| ||

|

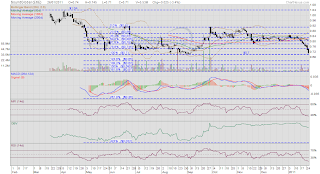

Not a pretty sight, is it? Scream in panic? Run around in circles? Sell everything and jump off a cliff like lemmings? There is plenty of fear. What should I do? Stay calm and look out for opportunities. I have spent time looking at various counters and I will talk about a few here.

More than two years ago, I went in big on E-pure, the current Sound Global, believing that the water industry is the logical beneficiary from constant efforts by governments around the world to improve water quality for their people. China is still underinvested in this area and Sound Global is a natural beneficiary.

Sound Global's share price touched a low of 40.5c in the recent sell down. As I got in at 20c more than two years ago, I was wondering if the price could go lower. After all, we can't tell if a bottom has been formed until after the fact. Could we see a retest of 40.5c now that sentiments have soured? We could, of course.

However, seeing how volume was not very high as black candles were formed, the bears seem to be lacking in conviction. I will probably start buying in at 48.5c. Why 48.5c? 48.5c could be a significant near term support as that is also where we find the trendline support and the rising 20dMA.

I also subscribe to the idea that there will be increasing demand for food and oil as the middle class in Asia expands. Golden Agriculture is a likely beneficiary of this long term trend.

The counter's price weakness in the last two sessions was on the back of decreasing volumes. This is again a sign that the bears lack conviction. I would like to get back in at supports. I see immediate support at 62c. In very bearish conditions, we could see gap filling at 58c.

I also want to re-initiate a long position in Keppel Corporation. This is a company I held rather short term long positions in both in the Asian Financial Crisis in the late 90s as well as in the Subprime Crisis a couple of years back.

I would like to re-initiate a long position in the conglomerate, believing that it will continue to be a beneficiary of the global race for oil which is a theme I firmly believe in although there could be short term setbacks.

Further weakness could see a retest of $8.40, a natural candlestick support which broke on 23 Sep after being tested multiple times. I would buy in slowly as there are quite a few gaps which could be filled at lower prices if $8.40 should give way. That volume expanded as a long black candle was formed today does not inspire confidence.

I also have my eyes on a few REITs which are seeing weakening unit prices and rising distribution yields. Prices could weaken further if sentiments continue to sour. I will judiciously add to my long positions to benefit from the sell down. Panic? Not me.

I also have my eyes on a few REITs which are seeing weakening unit prices and rising distribution yields. Prices could weaken further if sentiments continue to sour. I will judiciously add to my long positions to benefit from the sell down. Panic? Not me.Related posts:

1. Why do I not panic?

2. Sleep well at night with a plan.