When a reader asked me what I thought about Tuan Sing Holdings as it trades at almost 60% discount to NAV, it got me interested enough to take a closer look because this is something I think I understand.

I approached this in a way that is similar to my approach to investing in Guocoland.

Substantial shareholders, the Liem family, and also Koh Wee Meng of Fragrance Group together hold a 60% stake in Tuan Sing.

It is interesting to note that Mr. Koh's purchase price in 2014 was 43c a share and Tuan Sing's NAV per share then was 68c.

Based on its Annual Report for 2016, Tuan Sing's NAV per share grew to 77c and its stock is now trading at a lower price than in 2014.

On the face of it, therefore, Tuan Sing is worth more today and with a lower share price, it is more undervalued than before.

Why is this so?

Tuan Sing's earnings have been in decline and Mr. Market probably doesn't like that.

To top it off, Tuan Sing's gearing level is pretty high and interest cover ratio has also weakened from 14x in 2012 to just 2.2x in 2016.

At the current price level, there seems to be plenty of value waiting to be unlocked but it also seems to be thornier an investment.

We must remember that undervalued could stay undervalued for some time. So, it would be good to be paid while we wait.

Do they pay dividends?

Tuan Sing pays a dividend but it is nothing to shout about. How much? 0.5 cent to 0.6 cent a share.

Assuming a purchase price of 33c a share, we are looking at a dividend yield of 1.5% to 1.8%.

Anyone who buys into Tuan Sing for income has to be mental.

1.5% to 1.8% is lower than the 2.7% dividend yield from Guocoland based on an entry price of $1.83 a share and that was not an ideal investment for income either.

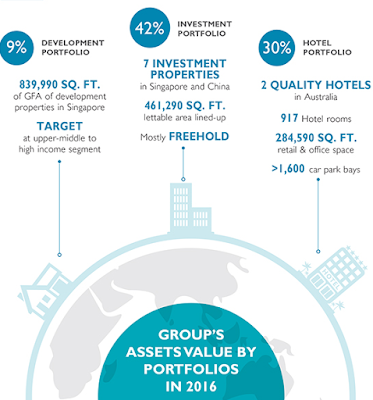

We know that property developers usually have pretty lumpy earnings but I am most interested in the fact that Tuan Sing has a relatively big portfolio of investment properties in Singapore, China and Australia.

Therefore, like Guocoland, Tuan Sing has the potential to become a more attractive investment for income investors if future payouts should increase together with any increase in future cash flow.

Of course, this is somewhat speculative as it is anyone's guess what the Liems have in mind.

|

| Source: Tuan Sing Holdings Limited. |

A big reason probably why Tuan Sing's gearing level is so high, their earnings is much reduced and, consequently, their interest cover ratio is so poor is because quite a big portion of its investment properties are still under development. They have yet to generate any income.

It stands to reason that once Tuan Sing's investment properties are fully completed, once they start generating income, earnings will improve and, significantly, it is worth noting that this will be recurring income which is something investors for income look for.

Of course, Tuan Sing still have development properties to sell but since that business is a relatively small portion of their entire portfolio, if they should sell well, it is the icing on the cake. If they don't sell well, it is not going to be a disaster either.

Cake without any icing, anyone?

Tuan Sing is another asset play and if the valuation is to be believed, they are a pretty heavily undervalued asset play too.

Just like my investments in OUE Limited, Wing Tai, PREH and Guocoland, my investment in Tuan Sing is only a nibble because it could be a long wait before value is unlocked.

In the news this year:

Sime Darby Centre purchased

and

Tuan Sing's earnings tumble 64%.

Related posts:

1. Guocoland analysis.

2. PREH analysis.

3. OUE Limited analysis.

4. Wing Tai Holdings analysis.

30 comments:

Hi AK,

You seem to be nibbling and building your portfolion on property counters...Waiting for a rebound in property prices? ;)

Hi K,

Maybe, I will blog about this. ;)

AK is the new-age Midas of the 21st century. Everything you touch turns to gold.

Hi Laurence,

I wish. ;p

wow wow AK, you are laughing to the bank :)

now we know why you have been collecting property stocks! Even Mr Lim says "Good AK, Good AK" :)

https://www.bloomberg.com/news/articles/2017-08-03/capitaland-detects-signs-of-singapore-property-bottoming-out

Hi AK,

Tuan Sing is quite similar to Hong Fok. Both trading at more than 60% discount to NAV but also has its challenges for example interest cover ratio and investment properties that are still under development which have yet to generate income.

However, Hong Fok's stock float seems very low and might be a potential value trap to retail investors. ;)

Added Tuan Sing to my watch list. 8)

On my FB wall:

Mervyn Lim:

https://www.nextinsight.net/story-archive-mainmenu-60/939-2017/11652-the-edge-investment-forum-stocks-to-buy-amara-banyan-tuan-sing-avi-tech

Also under activist fund quartz. They say Tuan sing is open to the idea of reit.

"We see potential upside of 40% by 2019. We are long term investors; we think things take time to work out." :o

Hi jojo,

Incidentally, I will be blogging about that, er, soon. ;)

Hi Kevin,

I know for a fact that Hong Fok is a value trap. ;)

Hong Fok is not shareholder friendly at all and I know for a fact that the controlling family regretted their decision to go public donkey years ago.

The Cheongs are more likely to reward company directors than to reward shareholders. ;)

In my opinion, minority shareholders in Hong Fok who are waiting for value to unlock would have to wait for the Cheongs to make an offer to take the company private. It could be a long wait.

What about GSH Holdings ah? Sam Goi bought recently.. I stared at their financial statements and it looks pretty decent.

Hi Bobbabu,

I have no idea what is going on at GSH Holdings. Maybe, you could share your thoughts with us here. ;)

Eve Low:

When will Tuan Sing start to 'grow' (like Guocoland) too...kekeke

AK:

Tuan Sing will take a longer time than Guocoland.

Tuan Sing Holdings previews Kandis Residence in Sembawang. ;)

https://sg.finance.yahoo.com/news/tuan-sing-holdings-previews-kandis-043000596.html

Hi Kevin,

Thanks for the update. :)

Hi AK,

Would like to seek your opinion on Hwa Hong.

Hi AK,

Would like to seek your opinion on Hwa Hong.

Hi AK,

Would like to seek your opinion on Hwa Hong.

Hi AK,

Would like to seek your opinion regarding Hwa Hong.

Hi ML,

I don't have an opinion on Hwa Hong.

Reader:

I read your blog on Tuan Sing and was waiting for the share price to fall before buying. It doesn't look like it is going to fall. It keeps going higher. Do you think it is still worth buying now?

AK:

If you are price focused, you are more speculating than investing. You might want to read my blog again to see why did I invest in this. :)

OUE Ltd has commenced operations at Downtown Gallery and Oakwood Premier OUE Singapore which will augment recurring income base.

After updating our valuation model, our fair value estimate increases from $2.17 to $2.47. Currently trading at 0.46x price to book, OUE's shares are attractively priced.

Source:

OCBC Investment Research, 7 Nov 17.

Been a while AK. Can see that you are still doing very well recently

OUE still remains undervalued so far.

My only concern after reading past few quarters report is the interest coverage part. The operating cash flow barely manage to cover the interest expense.

Any increase in interest rate can trigger a rights issue.

Hi Solace,

I do have some investments which are rather disappointing but I am lucky that my positions in those are relatively small.

As for OUE Ltd, I hope that with recurring income from Downtown Gallery and Oakwood Premier OUE Singapore, things would improve on the interest cover front.

Haha AK,

When i refer to you doing well, i meant your overall well being, i.e health, happiness, mental etc not just investment only lah, friend hahaha.

I have vested interest in OUE, will continue pay key attention to their interest expense and gearing ratio. Will update if i uncover more stuff lol

Hi Solace,

Still invested in OUE?

I am in good company. Haha ;p

Looking forward to your updates. :)

Hi AK,

Good news for Tuan Sing! Prepare for Tuan Sing stock price to rise at least another 20%.

https://i.imgur.com/K7yC1M9.jpg

Hi Kevin,

Robinson Tower is 93% leased.

That is good news indeed. :)

Lena Nyk says...

Can I ask if you still have position on Guocoland.

Also would you accumulate more now that Guocoland is at $1.84.

Thankful if you can talk to yourself.

AK says...

I am still invested but I am not adding.

On its own, it isn't a big investment but my overall exposure to property developers in Singapore is quite significant if we put all the investments together:

Guocoland

OUE

WingTai

PREH

TuanSing

HoBee

I stay invested because they are all trading at discount to valuation and look cheap but I won't be adding unless Mr. Market goes into a depression

long awaited break :)

https://www.straitstimes.com/business/companies-markets/undervalued-tuan-sing-set-to-get-major-ipo-boost

Hi Invest Sg,

I have so many undervalued investments in my portfolio but I have kept them mostly smallish in size as it could take a long time for value to be unlocked.

Thank you so much for sharing the good news. :)

Post a Comment