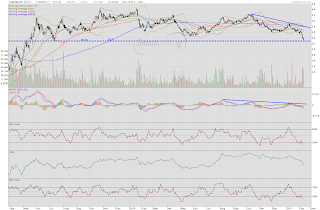

Is the bear losing strength or just taking a breather? It could be interpreted as the bulls are getting stronger or the short sellers are simply covering their positions. Whatever the case may be, closing lower by 5c at $3.34 after touching a low of $3.30 means that the bears have again emerged the victors.

Volume is, once again, very high although it has been in decline for three sessions in a row. Selling is still very much alive. Notice how the distance between the declining MACD and the signal line has widened. The MACD now approximates the low of 1 Dec 10. It does not seem likely that a higher low would form. The OBV suggests a continuation of intense distribution while the MFI and RSI are both deeper in oversold territories.

However, unless the low of July 2009 at $3.28 breaks, there is little incentive for short sellers to continue selling down the stock. For people who are thinking of cutting losses, the time for cutting losses could have come and gone. Remember that prices move down a river of hope. Cut loss when there is a rebound, not when price is testing supports.

Is AK71, therefore, hinting that the downward movement could be near its end? No, he is just wondering aloud which is something he is prone to do.

Related post:

Capitaland: Time to buy more?