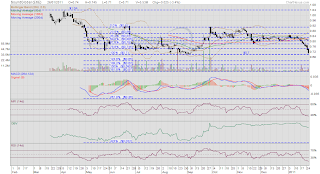

Price closed below the trendline support today at $1.89. I would not advise buying more at this price since the uptrend is compromised. I have turned cautious. However, notice that the trading volume is, once again, very thin on a black candle day. It looks to me to be a continuation of a low volume pull back pattern.

Does low volume mean that price could not weaken further? Definitely not but if we look at the OBV, it is obvious that there isn't any distribution activity. In fact, if you ask me, the OBV has gone up slightly in the last 4 sessions which suggests mild accumulation. This is consistent with what I said in my last blog post that there are bargain hunters out there who are waiting to buy at lower prices.

So, what am I looking out for now? The previous low was at $1.87. This was formed earlier this month. Will price form a higher low at $1.89 and recapture the uptrend later on? Of course, we might have to draw a gentler trendline support too. Or will the price go down further to test $1.83? No one has the answer but with the very low volumes as price pulled back, I do not think there would be any drastic sell downs in the near future. I would wait for the situation to become clearer before making my next move.

Related post:

CapitaMalls Asia: Doji at $1.91.