It could be a sign of things to come.

Cut-off yield in the latest 6 months T-bill auction was 3.54% p.a.

That is a huge decline from 3.7% p.a. seen in the prior auction.

100% of my non-competitive bid was filled.

3.54% p.a. is still decent but it is similar to what I am able to get from 6 months fixed deposits now.

I have a few fixed deposits maturing this month and I will be renewing them at 3.55% p.a. interest rate for a 6 months tenure with CIMB.

I have talked to myself about when to dismantle the T-bill ladder.

The plan is to dismantle the ladder when Mr. Market goes into a depression.

However, if the cut-off yield becomes significantly lower than what I could get from 6 months fixed deposits, then, I could dismantle the ladder too.

Place fixed deposits instead of buying T-bills.

Still laddering but with fixed deposits instead.

As for CPF OA money, I would simply leave the money undeployed if cut-off yield goes under 3.5% p.a. which is where I would place my competitive bids.

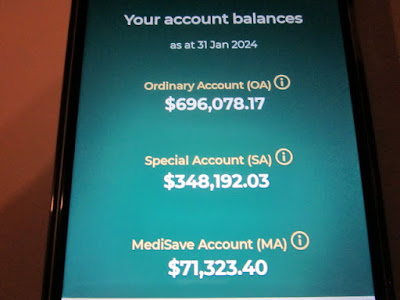

This is why I said it makes sense to transfer the funds from CPF IA to CPF OA when I did.

It is for in case I am unsuccessful in getting T-bills at the cut-off yield which is meaningful to me.

Where are things going?

So, it seems that T-bill cut-off yield is trending lower.

This is probably in response to dovish statements from the Fed and also the ECB on possible interest rate cuts this year.

Just have to roll with the punches and adapt.

If AK can roll, so can you!

Recently published:

1. $700K coming back!

2. DBS and CPF miracle!