apart from applying with SRS money which I earmarked earlier, I could also apply with some of the dividends coming in this month which I have estimated in the blog before this one as possibly being under $40,000.

With yields at the front end of the curve still rising, it is quite possible to see cut-off yields exceeding 4% p.a. in the two upcoming auctions.

A greater exposure to 6 months T-bills using cash on hand would slightly strengthen my portfolio's passive income generation in the month of March.

Getting more T-bills also means staying consistent in my plan to maintain a meaningful exposure to fixed income.

It is probably a good idea to remember that fair weather doesn't last forever and that throwing some defensives into our portfolio isn't a terrible idea.

It is not just about making hay while the sun shines but also about stashing a good portion of that hay away.

This higher exposure to fixed income will generate more passive income in a risk free manner while reducing volatility in my investment portfolio.

Risk free and volatility free, T-bills fit the bill to a t.

I do very much enjoy a good pun.

Anyway, as interest rates are likely to remain higher for longer, this strategy is probably going to help my portfolio bring home the bacon for some time to come.

As an aside, you might want to eavesdrop on Warren Buffett and Charlie Munger in this video before continuing to eavesdrop on AK:

We would very likely appreciate having a meaningful exposure to fixed income a lot more if the world continues to grapple with sticky inflation and more than a handful of economies around the world sink into recession.

Singapore is a very open economy and we would probably take some collateral damage in such a scenario.

If such a scenario should materialize, having a meaningful exposure to fixed income is not only comforting but we could then redeploy the funds which were previously locked up in a gradual manner.

This is if we have laddered into T-bills and fixed deposits which, of course, is what I have been doing.

|

| Source: MAS. |

Using a laddering strategy, we ensure that the maturities of T-bills and fixed deposits are staggered.

If you think that this strategy allows us to have access to investible funds at multiple points in time over the next 12 months, you are right.

Long time regular readers have overheard me talking to myself many times before and would be familiar with what is coming.

Don't be overly pessimistic.

Don't be overly optimistic.

Be pragmatic which means staying invested in genuine income generating assets while preparing for when Mr. Market goes into a depression.

Yes, when and not if.

"There are worse situations than drowning in cash and sitting, sitting, sitting," Charlie Munger.

Charlie Munger said that, not me.

Just talking to myself, as usual.

Reference:

Largest investments updated.

P.S. We cannot always be right and you might want to eavesdrop on Charlie Munger in this video: