I have always liked industrial S-REITs.

Long time readers would remember blogs like this:

Office REITs versus Industrial REITs.

Of course, although it has dropped the word "retail" from its name, it still has shopping centers in its portfolio.

Industrial REITs having much higher distribution yields made the decision to invest heavily in them easier too.

We will always need all kinds of warehouses and with e-commerce being so entrenched, they are even more in demand.

Business parks fit a niche demand for where office space in the CBD is considered too expensive.

Together with all other types of industrial buildings, they are pretty difficult to disrupt as a class.

In fact, they are more likely to be disrupters or friends of disrupters than victims of disruption.

Of course, on hindsight, we also see how resilient industrial S-REITs can be in a pandemic setting.

I have the following in my portfolio:

1. AIMS APAC REIT

2. Sabana REIT

3. Frasers Logistics Trust

4. Capitaland China Trust

Yes, it is a bit strange to see Capitaland China Trust in this list because it was Capitaland Retail China Trust before.

Of course, although it has dropped the word "retail" from its name, it still has shopping centers in its portfolio.

It is more of a hybrid now.

|

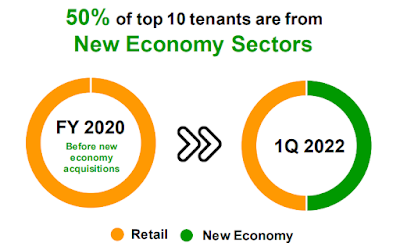

| Source: Presentation 26 April 2022 |

I have been adding to Capitaland China Trust at around $1.10 a unit.

I don't think that the lockdowns in China can go on forever.

So, the pessimism will lift at some point.

The initial plan was to have the investment similar in size to my investment in Frasers Logistics Trust which is one of my larger smaller investments.

However, I am now thinking of making my investment in Capitaland China Trust similar in size to my investment in Sabana REIT which is one of my largest investments albeit the smallest in the club.

Maybe, I am feeling a little sorry for Sabana REIT being all alone in the lowest bracket in my list of largest investments.

Capitaland China Trust is trading at a big discount to NAV.

Its NAV is about $1.50 a unit.

Capitaland China Trust also offers a relatively high distribution yield.

If a DPU of 9c continues to be paid, at $1.10 a unit, that is a distribution yield of almost 8.2% which sufficiently compensates for any negative vibes Mr. Market might have.

Yes, I think that we will look back at this episode in history as just negative vibes.

It is like how Mr. Market was feeling very negative about Sabana REIT when ESR REIT made the low ball takeover offer.

It was because of that episode that I was able to accumulate aggressively at around 35 cents a share which brought my investment in Sabana REIT back into my list of largest investments at the end of 2020.

The distribution yield for that investment based on my cost is almost 9%.

Pulling another rabbit out of the hat with Capitaland China Trust, perhaps?

Your guess is as good as mine, of course.

Recently published:

AIMS APAC REIT: Gearing too high?

AIMS APAC REIT: Gearing too high?

Related posts:

1. Reallocate as interest rate rises.

1. Reallocate as interest rate rises.

30 comments:

Dear AK,

Nice to know that you have added this to your portfolio, as I've actually added this at a higher price back then during the unfortunate period where China has started to control covid spread with their lockdown measures.

Hopefully with recent news on relaxation of Shanghai covid measures, CLCT can recover to it's NAV price. =)

Hi Unknown,

I first bought some units of CapitaRetail China Trust in 2017 but it remained a relatively small investment.

At the time, I was more interested in increasing my investment in Frasers Logistics Trust.

It was probably because I was more interested in industrial REITs than retail REITs.

See:

Frasers Logistics Trust and CrapitaRetail China Trust.

Of course, Capitaland China Trust is not the same animal as it was and I am much more interested in it now especially with its unit price being depressed. :)

Hi AK,

Thanks for the heads up on CCT. Especially after reading ur current blog and checkout the below info link. Will be looking to invest into CCT for dividend growth and future capital appreciation. Although the current 2nd quarter results may potentially be affected due to their covid lockdown. Valuations definitely looked cheap. Thanks once again, AK “)

https://links.sgx.com/1.0.0/corporate-announcements/9L2PVOX073MBBRCG/718366_20220524_CLCT%20CLSA%20CapitaLand%20Investment%20and%20REITs%20Access%20Call.pdf

Hi Eddy,

Fundamentally, it looks like good value for money.

Technically, it looks like the bottoming process has started and we could have seen capitulation on 12th of May.

Of course, we could see unit price going lower and if I see a positive divergence in the chart, it would be a signal to buy even more. :)

Why dont you consider the political environment in China? I would say it is becoming more and more complicated.

Hi PeachTea,

That is a pertinent consideration but I like to think that Charlie Munger is right. ;p

Have to remind myself not to let analysis lead to paralysis. -.-"

After all, if I am worried about China going the way of the Dodo, then, many other investment options are out the window.

Wilmar, OCBC, DBS and other entities with a significant interest would be hit.

Also, don't tell this to people who are invested in Alibaba and Tencent. ;p

So, what to do?

When in doubt, it is probably better to stay out. :)

Wow, most of your timing to buy is always at the right time.

Hi ngs,

Just pure dumb luck. ;p

Things could still go the other way. -.-"

Dear AK

Nice buy

I decided to not add and average down as I am worried about the political risks as well ha in’s seen losses from the Chinese tech ETF falls

My last buy was at 1.15 and 1.13

Overall, it has shown a declining trend ever since last 4/5 years with numerous rights and placements etc

This has undone most of the accrued distribution gains and actually lost me money

This is a problem with most SG REITS as I have mentioned before

I used the cash for the banks and will continue to do so as they offer better overall long term returns and boost portfolio value

Let us see

Regards

Garudadri

Hi Garudadri,

At $1.10 or lower per unit, it was an offer I had to accept.

It is a mental illness, I know. -.-"

As for Chinese tech, I only have a little exposure at less than 1% of my portfolio through Lion-OCBC HS Tech ETF and, also, it was only after the massive declines that I got in.

I just couldn't bring myself to get in with the stratospheric valuations before.

I am hopeful that we have seen the bottom.

Still, there is a chance things could continue to go south like you said.

The banks are good long term investments and like you, I will wait for an opportunity to increase my investment. :)

Quote.

Pulling another rabbit out of the hat with Capitaland China Trust, perhaps?

Unquote.

AK is being too modest.

AK pulls endless streams of high dividends from his hat !!!! 0:)

Hi Laurence,

Endless dividends?

I wish that was true. ;p

With the numerous lockdowns, can CLCT maintain the 1H DPU of 4.6c? Expecting writedown in valuations this coming half?

Hi WK888,

We could see some weakness in the numbers, for sure.

The question to ask is whether these negatives are temporary or permanent?

Hi AK, I notice the US office Reits listed on SGX are also high yield and below book value now. Do you have any opinion of those?

Hi JBVF,

I get asked this from time to time.

I just don't feel comfortable about how these REITs use a loophole in the system to help investors here avoid paying a withholding tax on income distributions.

If in doubt, I prefer to stay out. :)

How now after recent HY report? China's stand on C19 still pretty firm!

Hi WK888,

Unfortunately, Xi seems to be pretty stubborn.

Oh well, have to take the good with the bad, I suppose.

hello AK

I m hoping you would talk a bit about capitaland china trust.i remembered you are a bit hesitant to add on to this share looking at how the central govt is wiping out private tuition in the country and hammering the tech stocks.

today this share is starting to climb like China is doing `quantitative easing' by cutting reserve requirements ratio.

would you consider adding on at such attractive price of 0.910?

Hi Ruby,

When you said "attractive price" in the last sentence, it gave me the impression that you have done your research and are thinking of adding.

Don't let what I am doing or what anyone else is doing affect your thinking. :)

I am just holding on as I am not comfortable increasing exposure to China now.

Mr. Market will do what Mr. Market will do, of course. ;)

Today reach a new low, will it go all the way to 2008-2009 levels? Only time will tell!

Hi VT,

Well, Piyush Gupta recently said that concerns about China's economy is not "overdone".

Food for thought!

Hello all, with all the risk and uncertainty, probably a 10% distribution yield is required. I anyhow calculate to be around $0.72. Even then a small nibble and not all in...otherwise just find other better alternative I think

Hi HH,

When even the usually upbeat CEO of DBS becomes concerned, we should be concerned too.

No need to die die must buy CLCT.

Peace of mind is priceless. :)

AK can u talk to yourself re CLCT'S latest DRP pls? Should you take cash or more units?

Hi garyp,

I always take cash as I am an investor for income.

There was only once I took more shares instead of cash and that was during the pandemic when the share price of OCBC was so depressed.

CLCT does not look like it is going to bounce back quickly because China doesn't look like it is going to bounce back quickly.

So, I will simply wait and see.

k AK take cash so i also take cash.

AK wait n see so i also wait and see.

Hi garyp,

Aiyoh, don't like that say. I scared. ;p

I just feel that there are too many unknowns in China now and the problems we do know are not going to be resolved quickly.

I take my cue from people like Piyush Gupta who have a greater understanding of the situation in China. :)

U take ur cue from people like Piyush Gupta who have a greater understanding of the situation in China and i take my cue fr u......... nubbad.....

HI garyp,

Like that also can. ;p

Post a Comment