I received an SMS from CPF that went:

"You have a CPFIS investment deduction from your Ordinary Account."

I suppose this means that my competitive bid (using CPF-OA money) for the last 6 months T-bill auction that took place on 14 September was successful.

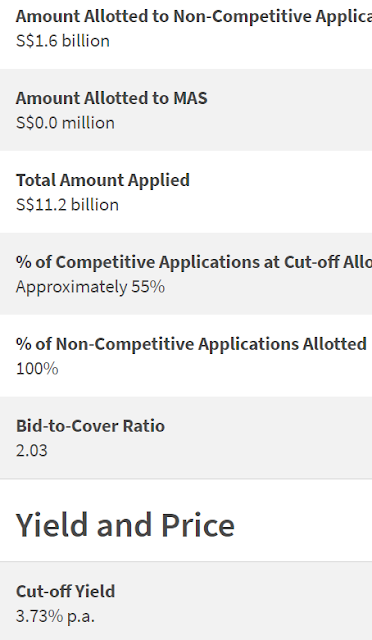

A quick check revealed that the cut-off yield was 3.73% p.a. and this is still relatively attractive.

This is relatively attractive when our local banks are offering much lower interest rates for 6 months fixed deposits.

Definitely, it is more attractive than the 2.5% p.a. offered by CPF-OA even when accounting for a loss of 7 months worth of interest income which would have been paid by CPF.

Why 7 months?

This is due to how CPF calculates and pays interest on our CPF savings, taking only the month-end balance into consideration.

So, all three of my applications using cash on hand, SRS and CPF-OA money were successful.

I find it strange that there seems to be less interest in 6 months T-bill now.

It seems to be weaker compared to a year ago, for example.

I remember non-competitive bids being so plentiful that my offer to buy was only partially filled at times.

Could it be that more people are buying the common stocks of DBS, OCBC and UOB instead, given the higher level of public awareness of how attractive their dividends are?

After all, a 6% dividend yield beats 3.73% p.a. return hands down.

Could AK be doing something wrong?

OMG!

I can feel an anxiety attack coming.

Time to go sink some enemy warships to calm myself down.

Related post:

Must buy T-bill?

(How to transfer from CPF-IA to CPF-OA?)

21 comments:

Maybe people are rushing to place $$$ in UOB One account for irresistible (up to) 5% p.a. effective interest rate! 🤔🙄🤑

I waited for 1.5 hours (16 customers in queue, luckily I can savor on my teh c kosong in air-conditioned Kopitiam while waiting for my turn)

just to link my UOB One debit card to newly opened UOB One saving account (previously link to Uniplus account) online! 😓

Just found out that I can check the crowd level indicator (serve as a guide though) on the website!🙁

Hi Candy,

UOB ONE is probably the best savings account for regular folks right now. :)

Dear AK, admire your discipline to buy good stocks and hold on to it.

I do have a SRS account too, over time i have seen it growth, it will be interesting if you can share with your readers how many times your SRS account had growth or the compounded annual growth rate.

Hi Simon,

I have never bothered to do such calculations.

Too lazy. ;p

I only know that my SRS is growing because of dividends received year after year.

I am also pretty conservative with SRS money and a big chunk of it is in long term endowment policies.

Reference:

How AK uses his SRS money and why?

Money goes to where it's treated the best.

$127.75 into SRS from T-Bill 3.65%

In Oct:

$757.43 into Cash from OCBC FD 4.08%

$13,110.72 into CPF OA from OCBC FD 3.88%

Hi Siew Mun,

For CPF-OA money, I only take in the difference between what is being paid and what the CPF-OA would have paid me.

So, for the recent T-bill, using $52K from CPF-OA, I am getting $216.16 more in interest income.

I don't know if you calculate it the same way I do but, in any case, huat ah! :D

I took the gains and not the difference for CPF OA. The difference would be $3,575.31 between 2.5% and 3.88%, not a small change to me. ;-p. These are 'cash' to me as I am above 55 years old. Will be reinvesting the principle and gains in SSBs/T-Billing

Let us make hay while the sun shines.

small increment but still money.. :-)

https://www.straitstimes.com/singapore/interest-rate-for-cpf-medisave-and-special-accounts-up-slightly-in-final-quarter

Hi Siew Mun,

That is no small change to me either. ;p

For me, the big one is coming only in January next year as I plonked the bulk of my CPF-OA money in a 1 year T-bill earlier in January this year.

That one had a cut-off yield of 3.87% p.a.

I calculated the difference to be about $6,300.

Can only touch it 3 years from now but I am in no hurry. ;p

Hi C,

"Interest rates for Special and MediSave accounts (SMAs) of Central Provident Fund (CPF) members will go up by 0.03 percentage point to hit 4.04 per cent a year for the final quarter of 2023, the CPF Board and the Housing Board said in a joint statement on Thursday."

Much better than the increase from 4% to 4.01% :)

At least, now, we can say interest rate went up 1% from 4% p.a. and not a fraction of 1%. ;p

For CPFIS, I believe some are looking at the 12 months MAS T bill for a more effectiive return so there is less interest seepage than from the re-investment of 6 months bills.

Hi Gc,

The difference is not that much, considering the fact that 6 months T-bills usually have a higher cut-off yield than the 12 months.

Also, if we buy 6 months T-bills only in the first half of the month, we should be able to roll it into another T-bill within the same month.

So, we won't lose another month of interest.

The issue is that 12 months T-bill only comes around once every 3 months and while waiting for it to come around, we could be making higher interest income from a 6 months T-bill.

AK, do you consider depositing funds on platforms like Webull and Moomoo - both of which have offers at the moment well over the T-Bill rate. For example, Moomoo is offering 5.8% for 30 days and Webull has a promotion such that if you deposit the equivalent of USD$5k you can 18% return (annualised) for ~2.5 months.

Hi John,

Webull and Moomoo are not banks and not covered by the SDIC.

That's the first thing.

Second thing is that for them to offer a much higher return, they must be generating even higher returns elsewhere, because if they are not, then, it becomes a PONZI scheme.

I would question how is that even higher return being generated?

This reminds me of bond funds offered by some financial institutions which offered returns of 6% p.a. when interest rates were very low.

To offer that kind of returns, they must have been speculating in junk bonds which paid in excess of 10% p.a.

I know that many bloggers and YouTubers are promoting Webull and Moomoo.

They are being incentivized to do so but we should do our own due diligence.

Unless it is risk free, I will stay far away from such "promotions".

They are not covered by SDIC. But they are covered by SPIC up to USD$250k though, right? So if there is this cover, what risk is there?

Hi John,

I have no knowledge of SPIC.

So, I should not comment on this.

Hi John,

OK, I went and did some research.

It is SIPC or Securities Investor Protection Corporation.

Apparently, it only covers US accounts.

There is an active discussion on this topic in Reddit 2 years ago.

Thanks AK. Yes, it covers only USD balances. In my case I happen to have some USD I could deposit there if I wanted. It is a dilemma actually. The current offer to place funds there until end of December, with an effective yield of ~18% seems to good to be true. But on the other hand if you choose to deposit USD (as opposed to SGD) then you are seemingly covered by SIPC.

Of course we should be cautious, but on the other hand if the extra money is almost risk-free, then why leave almost risk-free money on the table?

Even UOB offered a promotion for those who opened a ONE account. Under their National Savings Day promotion you received a free gift of $558 for a deposit of $100k for the period Oct-Jan - which works out as a total annualised rate for the 3 months of 5% on the ONE account + 2.2% for the gift. 7.2%. Also too good to be true?

I guess it comes down to the trust we have in UOB, whereas a brokerage like Webull is something new to us (all be it they are regulated by MAS).

Maybe I best stay with the lowest tier of USD$5k, rather than the max tier of USD$100k. Decisions. Decisions. Decisions !

Hi John,

If you have a US account, then, no worries.

As for UOB ONE's promotional interest rate, I wish it was higher than 5% p.a.

Since SDIC will start covering deposits up to $100K very soon.

No risk.

Also, we know how UOB makes their money and that they are very profitable.

In my younger days, I had the mental capacity to go for as many promotions as possible to get as much money in return as possible.

Now, I like to keep things simple. :)

I blur. So John has US account or just USD deposit in SG account?

Hi LKH,

From what I know, John would have to open a US account and deposit US$ into the US bank account of the brokerage.

For Singapore account holders, whichever currency they deposit into the Singapore bank account of the brokerage, they do not get protection from SIPC or Securities Investor Protection Corporation in the USA.

Post a Comment