A friend read something in hardware zone and thought I would like to know. He had a good laugh and I had a good laugh.

I am sharing it here so that maybe many more people would have a good laugh.

Now, read this with an open mind. There could be some truth in what the person says.

Oh, and this video clip is just for dramatic effect.

HWZ forumer, w1rbelw1nd:

I dont think very positively on local bloggers, frankly. Yes, most of them may be altruistic and do it out of interest and passion, but also because of doing it for interest they have a tendency to interact with people of the same mindset (a sinkie tendency, no doubt), rather than challenge their own thinking.

Just take a look at ASSI facebook page.

Quite recently there was a reader commenting that he should share more on his failures and bad picks.

ASSI immediately (IMO) self-victimise himself and say things like "yea maybe i should take a break from blogging, since my sharing has adverse impacts on readers" and lol all the ASSI white knights come in and comfort him.

The point is, under an environment where like-minded people seek each other, and just parrot each other, can these bloggers give a truly learned, informed and balanced view?

(Source: HWZ)

Well, it is the truth. What? True?

Yes, it is true that I am blogging because I enjoy it.

I am not blogging because I have to.

I am blogging because I want to.

So, I don't have to give in to the demands of the audience. I do what I like.

Remember, I am just talking to myself here in my blog. I don't give advice.

If you want to eavesdrop although I don't know why you want to, take whatever I say with a pinch of salt (unless you suffer from high blood pressure).

Alamak! Did I just give some medical advice?

Die lah. How like that? I blur.

Related post

AK the teacher or the mental blogger?

PRIVACY POLICY

Featured blog.

1M50 CPF millionaire in 2021!

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

Archives

Pageviews since Dec'09

Recent Comments

ASSI's Guest bloggers

- ENZA (3)

- EY (7)

- Elsie (1)

- Elvin H. Liang (1)

- FunShine (5)

- Invest Apprentice (2)

- JK (2)

- Jean (1)

- Kai Xiang (1)

- Kenji FX (2)

- Klein (2)

- LS (2)

- Matt (3)

- Matthew Seah (18)

- Mike (6)

- Ms. Y (2)

- Raymond Ng (1)

- Ryan (1)

- STE (9)

- Serejouir (1)

- Solace (13)

- Song StoneCold (2)

- TheMinimalist (4)

- Vic (1)

- boon sun (1)

- skipper (1)

Resources & Blogs.

- 5WAVES

- AlpacaInvestments

- Bf Gf Money Blog

- Bully the Bear

- Cheaponana

- Clueless Punter

- Consumer Alerts

- Dividend simpleton

- Financial Freedom

- Forever Financial Freedom

- GH Chua Investments

- Help your own money.

- Ideas on investing in SG.

- Invest Properly Leh

- Investment Moats

- Investopedia

- JK Fund

- MoneySense (MAS)

- Next Insight

- Oddball teen's mind.

- Propwise.sg - Property

- Scg8866t Stockinvesting

- SG Man of Leisure

- SG Young Investment

- Sillyinvestor.

- SimplyJesMe

- Singapore Exchange

- Singapore IPOs

- STE's Investing Journey

- STI - Stocks Info

- T.U.B. Investing

- The Sleepy Devil

- The Tale of Azrael

- TheFinance

- Turtle Investor

- UOB Gold & Silver

- Wealth Buch

- Wealth Journey

- What's behind the numbers?

HWZ says AK "self-victimise himself".

Saturday, August 5, 2017Posted by AK71 at 8:07 AM 14 comments

Investment philosophy and property market.

Friday, August 4, 2017

After my blog about nibbling at Tuan Sing Holdings, a reader commented that I seem to be building up a position in property counters and asked if I am waiting for a rebound in property prices.

At the same time, a couple of readers shared that DBS is expecting residential property prices in Singapore to recover by up to 10% in the next two years.

Here is what I have to say:

I know some analysts are positive that residential property prices have bottomed and are going to rise next year or the year after.

Is this going to happen?

Your guess is as good as mine (or the analysts'). The best anyone could do in such an instance is to make an educated guess.

When it comes to buying a property, if I am looking at a possible capital gain, I am probably speculating unless I am pretty sure I am buying it undervalued which gives me a margin of safety and probably an arbitrage opportunity.

The decision should be guided by valuation which should logically be guided by rental yield.

To have an idea of my philosophy when it comes to property investment, recall my relatively large investment in Saizen REIT.

It was trading at a big discount to valuation although its assets were generating steady and meaningful rental income which, together, offered an attractive yield of about 10% based on my entry price.

Even if the sale of assets a few years later to another investor at a slight premium to valuation did not happen, it would not have mattered to me. Why?

Because it was a good investment, not a speculation.

Bombarded by invitations to "invest" in properties, we have to be at least discerning enough to know if these are invitations to "invest" in properties or are they really invitations to "speculate" in properties.

There is a difference and one that vested interests will not take pains to highlight even if they are aware of it.

I remember a family friend bought a property here during the Gulf War.

Property prices here plunged back then.

He went and bought a landed property at a bombed out price. Pardon the pun.

The observation was that although property prices plunged, rental income was relatively resilient.

That gave rental yield an uplift.

For sure, he made a good investment.

Some might remember that I blogged about why I stay in a condo and some might remember that I bought my first condo during SARS.

Why during SARS?

Mr. Market was suffering from a severe bout of pessimism and I got a good deal.

Based on the price I paid, potential rental yield was about 5%.

This increased to almost 9% by the time I sold. There was a robust growth in rental demand in those years.

Based on my selling price, however, the rental yield would have been just shy of 4%.

Prices rose and they rose a bigger percentage than the growth in rental income.

Today, that same property's rental yield is barely 3% based on my selling price but based on the recent selling price of a unit in the same stack, the rental yield is not even 2.7% now.

Market price of the property is about 10% higher but rental income is more than 20% lower than when I sold the property.

To any investor for income, this combination should be an alarm bell.

To continue along the same line, I bought my current home during a lull in market activity after all the rounds of cooling measures were implemented a few years ago.

Back then, the potential rental yield was 6% and I verified this.

Today, based on my purchase price, the yield has come down to 4.6%. Based on the current market price which is quite a bit higher than my purchase price, it would be less than 4%.

Again, market price has gone up but rental income has reduced.

So, lowering rental income does not mean that property prices in Singapore could not increase in future. It just means that the property market is simply one that doesn't make sense to the rational investor in me now.

However, Mr. Market can stay irrational for a long time.

Look at Hong Kong for an example of sky rocketing property prices and miserable rental yields.

Invest in Hong Kong properties? Not me.

My nibbles in property counters do not represent any belief that property prices will rebound in future.

Instead, they are pretty consistent with my philosophy to buy at bargain prices which make sense to me.

Being able to own a bit of Tanjong Pagar Centre, OUE Downtown and Robinson Tower at a big discount to valuation is pretty attractive to me.

I emphasize that I will not tell anyone if they should or should not buy anything.

I am only sharing my philosophy and experience in my blog. I am not here to make a decision for you.

What you do is up to you.

Related posts:

1. Invested in Tuan Sing Holdings.

2. Ask 2 questions before buying.

Posted by AK71 at 8:39 AM 21 comments

Labels:

investment,

real estate

Invested in Tuan Sing Holdings.

Thursday, August 3, 2017

When a reader asked me what I thought about Tuan Sing Holdings as it trades at almost 60% discount to NAV, it got me interested enough to take a closer look because this is something I think I understand.

I approached this in a way that is similar to my approach to investing in Guocoland.

Substantial shareholders, the Liem family, and also Koh Wee Meng of Fragrance Group together hold a 60% stake in Tuan Sing.

It is interesting to note that Mr. Koh's purchase price in 2014 was 43c a share and Tuan Sing's NAV per share then was 68c.

Based on its Annual Report for 2016, Tuan Sing's NAV per share grew to 77c and its stock is now trading at a lower price than in 2014.

On the face of it, therefore, Tuan Sing is worth more today and with a lower share price, it is more undervalued than before.

Why is this so?

Tuan Sing's earnings have been in decline and Mr. Market probably doesn't like that.

To top it off, Tuan Sing's gearing level is pretty high and interest cover ratio has also weakened from 14x in 2012 to just 2.2x in 2016.

At the current price level, there seems to be plenty of value waiting to be unlocked but it also seems to be thornier an investment.

We must remember that undervalued could stay undervalued for some time. So, it would be good to be paid while we wait.

Do they pay dividends?

Tuan Sing pays a dividend but it is nothing to shout about. How much? 0.5 cent to 0.6 cent a share.

Assuming a purchase price of 33c a share, we are looking at a dividend yield of 1.5% to 1.8%.

Anyone who buys into Tuan Sing for income has to be mental.

1.5% to 1.8% is lower than the 2.7% dividend yield from Guocoland based on an entry price of $1.83 a share and that was not an ideal investment for income either.

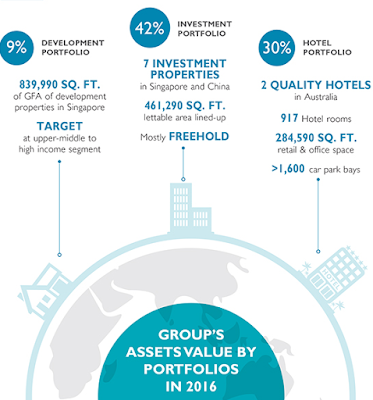

We know that property developers usually have pretty lumpy earnings but I am most interested in the fact that Tuan Sing has a relatively big portfolio of investment properties in Singapore, China and Australia.

Therefore, like Guocoland, Tuan Sing has the potential to become a more attractive investment for income investors if future payouts should increase together with any increase in future cash flow.

Of course, this is somewhat speculative as it is anyone's guess what the Liems have in mind.

|

| Source: Tuan Sing Holdings Limited. |

A big reason probably why Tuan Sing's gearing level is so high, their earnings is much reduced and, consequently, their interest cover ratio is so poor is because quite a big portion of its investment properties are still under development. They have yet to generate any income.

It stands to reason that once Tuan Sing's investment properties are fully completed, once they start generating income, earnings will improve and, significantly, it is worth noting that this will be recurring income which is something investors for income look for.

Of course, Tuan Sing still have development properties to sell but since that business is a relatively small portion of their entire portfolio, if they should sell well, it is the icing on the cake. If they don't sell well, it is not going to be a disaster either.

Cake without any icing, anyone?

Tuan Sing is another asset play and if the valuation is to be believed, they are a pretty heavily undervalued asset play too.

Just like my investments in OUE Limited, Wing Tai, PREH and Guocoland, my investment in Tuan Sing is only a nibble because it could be a long wait before value is unlocked.

In the news this year:

Sime Darby Centre purchased

and

Tuan Sing's earnings tumble 64%.

Related posts:

1. Guocoland analysis.

2. PREH analysis.

3. OUE Limited analysis.

4. Wing Tai Holdings analysis.

Accumulating Wilmar on price weakness.

Wednesday, August 2, 2017

When I revealed my top investments earlier this year (read related post #2 at the end of the blog), some were surprised that I had a relatively large investment in Wilmar International which isn't a typical investment for income.

Of course, long time readers of ASSI would know that not all investments in my portfolio are for income although almost all lean in that direction.

Why Wilmar?

Its distribution network is extensive, established and still growing.

It is a truly impressive business entity.

This will continue to impact its earnings for some time to come.

And while BreadTalk's extremely high PE ratio was rather unpalatable at the time when I became an investor (read related post #1 at the end of the blog), although not strictly comparable, Wilmar is currently trading at a much lower PE ratio of about 15x.

Based on the full year earnings per share in 2009, it represented a PE ratio of above 20x.

It is important to point out that, in 2010, Wilmar's NAV per share was about 22% lower than what it is today.

Paying S$7.11 a share then would have been a huge premium to NAV (US$1.85 per share) back then.

This is an important distinction to make.

Wilmar is a more valuable business entity today than it was in 2010.

I am also paying a lower price than what Archer Daniels Midland Co paid about a year ago to hike its stake in Wilmar from 20% to 22%, paying S$3.38 a share. (Reference: Reuters.)

Having said this, Wilmar's share price is currently in a downtrend and it could decline further and, if that should happen, I will be quite happy to accumulate again.

When CAPEX tapers off, that is when Wilmar will be able to pay more generous dividends.

Patience, I believe, will be rewarded.

Posted by AK71 at 7:50 AM 18 comments

Monthly Popular Blog Posts

-

It has been a while since my last blog. Hope everyone is doing well. Instead of revealing the numbers at the end of the blog, I have put it ...

-

Time for another update. First, on the personal front, I have been spending more time on other stuff in life as I have been feeling that too...

-

Today, Marco Polo Marine's share price rose significantly on the back of much higher volume and the recent visit by a group of investors...

-

Regular readers know that I much prefer rights issues compared to share placements as long as the funds raised go towards increasing income ...

-

Been a while since my last blog post. Hope everyone is staying calm as stock markets crash around the world. I produced a video last night w...

All time ASSI most popular!

-

A reader pointed me to a thread in HWZ Forum which discussed about my CPF savings being more than $800K. He wanted to clarify certain que...

-

The plan was to blog about this together with my quarterly passive income report (4Q 2018) but I decided to take some time off from Neverwin...

-

Reader says... AK sifu.. Wah next year MA up to 57200... Excited siah.. Can top up again to get tax relief. Can I ask u if the i...

-

It has been a pretty long break since my last blog. I have also been spending a lot less time engaging readers both in my blog and on Face...

-

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...