It has been quite a while since I last blogged about my largest investments.

The last time I published such a blog was in January 2023.

So, it has been a year and a half!

Apart from being lazy, I didn't do very much to my portfolio and, hence, I did not see the need to publish any updates.

However, I think it is about time I do this even if it is just to take into account changes in market prices.

Many things have changed in the past 18 months.

Before we start, I want to share a YouTube video I produced on how not to run out of money in retirement which I feel is an important topic:

Anyway, here is the update.

$500,000 or more

1. CPF

2. OCBC

My CPF savings is a constant.

Being risk free and volatility free, it provides peace of mind.

I have not done any voluntary contributions to my CPF account in the last 18 months.

Instead, I have used that money to buy Singapore Savings Bonds and I shared the reason why here and also in my YouTube channel, of course.

I have also used money in my CPF OA to buy T-bills which grows my CPF OA savings at a faster clip.

In dollar terms, it is quite meaningful as I have quite a large amount of money in my CPF OA.

So, my CPF savings has grown in size in the last 18 months despite lacking mandatory or voluntary contributions.

Next is OCBC which is my largest investment in equities.

Since the last update on my largest investments, I added to my position in OCBC at about $12.30 a share in the middle of 2023.

The market value of my investment in OCBC has gone up significantly as its share price has also appreciated quite a bit.

This is very nice but as an investor for income, I am more interested in the passive income generation.

OCBC has become and will continue to be the most important passive income generator for me.

$350,000 to $499,999

1. AIMS APAC REIT

2. DBS

3. UOB

4. SSBs and T-bills

Unlike the top bracket, there are some changes in the second highest bracket in my portfolio.

DBS and UOB have both moved upwards to join AIMS APAC REIT in this bracket.

The spectacular increase in the share prices of DBS and UOB resulted in their promotion in my portfolio.

There is also the fact that I added to my investment in UOB in the middle of 2023 at about $27.90 per share.

I also added to my investment in DBS in November of 2023 at about $31.80 per share.

Together, OCBC, UOB and DBS account for more than 45% of my portfolio's market value.

Then, there are SSBs and T-bills.

Together, they jumped two brackets upwards from 18 months ago.

Yes, together, they were in the lowest bracket 18 months ago.

I can save money relatively quickly since my passive income exceeds my expenses rather significantly.

I have been socking away money in SSBs and T-bills in the last 18 months.

Money which would have gone into my CPF account was instead used to buy SSBs.

Excess money was used to buy 6 months T-bills, strengthening my T-bill ladder.

This provides me with more passive income without any price risk.

The money in T-bills also come back every 2 weeks which is useful if there are investment opportunities presented by Mr. Market.

$200,000 to $349,999

1. IREIT Global

For readers who have a keen eye, they would have wondered what happened to IREIT Global which was in the higher bracket 18 months ago?

The large decline in unit price since the last update means IREIT Global has fallen in its position in my portfolio.

Having declined more than 40% in the last 18 months means IREIT Global is no longer my largest investment in the REIT universe.

It briefly replaced AIMS APAC REIT as the largest REIT investment in my portfolio 18 months ago.

I made a video about IREIT Global several months ago and the decline in unit price is not unexpected.

Here is the video for anyone who might be interested:

I am still holding on to the investment and will be adding if its unit price declines further.

I find it easier to value IREIT Global because it isn't holding something amorphous.

It is deeply undervalued and more so now that Mr. Market is feeling very pessimistic about it.

In fact, I am getting a bit of that Saizen REIT vibe.

Readers who have been following my blog for many years would know what I mean.

Still, same same but different.

So, do not throw caution to the wind.

I made a video about this recently too:

$100,000 to $199,999

1. Wilmar International

2. ComfortDelgro

3. Frasers Logistics Trust

Membership in this lowest bracket of my largest investments has changed.

Wilmar dropped one rank as its share price declined significantly.

I know Mr. Kuok and Mr. George Yeo added to their investments recently.

However, I am still waiting for $3.00 per share before adding.

Wilmar is very undervalued if we look at the sum of its parts.

However, conglomerates always suffer from conglomerate discount.

So, buying with a larger margin of safety for a person of limited means like myself is not a bad idea.

Wilmar is still profitable and pays a meaningful dividend which means I am being paid while I wait.

This is true for all my investments.

ComfortDelgro and Frasers Logistics Trust are both chugging along fine.

Nothing much to say there.

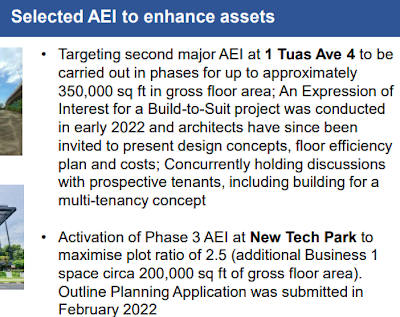

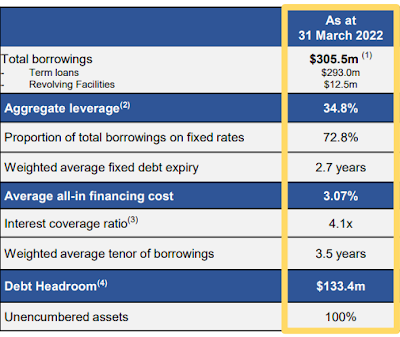

Sabana REIT and CapitaLand China Trust have dropped out from this bracket.

I reduced my investment in Sabana REIT substantially not too long ago and I blogged about it too.

Don't like how the internalization process seems to be fraught with speed bumps.

Like I said in the blog, it is very different from my experience with Croesus Retail Trust.

CapitaLand China Trust has seen its unit price plunged.

Unfortunately, its fate is tied to that of the Chinese economy which is not in a good place now.

Specifically, the Chinese property sector which accounts for 30% of the economy will be a dead weight for many years to come.

So, this is the update.

Although there are a couple of investments which are underperforming, overall, the portfolio is doing well.

That is what matters to me.

Performance on a portfolio level.

Of course, all of us have different beliefs and we should all do what we feel is right for us.

If AK can talk to himself, so can you.

Related posts:

1. Sabana REIT divestment.

2. Largest investments (4Q 2022.)