I made quite a few new investments in the last six months to a year but, of these, the largest investment was in Centurion Corporation.

I was attracted not just by their ability and willingness to pay meaningful dividends but also their clear and viable strategy for growth.

With insiders eating their own pudding too, it was a vote of confidence which regular readers know I have always liked.

2Q 2017 was another stellar quarter.

72% rise in earnings is definitely nothing to scoff at.

However, what I am more impressed with is the gross profit margin which improved some 7% to 73% while gross profit improved 36%.

Much has been said about the increasingly difficult business environment with many more competitors sharing the Singapore foreign workers accommodation pie.

The stellar results tell me that Centurion's management are not only competent, they are also fast to move into a new growth area and they are masters in branding.

An interim dividend per share (DPS) of 1c has been declared and that makes me happy.

Although I had no idea that Centurion Corporation had plans to list in Hong Kong when I became an investor in February, if that should come to pass, we could see its share price going higher.

Of course, although less important to me than the investing for income angle, a higher share price would make me happy too.

Am I going to buy more now?

You want to read related post #1.

Related posts:

1. Invest in Centurion Corporation.

2. Centurion Corporation to double.

PRIVACY POLICY

Featured blog.

1M50 CPF millionaire in 2021!

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

Archives

Pageviews since Dec'09

Recent Comments

ASSI's Guest bloggers

- ENZA (3)

- EY (7)

- Elsie (1)

- Elvin H. Liang (1)

- FunShine (5)

- Invest Apprentice (2)

- JK (2)

- Jean (1)

- Kai Xiang (1)

- Kenji FX (2)

- Klein (2)

- LS (2)

- Matt (3)

- Matthew Seah (18)

- Mike (6)

- Ms. Y (2)

- Raymond Ng (1)

- Ryan (1)

- STE (9)

- Serejouir (1)

- Solace (13)

- Song StoneCold (2)

- TheMinimalist (4)

- Vic (1)

- boon sun (1)

- skipper (1)

Resources & Blogs.

- 5WAVES

- AlpacaInvestments

- Bf Gf Money Blog

- Bully the Bear

- Cheaponana

- Clueless Punter

- Consumer Alerts

- Dividend simpleton

- Financial Freedom

- Forever Financial Freedom

- GH Chua Investments

- Help your own money.

- Ideas on investing in SG.

- Invest Properly Leh

- Investment Moats

- Investopedia

- JK Fund

- MoneySense (MAS)

- Next Insight

- Oddball teen's mind.

- Propwise.sg - Property

- Scg8866t Stockinvesting

- SG Man of Leisure

- SG Young Investment

- Sillyinvestor.

- SimplyJesMe

- Singapore Exchange

- Singapore IPOs

- STE's Investing Journey

- STI - Stocks Info

- T.U.B. Investing

- The Sleepy Devil

- The Tale of Azrael

- TheFinance

- Turtle Investor

- UOB Gold & Silver

- Wealth Buch

- Wealth Journey

- What's behind the numbers?

Centurion Corporation's sky rocketing earnings.

Tuesday, August 8, 2017Posted by AK71 at 8:58 AM 15 comments

Labels:

Centurion

My family almost went bankrupt.

Monday, August 7, 2017

As my blog grows in readership, there are many more questions which are repeated. There is some level of predictability when it comes to questions from readers, I see.

This is why I find it useful to share some older blogs regularly on my Facebook wall. It is mainly for the benefit of my new readers and also readers who are more forgetful.

A question which I get asked before and which has picked up in frequency in recent months is why am I the way I am?

This is a question I have addressed on a piece meal basis and to make it easier for me in future, I am blogging a reply in the comments section so that I have something which I can find easily to point to readers.

Read only if you are interested in my psyche:

I have some deep seated insecurities which I can never be rid of. I have provided glimpses of these in my blog before. They are, of course, very piecemeal in nature and scattered.

I cannot remember where they are in my blog exactly. I do remember that I shared in the comments section but I have never really blogged about these insecurities in their entirety.

I try not to relive those years.

So, I will be brief.

My family almost went bankrupt when I was entering my teens and our financial hardship lasted many years. Those years left a mark on me.

I hinted about the financial hardship my family went through in a few blog posts before and one which I can remember is:

The secret to avoiding financial ruin.

My family learned first hand that banks are fair weather friends and I developed a strong aversion to debt. I try to avoid borrowing money for anything.

Sleeping in the living room of a HDB flat for some years as a teenager was a humbling experience. It was awkward too.

I learned early on in life how finances could go wrong so badly and so quickly and how not having enough money was a terrible thing, how being indebted was much worse.

Living with the constant threat of losing whatever we had left was very stressful but my parents tried to give us as normal a life as they could.

Those years of financial hardship left me with scars and I believe that anyone who had similar experience will always have shadows haunting them.

"Do I have enough money? Maybe, it is not enough. What about my parents? Do I have enough to take care of them? What about my younger siblings?"

So, I tend to overcompensate.

I tend to save as much money as possible. I put away much more in my emergency fund than what some people think is necessary.

I do this although, financially, we became more comfortable as I graduated from university and started working.

I craved greater financial security.

The CPF-SA was a natural candidate and I blogged about how I transferred funds from my OA to my SA in the first few years of my working life and that was almost 20 years ago.

There are many clues littered throughout the blog about the way I think and why.

Of course, I don't expect anyone to piece all the clues together to understand AK the giam siap fellow.

I vowed not to grow old and destitute.

The End.

Another peek into my past:

With some difficulty, AK says good bye. Thank you, mom.

Posted by AK71 at 10:57 AM 19 comments

Labels:

ASSI,

money management

Wondering about QAF Limited (Updated).

Sunday, August 6, 2017

Pulled pork as Rivalea calls off IPO

The Australian, November 7, 2017

(See Comments section at the end of this blog.)

--------------------------------

7 October 2017

Reader:

Hi AK, thanks for the session (i.e. Evening with AK and friends).

QAF has received shareholders approval to list it's primary production on the ASX.

Since management has not indicated that the proceeds from listing will likely not translate to special dividend for shareholders, hopefully they can put the money to good use to expand their operations in the Philippines.

Wonder when the share price will be appreciated by investors and truly appreciate upwards.

AK:

I dunno if the share price will move up or not. One off gains are one off. So, don't place too much emphasis on that.

Although QAF has a good track record, we could see lower share price if the pork oversupply situation in Australia is prolonged and lasts for several quarters. Earnings will continue to suffer then.

Off the top of my head, in such a situation, we could see $1.00 - $1.10 a share then.

As QAF should be able to maintain its dividend, I am staying invested and getting paid while waiting.

-------------------------

Reader #1:

Reader #2:

Hi AK, I know you are an investor in QAF Limited. Any reason why the share price is plunging? I know a long time director just stepped down last year. Do you think that has an effect?

Singapore's Longest Sandwich

AK:

Don't ask me about share price. Ask Mr. Market. There is no way I can tell how prices might move now or in the future (with certainty). Past prices, I can tell you easily.

Dividend yield? That partly depends on share prices. Refer to what I said above. ;)

There will always be challenges in business. I will say that QAF's track record is a good one and I can only hope that they continue to bring home the bacon (and bread). ;p

Of course, QAF is not just about Gardenia bread although that is what most of us know them for. QAF is also in the business of pork production in Australia (i.e. Rivalea) which is doing very well.

It was only a few years ago that Rivalea's viability was still a big question mark and some readers might remember that I blogged about it too.

Now, Rivalea stands shoulder to shoulder with Gardenia in importance to QAF.

Of course, with the strategic review to improve value for shareholders still underway, it is difficult to say what will happen in future but it is reasonable to assume that any action taken will probably result in value being created.

The "worst" thing that could happen from the review is for QAF to maintain the status quo. To an investor for income, this is probably not really a bad thing but to a speculator, it could be.

Know our motivations as investors and know our investments. Then, we will know if the investments are appropriate for us.

If they are appropriate investments for me, I will stay invested. The day they are no longer able to do what I think they should do for me is when I would probably let them go. Time will tell.

Que sera sera.

Slides presentation on Rivalea:

HERE (published in June 2017)

Related post:

How much is QAF worth?

Posted by AK71 at 10:04 PM 8 comments

Labels:

QAF

Healthy cash flow is most important.

Saturday, August 5, 2017

Reader says:

Time flies and I'm glad to have taken your advise previously to do well in studies.

I am currently reaping what I've sow for my study & career.

Good news is that i have gotten a job that pay me well compared to my first job 3 years ago; i got close to 50% pay increment!

However, my life had been quite a drama due to conflicts at home.

So, i end up moving out, renting a room to keep myself in peace.

With that, expenses increased and i am having difficulty sustaining it.

As i am single (28 years old) and I have to wait to reach 35years old to be eligible for a hdb bto 2 room flat (considering the waiting time for BTO or higher price of resale flat).

I am currently thinking of getting private property (studio) which if possible, i would like to save enough downpayment before committing to own one.

i calcluated at least 3-4 years of saving to reach that goal.

Do share with me your opinions too to handle my current situation

AK says:

Whether to buy or rent a property, especially if buying a property is going to strain your finances, the Rule of 15 helps you to stay grounded.

http://singaporeanstocksinvestor.blogspot.sg/2017/05/to-rent-or-to-buy-rule-of-15-revisited.html

Think carefully what is the financially most prudent thing to do when it comes to housing for you now.

Reader says:

That is a interesting rule to use as a guide, but does other factors affect the outcome if we factor in the inflation, demand & supply of housing and uncertainty of the house value in future?

AK says:

It is about cash flow.

How can we tell what the demand and supply situation is going to be like in future?

The Japanese didn't know they were going to suffer 2 decades of decline in housing prices.

The Americans didn't know they were going to suffer a huge crash in housing prices that wiped out 10 years worth of wealth.

If cash flow is going to be an issue, forcing ourselves into buying a private property because we fear prices are going up higher in future is silly.

Too many people have too much of their wealth stuck in their homes.

This is why so many people in a wealthy nation like Singapore must work till the day they die.

Reader says:

I see, thats is a very good insight for me to learn.

i trust your experience in this.

AK says:

Alamak.

Don't trust me.

I don't have a crystal ball.

I cannot see what the future is going to be like.

I am just saying that we should stay prudent especially if cash flow is tight.

If you have plenty of money lying around and cash flow is not an issue, then, if you want to take a bet on property, go ahead.

Having healthy cash flow is always important.

Related posts:

1. Property market.

2. Slaving to stay in a condominium.

If to stay in a condominium, we are forced to live like paupers, the price is too high.

Posted by AK71 at 7:54 PM 2 comments

Labels:

real estate,

Singapore

HWZ says AK "self-victimise himself".

A friend read something in hardware zone and thought I would like to know. He had a good laugh and I had a good laugh.

I am sharing it here so that maybe many more people would have a good laugh.

Now, read this with an open mind. There could be some truth in what the person says.

Oh, and this video clip is just for dramatic effect.

HWZ forumer, w1rbelw1nd:

I dont think very positively on local bloggers, frankly. Yes, most of them may be altruistic and do it out of interest and passion, but also because of doing it for interest they have a tendency to interact with people of the same mindset (a sinkie tendency, no doubt), rather than challenge their own thinking.

Just take a look at ASSI facebook page.

Quite recently there was a reader commenting that he should share more on his failures and bad picks.

ASSI immediately (IMO) self-victimise himself and say things like "yea maybe i should take a break from blogging, since my sharing has adverse impacts on readers" and lol all the ASSI white knights come in and comfort him.

The point is, under an environment where like-minded people seek each other, and just parrot each other, can these bloggers give a truly learned, informed and balanced view?

(Source: HWZ)

Well, it is the truth. What? True?

Yes, it is true that I am blogging because I enjoy it.

I am not blogging because I have to.

I am blogging because I want to.

So, I don't have to give in to the demands of the audience. I do what I like.

Remember, I am just talking to myself here in my blog. I don't give advice.

If you want to eavesdrop although I don't know why you want to, take whatever I say with a pinch of salt (unless you suffer from high blood pressure).

Alamak! Did I just give some medical advice?

Die lah. How like that? I blur.

Related post

AK the teacher or the mental blogger?

Posted by AK71 at 8:07 AM 14 comments

Investment philosophy and property market.

Friday, August 4, 2017

After my blog about nibbling at Tuan Sing Holdings, a reader commented that I seem to be building up a position in property counters and asked if I am waiting for a rebound in property prices.

At the same time, a couple of readers shared that DBS is expecting residential property prices in Singapore to recover by up to 10% in the next two years.

Here is what I have to say:

I know some analysts are positive that residential property prices have bottomed and are going to rise next year or the year after.

Is this going to happen?

Your guess is as good as mine (or the analysts'). The best anyone could do in such an instance is to make an educated guess.

When it comes to buying a property, if I am looking at a possible capital gain, I am probably speculating unless I am pretty sure I am buying it undervalued which gives me a margin of safety and probably an arbitrage opportunity.

The decision should be guided by valuation which should logically be guided by rental yield.

To have an idea of my philosophy when it comes to property investment, recall my relatively large investment in Saizen REIT.

It was trading at a big discount to valuation although its assets were generating steady and meaningful rental income which, together, offered an attractive yield of about 10% based on my entry price.

Even if the sale of assets a few years later to another investor at a slight premium to valuation did not happen, it would not have mattered to me. Why?

Because it was a good investment, not a speculation.

Bombarded by invitations to "invest" in properties, we have to be at least discerning enough to know if these are invitations to "invest" in properties or are they really invitations to "speculate" in properties.

There is a difference and one that vested interests will not take pains to highlight even if they are aware of it.

I remember a family friend bought a property here during the Gulf War.

Property prices here plunged back then.

He went and bought a landed property at a bombed out price. Pardon the pun.

The observation was that although property prices plunged, rental income was relatively resilient.

That gave rental yield an uplift.

For sure, he made a good investment.

Some might remember that I blogged about why I stay in a condo and some might remember that I bought my first condo during SARS.

Why during SARS?

Mr. Market was suffering from a severe bout of pessimism and I got a good deal.

Based on the price I paid, potential rental yield was about 5%.

This increased to almost 9% by the time I sold. There was a robust growth in rental demand in those years.

Based on my selling price, however, the rental yield would have been just shy of 4%.

Prices rose and they rose a bigger percentage than the growth in rental income.

Today, that same property's rental yield is barely 3% based on my selling price but based on the recent selling price of a unit in the same stack, the rental yield is not even 2.7% now.

Market price of the property is about 10% higher but rental income is more than 20% lower than when I sold the property.

To any investor for income, this combination should be an alarm bell.

To continue along the same line, I bought my current home during a lull in market activity after all the rounds of cooling measures were implemented a few years ago.

Back then, the potential rental yield was 6% and I verified this.

Today, based on my purchase price, the yield has come down to 4.6%. Based on the current market price which is quite a bit higher than my purchase price, it would be less than 4%.

Again, market price has gone up but rental income has reduced.

So, lowering rental income does not mean that property prices in Singapore could not increase in future. It just means that the property market is simply one that doesn't make sense to the rational investor in me now.

However, Mr. Market can stay irrational for a long time.

Look at Hong Kong for an example of sky rocketing property prices and miserable rental yields.

Invest in Hong Kong properties? Not me.

My nibbles in property counters do not represent any belief that property prices will rebound in future.

Instead, they are pretty consistent with my philosophy to buy at bargain prices which make sense to me.

Being able to own a bit of Tanjong Pagar Centre, OUE Downtown and Robinson Tower at a big discount to valuation is pretty attractive to me.

I emphasize that I will not tell anyone if they should or should not buy anything.

I am only sharing my philosophy and experience in my blog. I am not here to make a decision for you.

What you do is up to you.

Related posts:

1. Invested in Tuan Sing Holdings.

2. Ask 2 questions before buying.

Posted by AK71 at 8:39 AM 21 comments

Labels:

investment,

real estate

Invested in Tuan Sing Holdings.

Thursday, August 3, 2017

When a reader asked me what I thought about Tuan Sing Holdings as it trades at almost 60% discount to NAV, it got me interested enough to take a closer look because this is something I think I understand.

I approached this in a way that is similar to my approach to investing in Guocoland.

Substantial shareholders, the Liem family, and also Koh Wee Meng of Fragrance Group together hold a 60% stake in Tuan Sing.

It is interesting to note that Mr. Koh's purchase price in 2014 was 43c a share and Tuan Sing's NAV per share then was 68c.

Based on its Annual Report for 2016, Tuan Sing's NAV per share grew to 77c and its stock is now trading at a lower price than in 2014.

On the face of it, therefore, Tuan Sing is worth more today and with a lower share price, it is more undervalued than before.

Why is this so?

Tuan Sing's earnings have been in decline and Mr. Market probably doesn't like that.

To top it off, Tuan Sing's gearing level is pretty high and interest cover ratio has also weakened from 14x in 2012 to just 2.2x in 2016.

At the current price level, there seems to be plenty of value waiting to be unlocked but it also seems to be thornier an investment.

We must remember that undervalued could stay undervalued for some time. So, it would be good to be paid while we wait.

Do they pay dividends?

Tuan Sing pays a dividend but it is nothing to shout about. How much? 0.5 cent to 0.6 cent a share.

Assuming a purchase price of 33c a share, we are looking at a dividend yield of 1.5% to 1.8%.

Anyone who buys into Tuan Sing for income has to be mental.

1.5% to 1.8% is lower than the 2.7% dividend yield from Guocoland based on an entry price of $1.83 a share and that was not an ideal investment for income either.

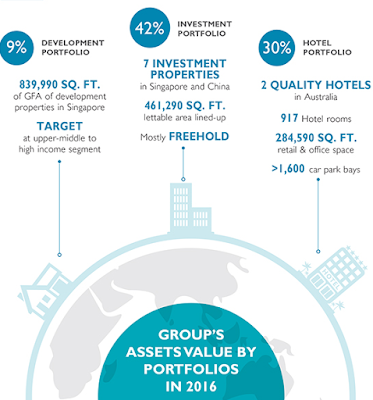

We know that property developers usually have pretty lumpy earnings but I am most interested in the fact that Tuan Sing has a relatively big portfolio of investment properties in Singapore, China and Australia.

Therefore, like Guocoland, Tuan Sing has the potential to become a more attractive investment for income investors if future payouts should increase together with any increase in future cash flow.

Of course, this is somewhat speculative as it is anyone's guess what the Liems have in mind.

|

| Source: Tuan Sing Holdings Limited. |

A big reason probably why Tuan Sing's gearing level is so high, their earnings is much reduced and, consequently, their interest cover ratio is so poor is because quite a big portion of its investment properties are still under development. They have yet to generate any income.

It stands to reason that once Tuan Sing's investment properties are fully completed, once they start generating income, earnings will improve and, significantly, it is worth noting that this will be recurring income which is something investors for income look for.

Of course, Tuan Sing still have development properties to sell but since that business is a relatively small portion of their entire portfolio, if they should sell well, it is the icing on the cake. If they don't sell well, it is not going to be a disaster either.

Cake without any icing, anyone?

Tuan Sing is another asset play and if the valuation is to be believed, they are a pretty heavily undervalued asset play too.

Just like my investments in OUE Limited, Wing Tai, PREH and Guocoland, my investment in Tuan Sing is only a nibble because it could be a long wait before value is unlocked.

In the news this year:

Sime Darby Centre purchased

and

Tuan Sing's earnings tumble 64%.

Related posts:

1. Guocoland analysis.

2. PREH analysis.

3. OUE Limited analysis.

4. Wing Tai Holdings analysis.

Accumulating Wilmar on price weakness.

Wednesday, August 2, 2017

When I revealed my top investments earlier this year (read related post #2 at the end of the blog), some were surprised that I had a relatively large investment in Wilmar International which isn't a typical investment for income.

Of course, long time readers of ASSI would know that not all investments in my portfolio are for income although almost all lean in that direction.

Why Wilmar?

Its distribution network is extensive, established and still growing.

It is a truly impressive business entity.

This will continue to impact its earnings for some time to come.

And while BreadTalk's extremely high PE ratio was rather unpalatable at the time when I became an investor (read related post #1 at the end of the blog), although not strictly comparable, Wilmar is currently trading at a much lower PE ratio of about 15x.

Based on the full year earnings per share in 2009, it represented a PE ratio of above 20x.

It is important to point out that, in 2010, Wilmar's NAV per share was about 22% lower than what it is today.

Paying S$7.11 a share then would have been a huge premium to NAV (US$1.85 per share) back then.

This is an important distinction to make.

Wilmar is a more valuable business entity today than it was in 2010.

I am also paying a lower price than what Archer Daniels Midland Co paid about a year ago to hike its stake in Wilmar from 20% to 22%, paying S$3.38 a share. (Reference: Reuters.)

Having said this, Wilmar's share price is currently in a downtrend and it could decline further and, if that should happen, I will be quite happy to accumulate again.

When CAPEX tapers off, that is when Wilmar will be able to pay more generous dividends.

Patience, I believe, will be rewarded.

Posted by AK71 at 7:50 AM 18 comments

An IPO for an IPO in the Philippines?

Tuesday, August 1, 2017

Reader:

Recently i come across an interesting pre-ipo for Philippines REIT during their roadshow at Raffles place.

This company acquires residential property from Singaporean whom has property in Philippines. In exchange for the property they would issue preference share equivalent to the property price.

They only acquire those property which is ready and fully paid. Thereafter they will just refurbish and rent/lease out for short term and long term stay.

Short term would be those Air Bnb or tourist type. Long term would be expat or local people who is working near CBD area.

So far they had acquired some 'condotel' means condominium within hotel. And some project will be completed this year and early next year.

They plan to get listed in Philippines in 3 years time and now they are inviting investors to invest in pre-ipo preferred shares. Two type of investment is capital repayment with 6% (2 yr)+5%(3yr). The second type is capital convert to preference share 5% (3yr) and upon listing will be converted to ordinary shares.

They will be conducting a submit with media coverage in manila in sep whereby investors & public can have a feel on how the company works including showing all articles n memorandum of company.

Have you ever come across such investment? Appreciate if you could talk to yourself on this investment.

AK:

Alamak. This food sounds so exotic. I dunwan. I might get food poisoning.

Such products are unregulated and we don't even know if they are what they claim they are.

Related post:

http://singaporeanstocksinvestor.blogspot.sg/2016/07/could-this-be-way-to-financial-freedom.html

Posted by AK71 at 9:16 AM 6 comments

Labels:

investment

Building your personal wealth in Singapore with some help. (AK the blogger or AK the benefactor?)

Monday, July 31, 2017

Reader:

Hey sifu thks so much

U changed my life

I was down to my last 100000

But yr saizen call

Save my life

My family

AK:

You took action. Thank yourself. 😉

Reader:

We will be praying to u

Downloaded yr pic

AK:

........................ :o

Reader:

We will pay tribute to u

Thks sifu

Really

I nearly killed myself

If not for yr call

AK:

I am glad. 🙂

Reader:

U save my life

No chance tell u

Till now

I am a ghost now

If not for u

I will ask my children pai u too

U are the benefactor

AK:

I am happy for you 🙂

Gambatte! 🙂

Reader:

Sifu wat are your latest picks?

Sifu u must help me

I need make enough for my children to study uni

AK:

Neverwinter! ;p

Anyway, I am only sharing my philosophy and experience as an investor in my blog. If it works for others too, I am happy.

I blog because I enjoy it.

If I feel that it has become work or if it has become a responsibility, I might stop blogging. ;)

To my Taoist readers, if you want to pray to AK, remember you must download the correct photo hor.

Jokes aside, to all my readers, remember that my approach to wealth building is a

1. holistic one (see related post #1)

and if you do the

2. right things, don't thank me, thank yourselves in future (see related post #2).

Gambatte!

Related posts:

1. Holistic approach to wealth building.

2. Don't thank AK but thank yourself.

Posted by AK71 at 9:29 PM 5 comments

Labels:

ASSI,

investment,

money management,

Saizen REIT,

wealth

Price we pay when die die must buy.

Someone told me that the fried mee from a hawker store at a market near my home is very good.

Die die also must try.

Every time I go, I see a long queue.

When I ask how long must I wait for a serving?

About half an hour or maybe longer.

Forget it.

|

| See: Comments. |

So, I tried the noodles.

I didn't have to wait very long.

What does this tell us?

If we die die must buy, then, there is a price we have to pay and that price might not be monetary in nature.

You want an example that is monetary in nature?

For those of us who buy cars, we would know the "discount" that they offer if we took a loan through the car dealer.

If we did not, then, the price tag of the car would be higher.

For both my current and previous cars, they did that to me.

I told the sales staff I would just buy a car elsewhere.

It was not as if I die, die must buy a car from them.

Suddenly, I could get the "discount" even though I didn't take a loan.

If we are die die must buy type of consumers, then, we could pay higher prices and it might or might not be in dollar terms.

Is this a story for consumers only or does it apply to investors too?

Related post:

I could not afford it but...

Posted by AK71 at 11:21 AM 11 comments

Labels:

ASSI,

consumption

Monthly Popular Blog Posts

-

It has been a while since my last blog. Hope everyone is doing well. Instead of revealing the numbers at the end of the blog, I have put it ...

-

Time for another update. First, on the personal front, I have been spending more time on other stuff in life as I have been feeling that too...

-

Been a while since my last blog post. Hope everyone is staying calm as stock markets crash around the world. I produced a video last night w...

-

I thought of not blogging about my 2Q 2020 passive income till a couple of weeks later because Mod 19 of Neverwinter, Avernus, just went liv...

-

Things at home are settling down into a new routine and I am feeling a bit better. Well, I did suffer a bone fracture a few weeks ago but it...

All time ASSI most popular!

-

A reader pointed me to a thread in HWZ Forum which discussed about my CPF savings being more than $800K. He wanted to clarify certain que...

-

The plan was to blog about this together with my quarterly passive income report (4Q 2018) but I decided to take some time off from Neverwin...

-

Reader says... AK sifu.. Wah next year MA up to 57200... Excited siah.. Can top up again to get tax relief. Can I ask u if the i...

-

It has been a pretty long break since my last blog. I have also been spending a lot less time engaging readers both in my blog and on Face...

-

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...