Sabana REIT was trading at a huge discount to NAV when I increased my investment significantly at the end of 2020 and the start of 2021.

Today, it is still trading at a 13.5% discount to NAV.

If we think a 3.1 cent DPU is sustainable, then, at 45c a unit, we are looking at a distribution yield of 6.89% which isn't too bad.

It isn't too bad because we could see DPU increasing in the not too distant future as Sabana REIT's portfolio is under rented.

Of course, there is a possibility that the portfolio could remain under rented.

However, I have a feeling that things are more likely to improve.

I like to see what insiders are doing and I find it very interesting that Donald Han, Sabana REIT's CEO, bought 100,000 units at 45c a unit in late April.

Being under rented means that Sabana REIT does not have to depend too heavily on acquisitions to grow its income.

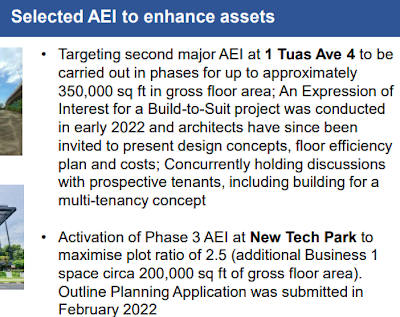

From their presentation dated 21 May 2022, this could give income a boost:

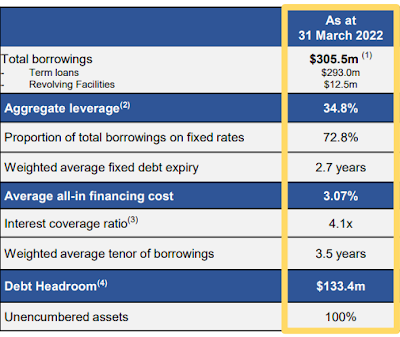

Sabana REIT's financials are relatively strong and this is important as peace of mind is priceless.

It is very fortunate that Sabana REIT did not fall prey to the low ball offer by ESR REIT.

A gem in the rough that is still in the process of being polished, I hope that Sabana REIT will shine brighter in my portfolio.

Of course, whether Mr. Market agrees or not is something else.

If Mr. Market agrees, then, we should see Sabana REIT trading closer to its NAV of 52 cents per unit in time to come.

My bowling ball that thinks it is a crystal ball says a unit price of 48 cents or even 49 cents would not be unreasonable.

The information shared in this blog is taken from Sabana REIT's latest presentation dated 21 May 2022.

See complete slides: HERE.

Having positive vibes about Sabana REIT has nothing to do with the $20 shopping vouchers they sent to me.

Honest!

I hardly leave home but I guess I will make a trip to look look see see.

Recently published:

1. CLCT: Another largest investment.

2. FLT: Another largest investment.

Related post:

Sabana REIT's lesson.

10 comments:

Nice. =) I got my $20 vouchers too. Can have some atas coffee and pastry at the cafe area

Hi Rellangis,

I just spent mine in the supermarket. ;p

The Katsudon in the foodcourt (level 2) is highly recommended :)

Hi Desmond,

I love Katsudon!

Must try.

Thanks for the recommendation! :)

Dear AK

Fully agree

On my watchlist for long, I was hoping to open my a count at circa 42 cents. My idea was that the incoming interest rate hikes would cause all REITS to pullback despite the reopening benefits. Alas, so far that has not happened. For a REIT like this, I need a better margin of safety and a circa 7% yield at the minimum. This can be achieved at 43/44 cents PROVIDED there is

- positive rent reversion

- new leases are signed at higher rents

- most importantly, the vacancy rate comes down to at least 10%

I might wait and add at 44 and add more if the unit price drops with fed hikes and/or bad sentiment

Let us see

Asset enhancement, particularly at the NTP plus mall, will do well and as a local resident I see that

However, place available to expand is limited unless they innovate and expand the first floor for more retail offerings

Let us see

Regards

Garudadri

Hi Garudadri,

Thank you for sharing your thoughts on Sabana REIT.

The REIT's performance was encouraging in 2021 and with the unhappy ESR REIT episode behind us, I hope that Donald and his team continues to deliver good results. :)

Hi AK, May I know how do you see Sabana as compared to ESR? After all, both seems to have focus on local industrial properties and at similar share price and relatively good DPU, I would then ask what are the fundamentally differences that cause you to load up on Sabana more. ESR seems to have a stronger sponsor from my understanding. As for future growth wise, I am not too sure about Sabana though I would reckon for a stable flow of income Sabana does tick the box for now.

Care to have some self talk pertaining to this?

Thanks AK!

Hi DT,

I didn't like ESR-REIT's merger with VIVA Industrial Trust.

See:

ESR-REIT and VIT.

The low ball offers for Sabana REIT and then ARA Logos left me with a bad impression of the people at ESR-REIT.

See:

ESR-REIT gives ARA Logos short end of the stick.

If I don't like somebody, I avoid the person and the same thing goes for REITs. ;p

There will be a time of reckoning and you will find my thoughts on this somewhere in the middle of this blog:

4Q 2020 passive income.

Of course, AK is just talking to himself. ;p

Hi AK,

Not sure if you are following the latest conflict between ESR and Quarz Capital for Sabana, with the latest development of ESR initiating a court injunction to halt the EGM to remove the current manager and internalization?

Understand that you have a legacy Sabana position (if you have not already divested). Like to hear you talking to yourself, if this is a cause for concern to consider divesting your Sabana position (ignoring the fact that this is your legacy position)?

AlcusTrader

Hi AlcusTrader,

I actually increased my investment in Sabana REIT in late 2020 so that it was no longer just a smallish legacy position.

In fact, it has been one of my largest investments since late 2020.

See:

4Q 2020 passive income.

I like Quarz Capital for what they have done so far in Sabana REIT.

Although I like the idea of an internal manager like what happened in the case of Croesus Retail Trust donkey years ago, I am not sure if the ongoing fight in Sabana REIT is productive.

After all, Croesus Retail Trust's management internalization exercise was proposed by the sponsor and it was a move that surprised me since external managers make good money.

Anyway, the fight might affect sentiments but I doubt it would affect fundamentals.

So, I am staying invested in the REIT.

Coincidentally, when I blogged about Croesus Retail Trust's internal manager in 2017, I mentioned Sabana REIT too:

Croesus Retail Trust: 1H FY2017.

Post a Comment