This blog was held in storage for many days because I was wondering if I should publish it.

What about a neighborhood school?

They habitually spent as much money as they made or more than what they made.

Have a more secure financial future in an uncertain world by creating a stream of reliable passive income with high yields.

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

This blog was held in storage for many days because I was wondering if I should publish it.

Posted by AK71 at 3:08 PM 22 comments

Labels:

CPF,

money,

money management,

passive income,

savings,

Singapore

Long time regular readers of ASSI know why AK was able to do much better on the investment front in 2022.

It wasn't only because AK avoided the highly speculative maze of cryptocurrencies and the high growth, zero dividends high tech space.

AK reallocated resources to enlarge an already relatively large exposure to our local banking sector in his investment portfolio.

Investments in DBS, OCBC and UOB did most of the heavy lifting in my portfolio in 2022, raising my full year passive income above the $200,000 mark.

In 2023, for various reasons, income generated from my investments in REITs as a group will likely take a hit as most have reported lower income distributions.

IREIT Global, Sabana REIT, CapitaLand China Trust and Frasers Logistics Trust have reported lower income distributions while AIMS APAC REIT and Ascott Residence Trust have reported higher income distributions.

With higher dividends declared by DBS, OCBC and UOB, I am hopeful that they, in the worst case scenario, would be enough to offset the weaker performance of REITs in my portfolio.

Not hoping for an increase in passive income, year on year, I would be happy to see passive income in 2023 staying the same as the year before.

March is the first month of the year in which I receive more meaningful sums of passive income.

I have quite a few more bills to pay this month as I have offered to pay more recurring expenses for my parents.

The recurring expenses to be added to the list are motor insurance and road tax for the family car.

I must pay for my own car's motor insurance and road tax this month too.

Those are the big ticket items this month, which, thankfully, occur only once a year.

Still, I would have some money left to invest with and, as I shared in an earlier blog, I plan to apply for the Singapore Savings Bond offered this month.

I plan to set aside $10K for that.

Then, with whatever money is left from passive income received in March, I had planned to get some 6 months T-bills as short term yields remain elevated and, therefore, relatively attractive for the income investor.

However, when I took a look at the charts of DBS, OCBC and UOB today, they look pretty bad in a good way, if you know what I mean.

If I wasn't already substantially invested in DBS, the current level seems like a good place to get a foot in, especially with a bumper dividend on the way.

This suggests to me that smart money is still accumulating even as the stock price stays above long term supports provided by the 200 days moving averages.

This could change, of course, and if the longer term supports should break, which seems unlikely in the near term, I would be interested to increase exposure at under $12 a share.

UOB, unlike OCBC, does not have a positive divergence and the stock price breaking a long term support is, therefore, not surprising.

Still, another long term support, the 200 days moving average is at $28.48 and, with momentum staying negative, we could see that tested.

If that should happen, if I didn't already have a significant exposure, I could get some although I would prefer to buy only when I see a positive divergence.

Fundamentally, all three local lenders are well capitalized and well run.

It now looks like Mr. Market could possibly offer me lower prices to increase my exposure to all three local lenders in the not too distant future.

So, instead of putting all the excess money from my passive income in March into T-bills, I might hold more cash instead, just in case.

For readers who have not visited my blog in a while, I published a blog yesterday regarding "Evening with AK and friends 2023."

You might want to take a look if you are interested in attending.

See:

Evening with AK and friends.

Have a good weekend!

Related posts:

1. T-bills and March strategy.

2. March dividends and SSB.

3. Give parents enough money?

4. UOB and OCBC final dividends.

5. DBS special dividend.

6. Largest investments updated.

Posted by AK71 at 3:00 PM 10 comments

On 19 February, when I blogged about "Evening with AK and friends" coming back this year, I wasn't bluffing.

Still, it does feel somewhat surreal because I didn't plan to do this.

The whole thing happened rather spontaneously in response to readers' comments.

I know that my blog isn't as well set up and that some readers have trouble getting updates.

At least, that is what I have been told.

Some readers asked if they could reserve seats for the event but, unfortunately, the ticketing system isn't smart enough to do it.

So, blogging about the event before ticketing starts is probably the best option as it, hopefully, gives readers who might only check my blog once every few days a better chance to secure a ticket.

Ticketing for the event will start on 13 March 2023 (Monday) in the afternoon.

Date and time of event:

10 May 2023 (Wednesday.)

7.00PM to 10.00PM.

Location of event:

Lifelong Learning Institute.

11 Eunos Road 8, Event Hall 1-1, Singapore 408601.

Total number of seats:

300 only.

Ticket price:

$38.00 each.

Auspicious number!

Although the event starts at 7.00pm, please try to arrive earlier for registration at the door.

Otherwise, my friend, Kenji, who is helping me to organize the event is going to be overwhelmed.

Maybe, 15 to 20 minutes earlier.

Another important reminder.

Please have your dinner before coming to the event.

You might also want to bring a bottle of drinking water and maybe a snack.

Not for AK but for yourself, of course.

We will try to have a break every 50 minutes or so but there wouldn't be enough time for you to go get dinner during the breaks.

Photo taking with AK is a must and that is what the breaks are for, of course.

I know a reader who pinned his photo taken with AK on a corkboard in front of his computer desk with the words "IF AK CAN DO IT, SO CAN I!"

Win liao lor!

He got good value for his money!

Yes, remember, come for the fun and laughter.

"Evening with AK and friends" is just an epic chit chat session.

It is definitely nothing profound.

If you think AK might be sharing some hot and steamy stock tips, don't come.

You have been warned.

So, if you are absolutely sure you still want to attend, please bookmark my blog and come back on 13 March 2023 (Monday) after lunch in the afternoon to get your ticket.

I will publish another blog with updates then.

Recently published:

Buy bonds, not stocks in 2023?

Related post:

Evening with AK and friends 2023. Incoming!

Posted by AK71 at 4:48 PM 14 comments

Labels:

ASSI

Reader says to AK:

Posted by AK71 at 12:18 PM 0 comments

Labels:

bonds,

investment,

passive income

Not too long ago, I said that restarting my YouTube channel was a good thing and in more ways than one.

Posted by AK71 at 8:31 AM 3 comments

Labels:

investment,

REITs

I have blogged about how we should not think of children as money trees before.

See:

What is our attitude towards children?

I have also blogged about how children should not treat parents as their ATMs before.

When it comes to money issues, even family members can become enemies.

These topics are so sensitive and views are so diverse that whenever I blog about them, I am likely to get some negative feedback.

Some readers even told me they had to stop reading my blogs for a while to recover from my blunt and, what they thought, unpalatable views.

This is why the Chinese people say:

谈钱伤感情When we talk about money, it hurts feelings.

Hard truth.

When I read about someone who was the eldest amongst three children complaining online about how he was not in his parents' will, it was somewhat poignant.

This is because I am also the eldest with two younger siblings in my family.

Apparently, being the eldest child, he gave his parents the most financial support.

He felt unloved and hurt that they had excluded him from their will.

What's in the will?

A HDB flat and nothing else.

His parents told him that he already had a flat of his own while his younger siblings didn't.

He went on to lament that he didn't ask to be the first born child and that, perhaps, he should have been more selfish.

Perhaps, he should have given his parents less financial support and put more money towards preparing for his own retirement instead.

I have said before that we work towards financial freedom because we want to have options.

We want to have the freedom to choose what we want to do with our time without having to worry about money.

Unfortunately, there are things in life which we have to live with.

All we can do is to make the best of the situation.

Sometimes, life just throws lemons at us.

I have said before that we have to be a bit cynical in life and being calculative is not a bad thing per se.

However, when it comes to my parents, this does not apply.

When I think about providing for my parents so that they don't have to worry about money in their old age, I do not think of possible future returns.

Children being nice to their parents so that they could get into their parents' good books all in the hope of receiving financial inheritance?

I have seen it in Chinese drama.

It was just drama, I thought.

Who thinks that way in real life?

Well, now, from time to time, I am reminded that some people actually do.

What my parents choose to do with their assets is their business.

I might have opinions which I would share with them but the final decision is theirs.

In fact, in a recent conversation with my mom, I told her to will everything to my two younger siblings.

She asked me why I didn't want her money?

I think she might have felt surprised and, maybe, even a bit offended.

I told her I didn't need her money and that she should give it to whoever might need it more in the family.

In fact, I told her she should try to spend more money on herself first.

Why shouldn't she?

It isn't a bad way to think.

Or is it?

For sure, I am not in the complainant's shoes.

I just felt the blogging bug bit me when I read the story because we are both the eldest of three children and we both provide the most financial support to our parents.

The complainant is going to feel miserable if he does not snap out of this feeling that he should be rewarded financially (eventually) for what he is doing for his parents.

If his parents were to find out, they would feel miserable too.

At the end of the day, if he is not hurting for money, it is just money.

I always say that if a problem can be solved with money, it really isn't a problem if we have the money.

There are more important things in life than money.

“Resentment is like drinking poison and waiting for the other person to die.” Carrie Fisher.References:

1. Worried as dividends reduced.

2. Inflation and my budget.

3. To better mental health.

Posted by AK71 at 10:10 AM 2 comments

Labels:

money

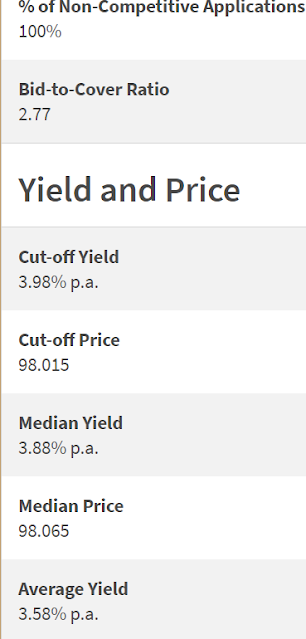

This blog is a continuation of my blog published last night titled:

March dividends & SSB 3.15% p.a.

The latest 6 months T-bill auction's numbers are in.

Cut-off yield: 3.98% p.a.

In a recent blog, I said that the US$ has strengthened against the S$ and yields have also moved higher on the front end of the curve.

My expectation was for a higher cut-off yield for the 6 months T-bill and the auction did not disappoint.

I applied for the T-bill, putting in a non-competitive bid with some SRS money raised from the sale of my investment in SATS in early February.

That was fully allotted.

I also put in a competitive bid with some CPF-OA money.

Why a competitive bid in that instance?

I did not want to tempt Murphy's Law with a non-competitive bid when the CPF-OA pays 2.5% p.a. risk free.

My bid yield was very close to 4% p.a. and, fortunately, my competitive bid was also fully allotted.

3.98% p.a. is only a bit higher than the 3.88% p.a. offered by OCBC's FD promotion using CPF-OA funds.

(That offer by OCBC ended on the 28th of February and their new offer of 3.55% p.a. for a 5 months tenure looks relatively unattractive.)

If we take into consideration that the "interest earned" is paid by T-bills at the beginning of the duration and not at the end, however, then, the cut-off yield for this T-bill looks more attractive.

The "effective interest rate" actually exceeds 4% p.a. and it is closer to 4.05% p.a. which, at face value, is even better than what the CPF-SA is paying.

We should also remember that the "interest earned" stays in the CPF-OA where it will continue to generate passive income for me at 2.5% p.a. for the T-bill's 6 months duration.

So, what's not to like?

To me, using CPF-OA money, it really is win and win again with this T-bill!

The T-bill will mature on 5 Sep 23 and I have made a note on my calendar so that I will remember to transfer the funds from my CPF-IA back into my CPF-OA when that happens.

This is so as not to lose interest income which would be paid by the CPF for the month of October.

There are two more 6 months T-bills on offer this month in March with auctions happening on the 16th and 30th.

The plan for me is to place non-competitive bids in both auctions with money in my SRS account.

Apart from applying with SRS money which I earmarked earlier, I could also apply with some of the dividends coming in this month which I have estimated in the blog before this one as possibly being under $40,000.

With yields at the front end of the curve still rising, it is quite possible to see cut-off yields exceeding 4% p.a. in the two upcoming auctions.

A greater exposure to 6 months T-bills using cash on hand would slightly strengthen my portfolio's passive income generation in the month of March.

Getting more T-bills also means staying consistent in my plan to maintain a meaningful exposure to fixed income.

It is probably a good idea to remember that fair weather doesn't last forever and that throwing some defensives into our portfolio isn't a terrible idea.

It is not just about making hay while the sun shines but also about stashing a good portion of that hay away.

This higher exposure to fixed income will generate more passive income in a risk free manner while reducing volatility in my investment portfolio.

Risk free and volatility free, T-bills fit the bill to a t.

I do very much enjoy a good pun.

Anyway, as interest rates are likely to remain higher for longer, this strategy is probably going to help my portfolio bring home the bacon for some time to come.

As an aside, you might want to eavesdrop on Warren Buffett and Charlie Munger in this video before continuing to eavesdrop on AK:

We would very likely appreciate having a meaningful exposure to fixed income a lot more if the world continues to grapple with sticky inflation and more than a handful of economies around the world sink into recession.

Singapore is a very open economy and we would probably take some collateral damage in such a scenario.

If such a scenario should materialize, having a meaningful exposure to fixed income is not only comforting but we could then redeploy the funds which were previously locked up in a gradual manner.

This is if we have laddered into T-bills and fixed deposits which, of course, is what I have been doing.

|

| Source: MAS. |

Using a laddering strategy, we ensure that the maturities of T-bills and fixed deposits are staggered.

If you think that this strategy allows us to have access to investible funds at multiple points in time over the next 12 months, you are right.

Long time regular readers have overheard me talking to myself many times before and would be familiar with what is coming.

Don't be overly pessimistic.

Don't be overly optimistic.

Be pragmatic which means staying invested in genuine income generating assets while preparing for when Mr. Market goes into a depression.

Yes, when and not if.

"There are worse situations than drowning in cash and sitting, sitting, sitting," Charlie Munger.

Charlie Munger said that, not me.

Just talking to myself, as usual.

Reference:

Largest investments updated.

P.S. We cannot always be right and you might want to eavesdrop on Charlie Munger in this video:

Posted by AK71 at 8:00 PM 27 comments

Labels:

bonds,

investment

January and February are usually pretty dry months when it comes to dividends.

If not for dividends in March, my passive income in 1Q of any year would be almost zero.

I will blog about my total passive income for 1Q 2023 by end of March or early April.

For now, if I were to do an estimate, passive income for 1Q 2023 could come in at under $40,000.

I shared my plan with regards to SSB, T-bill, CPF and the UOB ONE account in an earlier blog:

I did not apply for the SSBs offered in January and February this year as both offered 10 year average yields of lower than 3% p.a. which was lower than what I would get from my CPF account.

Now, I am not saying that those SSBs were not attractive for everybody but they were not attractive to me as my plan was to apply with money earmarked for CPF voluntary contribution in 2024.

I suppose many people agreed with me as those SSBs were rather badly undersubscribed, with the one offered in February less than half subscribed.

The one that is offered this month, however, is very interesting to me as it is offering a 10 year average yield of 3.15% p.a.

|

| Source: MAS. |

With the dividends coming in this month, I would set aside at least $10,000 to apply for the SSB.

I have made a note on my calendar to apply by 28 March 2023.

If the 10 year average yield remains higher than 3% p.a. for SSBs offered in the next few months, I would be able to fully deploy the $38,000 I have earmarked for voluntary contribution to my CPF account in 2024 earlier than anticipated.

I could do this in 2Q 2023 easily as 2Q and 3Q are usually relatively strong passive income generating periods for me.

In the next day or two, I will talk to myself a bit more on the subject of fixed income and how a meaningful exposure will do my investment portfolio a whole lot of good.

Of course, just talking to myself, as usual.

Reference:

SSB or CPF?

Posted by AK71 at 9:00 PM 6 comments

Labels:

bonds,

CPF,

passive income

In a blog published many years ago, I said that I was lucky that my parents didn't ever ask me for money.

If you are new to my blog or do not remember, here is the link to the blog:

How did AK achieve financial freedom?

However, I have also shared in my blog in recent years that I was providing my parents with financial support.

Sounds contradictory to what I said many years ago?

Well, my parents didn't ask me for financial support.

I offered.

The thing is if we are blessed with good parents, they usually try not to burden us, their children.

They might just tighten their belts or make some pocket money doing some part time work.

If we are good children, we wouldn't want to see our parents do that.

They have labored to provide for us children till we became independent and, in their golden years, it is our turn to make sure they are at least financially comfortable.

I believe that this is the least we can do as children.

Anyway, the catalyst for this blog was something I read online.

The author asked how much money did people give their parents?

He said he gave his parents 10% of his salary monthly.

The amount was $400 a month.

|

| Source: theindependent.sg |

The blogging bug bit me when I saw that.

If the author's parents were relatively well off and he was just giving them a monthly allowance to express his filial piety, I think his method would be OK.

Method?

Yes, setting aside a fixed percentage of his monthly pay to give to his parents.

Otherwise, it seems pretty arbitrary to me.

It's like saying,

"Hey, don't say I don't give you any money, OK?"

Don't get me wrong as it is better than not giving any money at all.

It would be more meaningful, however, to find out what our parents' needs might be financially and if we could do more to help.

Also, simply giving parents money might not always be the best way to help them.

Helping them pay recurring bills might be a better idea, especially if we want to make sure that the money is being used properly.

Some people are just not very good with money.

Both the giver and receiver would have peace of mind this way.

Hopefully, not having to worry about recurring expenses, our parents would have sufficient resources of their own to take care of their daily expenses.

Otherwise, we might have to provide financial support to defray their daily expenses too.

Then, it might also be a good idea to set aside an emergency fund for our parents, especially if they do not have one.

Things do go wrong like they sometimes do and unexpected expenses do pop up.

Being prepared for a rainy day or, worse, a storm is never a bad idea.

So, what about me?

Well, I don't set aside a percentage of my passive income to give to my parents.

I also do not give them money monthly but I do give them relatively generous red packets on Father's Day, Mother's Day and their birthdays.

That's the only cash I give them.

I can hear some long time regular readers asking questions now.

Yes, in a blog which I published in August 2022, I revealed my updated budget.

In that blog, I said I would be setting aside $48,000 per year from my passive income to provide financial support to my parents.

Most of the money would go to helping them pay recurring expenses and the biggest ticket items are H&S insurance premium, property maintenance and property taxes.

Up until recently, recurring expenses also included mortgage payments.

Thankfully, the final housing loan was fully paid in 2H 2022 and I paid the legal fees to discharge the mortgage as well.

To be honest, $48,000 per year has quite a comfortable buffer as the amount I set aside for parental support was $40,000 per year before.

So, what about the amount in excess of annual red packets and paying recurring expenses for them?

Well, I could increase the size of their red packets henceforth.

However, being a worrier, most of the excess would go into the emergency fund I have set up for them.

I have blogged about the importance of having an emergency fund and how mine was big enough to cover 24 months of routine expenses not just for myself but also my family.

However, I have not blogged about how our emergency fund should also keep pace with inflation, if my memory serves me right.

If we have set up an emergency fund a few years ago and if we have not looked at it since, maybe, it is a good idea to check if it is still as robust as before.

If you are new to my blog or need a refresher, read:

So, how much money am I giving my parents in percentage terms?

Well, this number is going to be different from year to year since my passive income is going to be different each year.

My passive income for 2022 totaled S$205,999.

$48,000 is about 23% of that total.

To be sure, I am not telling anyone how much money they should give their parents.

I am definitely not saying that I am 10x better than someone who gives $400 a month or $4,800 a year to his parents.

We most probably have different circumstances and, in some cases, quite possibly, very different circumstances.

However, instead of asking how much money are you giving your parents monthly, perhaps, the author of the article which was the catalyst for this blog should be asking are you giving your parents enough money monthly?

I am going to take shelter now.

Just talking to myself, as usual.

Related posts:

1. Inflation, passive income and my budget.

2. 4Q 2022 passive income.

Posted by AK71 at 7:55 AM 11 comments

Labels:

money management,

passive income