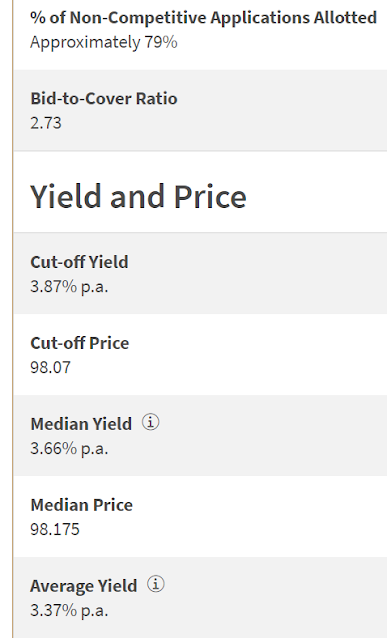

After the 4.07% p.a. cut-off yield in the prior T-bill auction, I was looking forward to a possibly higher cut-off yield for this auction.

Unfortunately, the possibility of a much higher cut-off yield attracted many low-ballers, and that crushed all hopes of a higher yield.

If we look at the average yield for this auction and the auction that took place on 28 Sep, it is quite clear what happened.

This auction's average yield is 3.37% p.a.

28 Sep's average yield was 3.51% p.a.

There were people bidding much lower than 3.37% p.a. to secure the T-bills in this auction.

As low as 2.37% p.a.

That is just asinine.

That is even lower than what the CPF-OA pays!

The amount of interest in this auction shot through the roof as only 79% of non-competitive bids were allotted.

I hope the low-ballers are happy now that everyone ends up with a lower cut-off yield.

Reference:

4.07% p.a. T-bill.

6 comments:

Hi AK

Indeed a lot of silly people out there ... puking blood now

Hi AK, you suddenly going full turbo now on YouTube? Anyway glad it has your voice which is energetic. Don't need to wait long long for your annual meet-up. Haha.

By the way, on another blog, you mentioned you don't need much insurance cover. Can you imagine yourself as other normal folks (similar age band) and talk to yourself, what would the the right insurance coverage other than Medishield? The premium is getting very expensive and it's a Hugh financial cost. Thanks.

Hi Yv,

Yeah, I thought I might need a blood transfusion. ;p

Hi DL,

Making YouTube videos is something I enjoy (for now.)

I could take a long break once I find something else I enjoy more.

It is just like how I took long breaks from blogging in the past too. ;p

Just hobbies to me and not something I do for a living. :)

As for insurance, I used to blog about this topic extensively.

Let me dig up something:

1. https://singaporeanstocksinvestor.blogspot.com/2017/09/total-and-permanent-disability-tpd.html

2. https://singaporeanstocksinvestor.blogspot.com/2014/09/term-life-insurance-why-buy-term-how.html

3. https://singaporeanstocksinvestor.blogspot.com/2017/08/is-early-critical-illness-insurance.html

I must end by saying you should talk to a professional. ;)

Hi AK! I have ST Eng and I recently decided to look at it as the share price crept up. While I know you are a dividend investor so you don't really review prices, but then I saw that the payout ratio has exceeded 100% so they may not be able to continue such good dividends next round. Wondering what do you think about when selling?

Hi gagmewithaspoon,

Paying out more than the earnings isn't a good enough reason for me to sell, if I were to do more active trading.

If a business has retained earnings, it is able to pay out more than its earnings.

I have past blog posts on when to SELL, BUY and HOLD.

You can probably find them in the right side bar of my blog or do a search using the search box at the top.

Oh, must use the web version of my blog. ;p

Post a Comment