I received an SMS from CPF that went:

"You have a CPFIS investment deduction from your Ordinary Account."

I suppose this means that my competitive bid (using CPF-OA money) for the last 6 months T-bill auction that took place on 14 September was successful.

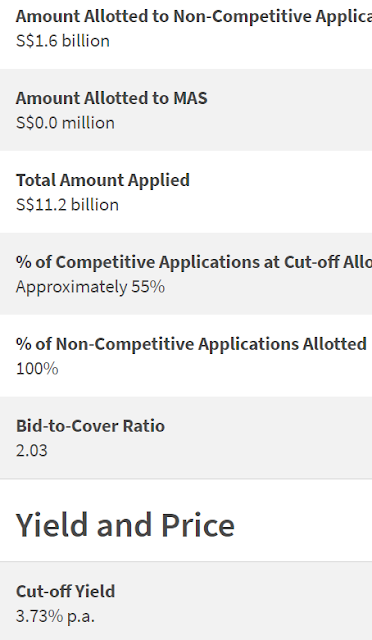

A quick check revealed that the cut-off yield was 3.73% p.a. and this is still relatively attractive.

This is relatively attractive when our local banks are offering much lower interest rates for 6 months fixed deposits.

Definitely, it is more attractive than the 2.5% p.a. offered by CPF-OA even when accounting for a loss of 7 months worth of interest income which would have been paid by CPF.

Why 7 months?

This is due to how CPF calculates and pays interest on our CPF savings, taking only the month-end balance into consideration.

So, all three of my applications using cash on hand, SRS and CPF-OA money were successful.

I find it strange that there seems to be less interest in 6 months T-bill now.

It seems to be weaker compared to a year ago, for example.

I remember non-competitive bids being so plentiful that my offer to buy was only partially filled at times.

Could it be that more people are buying the common stocks of DBS, OCBC and UOB instead, given the higher level of public awareness of how attractive their dividends are?

After all, a 6% dividend yield beats 3.73% p.a. return hands down.

Could AK be doing something wrong?

OMG!

I can feel an anxiety attack coming.

Time to go sink some enemy warships to calm myself down.

Related post:

Must buy T-bill?

(How to transfer from CPF-IA to CPF-OA?)