This blog is a continuation of my blog published last night titled:

March dividends & SSB 3.15% p.a.

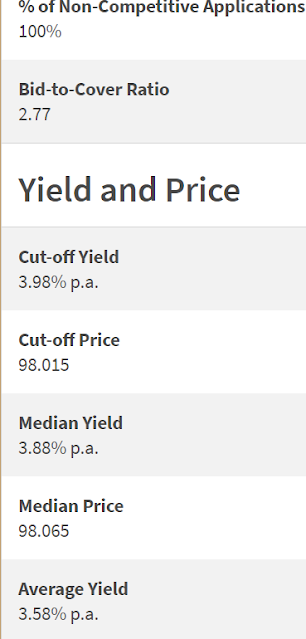

The latest 6 months T-bill auction's numbers are in.

Cut-off yield: 3.98% p.a.

In a recent blog, I said that the US$ has strengthened against the S$ and yields have also moved higher on the front end of the curve.

My expectation was for a higher cut-off yield for the 6 months T-bill and the auction did not disappoint.

I applied for the T-bill, putting in a non-competitive bid with some SRS money raised from the sale of my investment in SATS in early February.

That was fully allotted.

I also put in a competitive bid with some CPF-OA money.

Why a competitive bid in that instance?

I did not want to tempt Murphy's Law with a non-competitive bid when the CPF-OA pays 2.5% p.a. risk free.

My bid yield was very close to 4% p.a. and, fortunately, my competitive bid was also fully allotted.

3.98% p.a. is only a bit higher than the 3.88% p.a. offered by OCBC's FD promotion using CPF-OA funds.

(That offer by OCBC ended on the 28th of February and their new offer of 3.55% p.a. for a 5 months tenure looks relatively unattractive.)

If we take into consideration that the "interest earned" is paid by T-bills at the beginning of the duration and not at the end, however, then, the cut-off yield for this T-bill looks more attractive.

The "effective interest rate" actually exceeds 4% p.a. and it is closer to 4.05% p.a. which, at face value, is even better than what the CPF-SA is paying.

We should also remember that the "interest earned" stays in the CPF-OA where it will continue to generate passive income for me at 2.5% p.a. for the T-bill's 6 months duration.

So, what's not to like?

To me, using CPF-OA money, it really is win and win again with this T-bill!

The T-bill will mature on 5 Sep 23 and I have made a note on my calendar so that I will remember to transfer the funds from my CPF-IA back into my CPF-OA when that happens.

This is so as not to lose interest income which would be paid by the CPF for the month of October.

There are two more 6 months T-bills on offer this month in March with auctions happening on the 16th and 30th.

The plan for me is to place non-competitive bids in both auctions with money in my SRS account.

Apart from applying with SRS money which I earmarked earlier, I could also apply with some of the dividends coming in this month which I have estimated in the blog before this one as possibly being under $40,000.

With yields at the front end of the curve still rising, it is quite possible to see cut-off yields exceeding 4% p.a. in the two upcoming auctions.

A greater exposure to 6 months T-bills using cash on hand would slightly strengthen my portfolio's passive income generation in the month of March.

Getting more T-bills also means staying consistent in my plan to maintain a meaningful exposure to fixed income.

It is probably a good idea to remember that fair weather doesn't last forever and that throwing some defensives into our portfolio isn't a terrible idea.

It is not just about making hay while the sun shines but also about stashing a good portion of that hay away.

This higher exposure to fixed income will generate more passive income in a risk free manner while reducing volatility in my investment portfolio.

Risk free and volatility free, T-bills fit the bill to a t.

I do very much enjoy a good pun.

Anyway, as interest rates are likely to remain higher for longer, this strategy is probably going to help my portfolio bring home the bacon for some time to come.

As an aside, you might want to eavesdrop on Warren Buffett and Charlie Munger in this video before continuing to eavesdrop on AK:

We would very likely appreciate having a meaningful exposure to fixed income a lot more if the world continues to grapple with sticky inflation and more than a handful of economies around the world sink into recession.

Singapore is a very open economy and we would probably take some collateral damage in such a scenario.

If such a scenario should materialize, having a meaningful exposure to fixed income is not only comforting but we could then redeploy the funds which were previously locked up in a gradual manner.

This is if we have laddered into T-bills and fixed deposits which, of course, is what I have been doing.

|

| Source: MAS. |

Using a laddering strategy, we ensure that the maturities of T-bills and fixed deposits are staggered.

If you think that this strategy allows us to have access to investible funds at multiple points in time over the next 12 months, you are right.

Long time regular readers have overheard me talking to myself many times before and would be familiar with what is coming.

Don't be overly pessimistic.

Don't be overly optimistic.

Be pragmatic which means staying invested in genuine income generating assets while preparing for when Mr. Market goes into a depression.

Yes, when and not if.

"There are worse situations than drowning in cash and sitting, sitting, sitting," Charlie Munger.

Charlie Munger said that, not me.

Just talking to myself, as usual.

Reference:

Largest investments updated.

P.S. We cannot always be right and you might want to eavesdrop on Charlie Munger in this video:

27 comments:

Hi AK,

Do you have a good idea of the duration needed for money to be credited to CPFIS and transfer to CPF account? Reason is need to calculate whether will lose the additional month interests.

Take example for the next issue:

Auction Date - 16th Mar 2023

Issue Date - 21st Mar 2023

Maturity Date - 19th Sep 2023

When will the money appear back in CPFIS when it mature? On 19th? 20th? 21st? Or even later? When doing transfer from CPFIS to CPA-OA, how long will it take? Instant? 3 working days?

Also, the following issue after that Auction on 30th Mar and Issue on 4th Apr. Will the money be deduct on 30th? 31st? Or 4th Apr? Seems not worth risking cause might lose Mar interest if we don't now exactly when the deduction happens.

Hi ZZ,

If we are using CPF funds for T-bills, the funds will only be debited on the issue date.

As for moving funds from CPF-IA to CPF-OA, if I remember correctly, it takes 2 working days to effect.

So, with the most recent T-bill, it is pretty safe that we would not lose another two months' worth of interest from the CPF-OA.

Oops, I missed out one part.

As for when the money would appear in our CPF-IA when the T-bill matures, I only started buying T-bills in October last year.

So, I don't have any experience with this but I would think that the payment should be made to us on the maturity date, just like a fixed deposit.

Hi AK,

I was under the impression that after the funds reached CPF-IA when the T-bill matures, it will be automatically transferred back to the CPF-OA.

Do we need to manually request for a transfer physically at the bank?

Hi Alcus Trader,

The agent bank will only transfer the funds from the CPF-IA to the CPF-OA automatically 2 months after the funds stay inactive in the CPF-IA.

So, if we did not initiate the funds transfer from the CPF-IA to the CPF-OA, we would lose another 2 months' worth of CPF-OA interest income.

Fortunately, we do not have to visit the bank as we can do the transfer using ibanking. :)

Thanks!

Hi Alcus Trader,

Just talking to myself, as usual. ;)

Hi AK Shifu

1) I am using CPF OA to do a competitive bid for the 16 Mar auction for 6 mth T-bills, trust that DBS will let us when to apply when we log into website.

2) Sorry, I know you mention something about using OCBC FD to estimate the interest rate which we bid for 6-mth T-bills? How did you derive the interest rate for 6mth and 1 yr t-bills which we use our CPF /cash to buy?

Thank you

Hi C,

It was pretty easy to apply for the 6 months T-bill with DBS online banking and if I thought it was easy, it should be easy for you too. ;)

As for what bid yield to submit for the upcoming auction, the current offer from OCBC for FD using CPF-OA money is 3.55% p.a. for a 5 months tenure.

So, it would make sense to put in a bid yield higher than 3.55% p.a.

Otherwise, you are better off just taking up OCBC's offer. ;)

Dear AK, bid above OCBC FD rate (lower limit) but how do you determine upper limit, lol ? You mention in other post that 1-yr T-Bills is preferred when using CPF OA, any downside when I bid for 6 month t bill with CPF money? Sorry for such basic question.. cheers

Hi C,

I always say that if we take care of the downside, the upside will take care of itself. ;p

The more important thing is not to lose money or not to make less money compared to the alternative, in this case.

For example, I don't understand why another blog, Investment Moats, keeps telling people to bid lower, even lower than 2.5% just to secure their T-bills.

That not only runs the risk of us possibly getting an undesirable cut-off yield but, in the process, hurts everyone else.

As for the 1 year T-bill being preferred when using the CPF-OA, I said that when online application for T-bill with CPF-OA funds was unavailable.

Having to make a trip to the bank each time I wished to apply for a T-bill, to me, was too costly.

Doing it once a year was better than doing it twice a year. ;p

Of course, if we should be unsuccessful in our bids, it could be more than twice a year. OMG!

With online application available now, that is not longer an issue.

Things different already. :D

Good morning AK, thank you for patiently answer my questions. In Buddhism, they say patience is wisdom. I ask so detail because first time using my CPF to buy T-Bills. Eating crusty bread with ink slowly. :)

Hi C,

Definitely, I like to think that patience will be rewarded (eventually.)

Rushing headlong into things is usually not a good idea. :)

Crusty bread with ink doesn't sound delicious but it is probably quite nutritious. ;p

This is an afterthought and for the benefit of newer readers, read:

Investors eat crusty bread with ink slowly for peace of mind.

Hi

I put in a competitive bid that was very close to the 3.98 yield and was very glad to have it fully allocated. Alamak, I should have put in more.

Hi Yv,

3.98% p.a. cut-off yield huat ah!

Put in more in the next one.

Possibly higher than 4% p.a. by then. ;p

Hi AK,

We have turned very conservative in our investment since my wife and I turned 60 two years ago. We are now in the "wealth preservation" stage of our lives.

My wife retired two years ago while I still work, so we are not yet in the "wealth de-accumulation" stage. And we hope we dont ever have to. How come no de-accumulation? Its because we hope our passive income streams of dividends, rental, SRS savings drawdown, interests from our CPF OA & SA and CPF Life payout would be more than adequate to cover our annual expenses in retirement.

We have earlier built up an income ladder of Singapore Savings Bond (SSB) giving us a monthly income. We bought the maximum allowed of $200K SSB each.

When the T-bill yields started to rise late last year, we were thrilled. We tried to build up a similar ladder using the T-bills, but unfortunately we couldnt really complete the ladder as we were unsuccessful in securing any T-bills in the whole of Feb 2023.

Nonetheless, we were still happy that the elevated yield of the T-bills gave us a safe avenue to park our savings including our OA funds. As of today, we have parked $2.135M of our savings in the not quite complete T-bill ladder.

If you have a telegram account, you can take a peek at our T-bill ladder : https://t.me/CPF_Tree/1257

Hi AK,

Our T-bill ladder was built mainly with our OA funds, not from cash only.

Just thought I clarify this since you dont have telegram account to look at it.

Cheers

Hi MSI,

Ah, I see.

Thanks for letting me know.

OK, double accounting avoided. LOL. ;p

Even so, you have a very thick retirement cushion, if you should choose to retire. :)

Hi AK, Do you know where to find the steps to transfer the Tbills from DBS back to OA? Is it on DBS or CPF website uh? Thanks

Hi EX,

Transfer from CPF Investment Account to CPF Ordinary Account:

Perform a partial or full funds transfer to your CPF Ordinary account easily using digibank Online.

After you have logged in to digibank Online, follow these steps:

Select "More Investment Services" under the "Invest" tab on the top navigation.

Under the "Manage Investments" category, select "Refund to CPF Board".

Select "Refund Full Amount" or "Refund Partial Amount".

If you have selected "Refund Partial Amount", enter the amount to be transferred.

Read the agreement, then click "Next".

Verify that your details are correct, then click "Submit".

Print the completion page and note down the Transaction Reference Number for future enquiries/reference.

Q.E.D. :D

Source:

https://www.dbs.com.sg/personal/support/investment-cpfis-transfer-to-oa.html

Thank you AK. You're the BEST! 👍

Hi EX,

Alamak. I shy.

DBS did all the heavy lifting.

AK is only a messenger. ;p

Hi AK,

Disappointingly, the 16 Mar T-bill auction cut-off yield is only 3.65%, why like that.... wasn't expecting such a low yield...

Hi Sandra,

I was afraid this might happen.

Blame the U.S. banking crisis.

Everyone is rushing to the safety of bonds.

More specifically, the short duration bonds.

So, as demand spikes, the yield plunges. (TmT)

Hi AK

Should I be glad that I forgot about the auction date and missed this round's offering? :p

Hi Yv,

LOL.

We have to wait and see what happens next.

If the Fed stops tightening and we will know by next week, then, we could see bond yields dropping even more.

Mr. Market seems to be expecting a Fed pivot at this point and it could happen if the Fed decides that the priority has changed to managing risk and not inflation.

We are living in very turbulent times. -.-"

Post a Comment