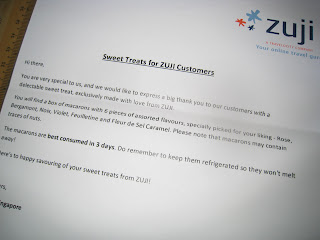

Today, I got a treat from ZUJI. They sent me a box of six macarons. What are macarons? I know what is macaroni. ;-p

|

| Very nicely boxed and ribboned. |

Wikipedia says it is "a sweet confectionery made with egg whites, icing sugar, granulated sugar, almond powder and food coloring. The macaron is commonly filled with buttercream or jam filling sandwiched between two cookies."

|

| Letter says to eat within 3 days but the expiry date on the box says 8 Dec 2011. |

According to a colleague, these macarons are quite pricey and they are being sold in atas places like MBS. Price? $3+ each! Oh, my goodness! I could have a very good lunch for $3! Sorry for the exclamations but I am not well informed when it comes to atas food and atas malls.

If I was not told, I would have thought the box of macarons is at most $5 in price. So, this box of 6 macarons is worth more than $18!

|

| I was told that Canele is definitely branded. |

|

| Macarons melted and cracked during delivery but the aroma was heavenly. Yummy too. |

Oh well, just food to me. It is very nice of ZUJI to send me something sweet for booking hotel rooms and sometimes air tickets through them. I do have a sweet tooth. :)

Planning a trip? Check if ZUJI has a good deal for you! Click here.