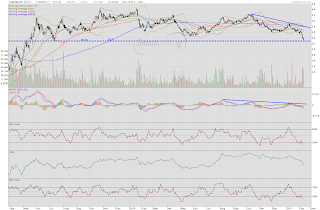

AIMS AMP Capital Industrial REIT

I remember how this REIT suffered from weakness in price before it went CD and some who got their buy queues filled at 21.5c were worried instead of happy. I guess they should be happy now since they would be receiving the income distribution of 0.51c per unit on 15 March and saw how the REIT's unit price held firm in a sea of red as stocks were sold down this week. I am happy too. Unless there are definite signs from the technicals that things have turned bearish, buying more on weakness cannot be too far wrong.

Read: AIMS AMP Capital Industrial REIT: Worried?

FIRST REIT

This REIT broke its immediate support at 75c decisively today and on higher volume. Hitting a low of 73.5c before closing at 74c, we could see its price weaken further as the MFI looks set to form a lower low. Looking at the weekly chart, the longer term uptrend is intact but the rising 20wMA is approximating 72c and if selling pressure were to intensify, we could see 72c tested eventually.

Related post:

First REIT: Testing immediate support.