It is no secret that I spend a lot of my time gaming online.

I have also been buying lots of things online.

I hardly leave my home and, so, I have become even more of a hermit in recent years.

Anyway, with my lifestyle, shouldn't I be interested in Alibaba and Tencent?

Well, on top of them being Chinese, as a retiree who depends on passive income for a living, I find it harder to be interested in them.

However, I am a relatively young retiree.

So, maybe, same same but different.

I have given it a lot of thought recently and I have decided that I should be at least a little bit interested in having some exposure to Alibaba and Tencent with their prices being where they are.

Not too much exposure though.

Just like adding some black pepper to my soup, powdering my portfolio with some Alibaba and Tencent to give it some pizzazz might not be a bad idea.

Invest in Alibaba because it is the big brother when it comes to online shopping platforms.

Invest in Tencent because it is the big brother when it comes to developing online games.

Of course, they do more than these but I am too lazy to list everything they do.

It is easy to find the information online and anyone who is interested can do a simple search.

Both Alibaba and Tencent are inexpensive for tech stocks if we look at their financial ratios.

Still, cheap could stay cheap as long as Mr. Market lacks confidence or interest in them.

I have not invested in any Chinese companies since China Minzhong donkey years ago.

China Minzhong had a PE ratio of only 3, if I remember correctly.

Chinese banks also look relatively cheap and they pay dividends too.

I think you get the idea.

In one of my blogs on Alibaba, I said:

"I waited for the dust to settle during the last bear market and for share prices to find a bottom before increasing my investment in the local banks.

"If I were interested in investing in Alibaba, I would do the same."

See: Invest in Alibaba.

So, since I have decided that I am interested in Alibaba and Tencent, has the dust settled?

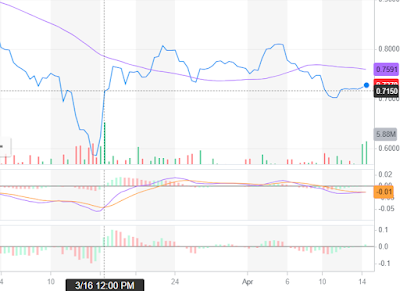

Well, it does look like their prices have "bottomed" in the middle of March, recovered and are now consolidating.

It doesn't mean that prices cannot move lower.

We could even see a retest of the "bottom" formed in March.

I say "bottom" because we wouldn't know that it is the bottom until the downtrend reverses for sure.

Yes, if we zoom out and look at the big picture, the downtrend is still very much intact.

So, for now, we can say prices have found a floor as we cannot be sure they have bottomed.

A floor with a big plunge pool, maybe.

Plunge pool.

Ooh.

Sounds so exciting.

So exciting that some people got a heart attack.

Then, what about double or triple plunge pools?

Alamak, liddat how?

Looking at the moving averages, Alibaba and Tencent are still stuck in a downtrend.

However, if prices were to retest the lows of 15 March, we would probably see strong buying interest.

People who missed the fun of playing in the first plunge pool wouldn't want to miss the fun again.

It is just market psychology at work.

If the buying pressure is strong enough, we could then see a double bottom forming.

Of course, we wouldn't know a double bottom has formed until the trend reverses for sure.

Yes, technical analysis can be pretty irritating.

Although I am interested in Alibaba and Tencent, I am not interested in buying their stocks in HK or the USA.

Why?

AK is lazy.

AK doesn't like "mafan" stuff.

I want to keep things simple and, so, I have decided to gain exposure through an ETF in Singapore, specifically, the Lion-OCBC Securities Hang Seng Tech ETF.

I have hyperlinked the name to the ETF's website to make it easy for interested readers to find out more about the ETF.

Eh, lazy AK not so lazy after all?

No lah.

I was reading about the ETF and have yet to close the tab to the website.

So, might as well.

Don't spoil my reputation for being lazy hor. ;p

The ETF is listed on the SGX and I don't have to worry about exchange rates, having a custodian account in another country and paying a custodian fee for each counter invested.

The ETF also has the advantage of being diversified and would give me exposure to some other Chinese businesses that I know like Lenovo, JD.com and Xiaomi too.

There is a management fee as there will be some expenses but they aren't sky high.

Yes, I am not as tight fisted with money as I once was and I feel that the fee is a small price to pay for the convenience.

Having things easier for me promotes peace of mind which is priceless.

So, maybe, this ETF is better for my heart in more ways than one.

|

| Source: Lion-OCBC Securities Hang Seng Tech ETF. |

This ETF is about growth and does not pay a dividend.

Consistent with my asset allocation pyramid, investments which are purely for growth will together form a much smaller percentage of my entire portfolio.

|

| S = speculative positions. |

Since I don't have any investment that is purely for growth other than this ETF for now, I could possibly put more money into it if the unit price plunges again (and again.)

Even so, the ETF should still form a very small percentage of my portfolio, all else being equal.

Maybe, just 1% of my portfolio for a start and I feel a 5% cap is probably a good idea.

As it now stands, I still have some way to go before it gets to 1%.

Yes, I being very cautious on this adventure.

Like with all adventures, no matter how well prepared we are, we must be mentally prepared for the worst while we hope for the best.

Some people compare Alibaba and Tencent to Amazon, for example, and if they are right, we could see a fivefold or even tenfold return in the next decade or two.

If this happens, then, even at 1% of my portfolio, in absolute dollar terms, it would be pretty amazing.

So, how likely is this?

To be honest, I would be quite happy if the investment sees a threefold increase in market value in the next decade.

Some might say I am being pessimistic.

Alamak, if I am pessimistic, I wouldn't have put down any money.

Long time readers might remember that I said on many occasions that we want to stay pragmatic and not be optimistic nor pessimistic.

Easy to say, of course.

Getting some exposure to Chinese tech at this point is me trying to be pragmatic.

It is so much fun to make predictions but I remind myself of some facts to stay grounded.

China is not the USA.

The USA, for example, does not care about "common prosperity."

Anyway, unless coming out of retirement and rejoining the workforce is something I am willing to consider, I shouldn't be too adventurous when it comes to investments.

This ETF is probably not a good fit for anyone who is a purist investor for income.

It is probably not a good fit for anyone who does not have the stomach for price volatility either.

Think carefully and don't anyhow hoot.

If AK can do it, so can you but should you?

References:

1. Cut loss on Alibaba or buy more?

2. Investing with some common sense.

Recently published:

Investment in QAF is larger now.

8 comments:

Got out from Lion ETF that time around 1.08 without much losses. Your post come in the right time. Looks like a good calculated gambled on timing.

Hi Cory,

Although I think of this move as a long term investment for an equally long term growth, you could be right too in calling it a gamble. ;p

It is a tiny initial investment.

See how it goes. :)

Dear AK

I started buying Chinese tech in August 2021 when it was already significantly down, only to see it go down further

So far, despite a 30-35% drawdown, I have resisted not only cutting losses but also averaging down

Fortunately, it is less than 1-2% maximum of my portfolio and though painful to see, does not bother me too much

It is very difficult to predict the future with this lot. I have been invested for nearly 3 plus years in the major Chinese banks. Although I have seen no capital appreciation, the chunky dividends have cushioned the impact of my overall greater China portfolio that is less than 4-5% of ,y holdings overall

The upside for Chinese tech is potentially much higher than the downside and those who are ok with a big capital risk downside, can add

I will watch longer before averaging down myself

Best wishes

Garudadri

Hi Garudadri,

I can see why you are not badly affected by the decline in the prices of Chinese tech stocks.

Limiting your exposure to a very small percentage of your portfolio is prudent.

Although I agree that Alibaba and Tencent look cheap now, when we throw in policy risk, conventional fundamental analysis and technical analysis become less useful compasses.

My initial investment is not even 0.5% of my portfolio.

Going to take my time with this one. :)

Got mine not long after it launched, and my average cost is $1.34...

Hi Daniel,

The rest of your portfolio should hopefully be able to smooth things over.

As long as we are right more often than we are wrong, we should do OK.

Gambatte! :)

References:

1. Peace of mind investing.

2. Right 6 times out of 10?

I started nibbling in HK dividend stocks towards end-2018.

And the reason I refused to invest in tech stocks was precisely bcos they paid zero dividends.

At that time, Tencent hit a recent low HKD251 but I refused to touch it.

Within months, it topped at HKD775 !!!!!

The same thing for Meituan which I also refused to buy at HKD40 at that time as it was making huge quarterly losses (and still does).

Last year Meituan peaked at a eye-watering HKD470 !!!

:(

Hi Laurence,

High PE ratio and no dividend were good reasons for a retiree like me not to be interested.

However, Alibaba is a more valuable company today than it was back in 2018 and yet it is trading at less than half of what it was trading at back then.

The same goes for many of the businesses the ETF is tracking.

I am not good at analyzing and investing in growth companies but with prices being where they are, it is like value investing now. ;p

Getting a little exposure now should be OK, I hope. :)

Post a Comment