I have been quite prolific recently as a blogger.

Yes, if AK can do it, so can you!

The sky is not falling!

Have a more secure financial future in an uncertain world by creating a stream of reliable passive income with high yields.

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

I have been quite prolific recently as a blogger.

Posted by AK71 at 9:33 AM 8 comments

Labels:

DBS,

investment,

OCBC,

UOB

Three signs of a banking crisis.

First is credit risk.

This is when loans turn bad and debtors are unable to make repayments.

Other assets can also turn bad and are unable to generate income required to make loan repayments.

We could see this playing out in the U.S. commercial real estate sector.

It also means it will be harder for certain borrowers to access credit.

Refinancing also becomes difficult as banks become more selective and risk averse.

Credit will tighten significantly as there will be heightened scrutiny of borrowers' credit worthiness.

Second is liquidity risk.

We might see withdrawals by depositors exceeding the available funds held by the banks.

This could lead to panic and runs on banks.

We saw this happened to Silicon Valley Bank in the U.S.A.

Later on, we also saw depositors withdrawing large amounts from First Republic Bank.

Even the $30 billion infusion provided by 11 big U.S. banks was insufficient.

Both S&P and Moody's downgraded First Republic Bank to junk.

Third is interest rate risk.

Rising interest rates reduce the value of long duration bonds held by banks.

This leads to weaker balance sheets.

In case many depositors need to make large withdrawals at the same time, banks might be forced to realize those losses by liquidating these long duration bonds.

Funding cost for banks can also rise further as they pay more to their depositors.

Funding cost could, in some instances, be higher than what banks receive in interest payments.

This could be the case if many long term loans on fixed rates were taken by the banks' customers before the interest rate hikes.

What is a systemic banking crisis?

A systemic banking crisis occurs when a large number of banks in a country have solvency or liquidity problems.

It could happen because of external shocks or because failure in one bank or a group of banks spreads to other banks in the system.

So, this explains why the U.S. regulators took over Silicon Valley Bank and Signature Bank very quickly.

It also explains why they moved to guarantee all deposits, even those larger than $250,000 insured under the F.D.I.C.

It was to prevent the failure of these two banks to spread to other banks in the system although in so doing, the U.S. regulators created a moral hazard as bad actors are not punished but bailed out.

Systemic banking crises are financial nightmares.

These crises often result in deep recessions for the countries concerned.

This is because banking crises usually affect consumer and business confidence.

Spending, investing and lending on all fronts reduce because of extreme fear.

Banking crises in major economies could also spread to other countries, resulting in a global banking crisis.

This is called a contagion.

This is why the Swiss authorities assigned partial blame for the collapse of Credit Suisse to the recent U.S. banking crisis.

After all, often, it is a crisis of confidence arising from heightened fear that is more damaging to the banking system and economy than any other crisis.

We could yet see Mr. Market going into another depression as an economic recession looks more likely now than ever to hit the U.S.A. in the not too distant future.

Recently published:

DBS, OCBC and UOB test supports. Bitcoin to $1m a coin?

Posted by AK71 at 3:00 PM 6 comments

Labels:

economics,

investment

As a new trading week is about to start, I am reminding myself not to be affected by Mr. Market's mood swings.

Posted by AK71 at 8:38 PM 6 comments

Labels:

investment,

OCBC

The week started with the shutting down of Silicon Valley Bank and Signature Bank by U.S. regulators.

Posted by AK71 at 12:45 PM 4 comments

Labels:

CPF,

investment,

passive income,

Singapore,

USA

I am not feeling too good today.

So, if this blog feels a little incoherent, you know why.

I have so many things flying around in my mind now.

I just need to deposit them here in my blog, my Pensieve.

So, it seems that the U.S. banking crisis is contained once again with eleven big U.S. banks pledging $30billion to First Republic Bank.

This is a significant move to shore up confidence in the U.S. banking system as the individual sums of $1billion to $5billion in deposit are, obviously, uninsured by the F.D.I.C.

It is pretty impressive as it should be quite obvious to anyone that the U.S. Fed is unable to fight high inflation and to bail out the U.S. banking system at the same time.

Choosing to hike interest rate to fight inflation would increase the fallout risk in the banking system while not hiking interest rate might result in higher inflation.

The $30billion joint deposit made to First Republic Bank did not happen because the largest banks in U.S.A. decided all at once that it was in their industry's best interest.

The CEO of J.P. Morgan, the largest bank in U.S.A., Jamie Dimon, together with Jerome Powell and the Treasury secretary, Janet Yellen, seeded the idea.

Jamie Dimon approached his peers and the $30billion package was born.

So, with the banking crisis contained once more, the Fed will be able to hike interest rate next week with one less thing to worry about.

This move will follow the ECB, which just hiked interest rate by 0.5% to fight inflation in the EU.

Bond yields sank for many days in a row, because Mr. Market was betting on the Fed choosing to manage the risk of further fallout in the U.S. banking sector rather than to continue hiking interest rate to fight inflation.

There was also a flight to safety as Mr. Market moved money to the relative safety of treasuries.

With the Fed likely to hike interest rate as planned, investors in Singapore should see yield on the short end of the curve rising again.

So, we should see 6 months T-bill yield going higher from the relatively low cut-off yield of 3.65% per annum we saw in the 16th March auction.

As for DBS, OCBC and UOB, the Monetary Authority of Singapore has issued a statement to say that the exposure which DBS, OCBC and UOB have to troubled Credit Suisse is “insignificant”.

I am staying invested in DBS, OCBC and UOB for income as I expect them to continue to bring home the bacon.

With higher dividends declared, I look forward to getting bigger portions in future too.

What about REITs?

In the current environment, U.S. banks are going to be more selective and risk averse.

So, I believe that it could be harder to secure loans or to refinance for some commercial properties in U.S.A. now.

So, I would avoid those U.S. REITs which have very high gearing and which need to refinance in the next 12 to 18 months.

Digital Core REIT, which is a data centre REIT, saw its unit price crashing because one of its largest tenants, Cyxtera, which accounts for 22% of its income has not been able to refinance a revolving credit facility that matures in Nov 2023.

Moody's downgraded Cyxtera's credit rating to junk as it believes the possibility of default over the next few months is significant.

Only a couple of months ago, there was a chorus of BUY calls for Digital Core REIT by analysts and some finance social media influencers.

It pays to remember not to ask barbers if we need a haircut.

It pays to remember that no one cares more about our money than we do.

Eat crusty bread with ink slowly for peace of mind.

Recently published:

Banking crisis spreads! AK issues warning!

Posted by AK71 at 12:00 PM 2 comments

Labels:

DBS,

investment,

OCBC,

REITs,

UOB

This is a reply to a regular reader and active commentator, Garudadri.

I thought I should publish it as a blog to issue a warning to all readers.

Here goes.

To be quite honest, I am not rubbing my hands in gleeful anticipation of a greater market crash.

Apart from being aware of what a market crash means for many people, I am also a very lazy investor who would very much prefer to do nothing instead of having to do something.

By my own standards, last year was a rather active year for me as an investor, too active for my liking, and I was looking forward to a year of relative inactivity in 2023.

I think Warren Buffett would approve since he famously said that "inactivity strikes us as intelligent behavior."

Nothing would please me more than to see my businesses chugging along nicely and paying me reasonably well, year after year.

I agree with you that if we have the ability to hold long term, barring earth shattering changes to the banking landscape, all three of our local lenders in Singapore should continue to do well even with all the speed bumps along the way.

So, if we have the resources and it is not difficult to find people with deeper pockets than mine, we could buy into DBS, OCBC and UOB now, especially if we don't have any exposure to them yet.

Especially so if we don't plan to look at stock prices regularly over the next few years.

"I would tell investors not to watch the market too closely." - Warren Buffett.

Of course, we have to remember that most of us don't have money gushing in all the time like Warren Buffett does.

He is in a class of his own.

As for the technical analyses (TA) on the stock prices of DBS, OCBC and UOB which I have shared recently in my blog, they are just something I enjoy doing from time to time.

I don't do as much TA as much as I used to many years ago when I was more active in the stock market as a trader.

So, I am probably pretty rusty.

This is why I decided to publish my reply to you as a blog to warn people to take their anti-tetanus jabs before looking at my TA.

AK is just talking to himself as usual.

Warning issued.

|

| Source: T-bills March strategy. Comments section. |

Red Alert! Latest content by AK Production House on the spreading banking crisis, exclusively on my YouTube channel:

Ticketing for "Evening with AK and friends 2023" is ongoing.

Posted by AK71 at 3:00 PM 4 comments

Labels:

DBS,

investment,

OCBC,

TA,

UOB

Just a few days ago, I talked to myself about DBS, OCBC and UOB.

|

| Source: MAS |

Posted by AK71 at 10:10 AM 2 comments

Labels:

DBS,

investment,

OCBC,

UOB

Reader says to AK:

Posted by AK71 at 12:18 PM 0 comments

Labels:

bonds,

investment,

passive income

Not too long ago, I said that restarting my YouTube channel was a good thing and in more ways than one.

Posted by AK71 at 8:31 AM 4 comments

Labels:

investment,

REITs

This blog is a continuation of my blog published last night titled:

March dividends & SSB 3.15% p.a.

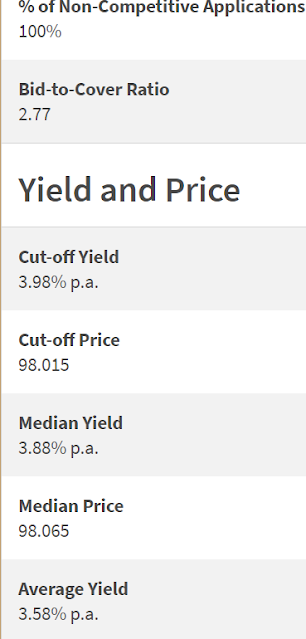

The latest 6 months T-bill auction's numbers are in.

Cut-off yield: 3.98% p.a.

In a recent blog, I said that the US$ has strengthened against the S$ and yields have also moved higher on the front end of the curve.

My expectation was for a higher cut-off yield for the 6 months T-bill and the auction did not disappoint.

I applied for the T-bill, putting in a non-competitive bid with some SRS money raised from the sale of my investment in SATS in early February.

That was fully allotted.

I also put in a competitive bid with some CPF-OA money.

Why a competitive bid in that instance?

I did not want to tempt Murphy's Law with a non-competitive bid when the CPF-OA pays 2.5% p.a. risk free.

My bid yield was very close to 4% p.a. and, fortunately, my competitive bid was also fully allotted.

3.98% p.a. is only a bit higher than the 3.88% p.a. offered by OCBC's FD promotion using CPF-OA funds.

(That offer by OCBC ended on the 28th of February and their new offer of 3.55% p.a. for a 5 months tenure looks relatively unattractive.)

If we take into consideration that the "interest earned" is paid by T-bills at the beginning of the duration and not at the end, however, then, the cut-off yield for this T-bill looks more attractive.

The "effective interest rate" actually exceeds 4% p.a. and it is closer to 4.05% p.a. which, at face value, is even better than what the CPF-SA is paying.

We should also remember that the "interest earned" stays in the CPF-OA where it will continue to generate passive income for me at 2.5% p.a. for the T-bill's 6 months duration.

So, what's not to like?

To me, using CPF-OA money, it really is win and win again with this T-bill!

The T-bill will mature on 5 Sep 23 and I have made a note on my calendar so that I will remember to transfer the funds from my CPF-IA back into my CPF-OA when that happens.

This is so as not to lose interest income which would be paid by the CPF for the month of October.

There are two more 6 months T-bills on offer this month in March with auctions happening on the 16th and 30th.

The plan for me is to place non-competitive bids in both auctions with money in my SRS account.

Apart from applying with SRS money which I earmarked earlier, I could also apply with some of the dividends coming in this month which I have estimated in the blog before this one as possibly being under $40,000.

With yields at the front end of the curve still rising, it is quite possible to see cut-off yields exceeding 4% p.a. in the two upcoming auctions.

A greater exposure to 6 months T-bills using cash on hand would slightly strengthen my portfolio's passive income generation in the month of March.

Getting more T-bills also means staying consistent in my plan to maintain a meaningful exposure to fixed income.

It is probably a good idea to remember that fair weather doesn't last forever and that throwing some defensives into our portfolio isn't a terrible idea.

It is not just about making hay while the sun shines but also about stashing a good portion of that hay away.

This higher exposure to fixed income will generate more passive income in a risk free manner while reducing volatility in my investment portfolio.

Risk free and volatility free, T-bills fit the bill to a t.

I do very much enjoy a good pun.

Anyway, as interest rates are likely to remain higher for longer, this strategy is probably going to help my portfolio bring home the bacon for some time to come.

As an aside, you might want to eavesdrop on Warren Buffett and Charlie Munger in this video before continuing to eavesdrop on AK:

We would very likely appreciate having a meaningful exposure to fixed income a lot more if the world continues to grapple with sticky inflation and more than a handful of economies around the world sink into recession.

Singapore is a very open economy and we would probably take some collateral damage in such a scenario.

If such a scenario should materialize, having a meaningful exposure to fixed income is not only comforting but we could then redeploy the funds which were previously locked up in a gradual manner.

This is if we have laddered into T-bills and fixed deposits which, of course, is what I have been doing.

|

| Source: MAS. |

Using a laddering strategy, we ensure that the maturities of T-bills and fixed deposits are staggered.

If you think that this strategy allows us to have access to investible funds at multiple points in time over the next 12 months, you are right.

Long time regular readers have overheard me talking to myself many times before and would be familiar with what is coming.

Don't be overly pessimistic.

Don't be overly optimistic.

Be pragmatic which means staying invested in genuine income generating assets while preparing for when Mr. Market goes into a depression.

Yes, when and not if.

"There are worse situations than drowning in cash and sitting, sitting, sitting," Charlie Munger.

Charlie Munger said that, not me.

Just talking to myself, as usual.

Reference:

Largest investments updated.

P.S. We cannot always be right and you might want to eavesdrop on Charlie Munger in this video:

Posted by AK71 at 8:00 PM 27 comments

Labels:

bonds,

investment

In my blog detailing changes made to my investment portfolio in January 2023, I said that I increased my exposure to ComfortDelgro.

In that blog, I said that ComfortDelgro's fundamentals looked to be stabilizing and, technically, it looked like ComfortDelgro's stock price was bottoming too.

If you missed that blog or need a refresher, see:

Changes to portfolio in Jan 23.

ComfortDelgro has just reported an increase of 63% in 2H earnings, year on year.

Operating costs for the full year increased 6.3% while operating profit increased 35.1% which is pretty impressive, given the many challenges ComfortDelgro is facing.

Higher dividend income from ComfortDelgro is going to be pretty impactful as it is still one of my largest investments.

ComfortDelgro has declared a final dividend of 1.76c per share and a special dividend of 2.46c per share.

ComfortDelgro has a huge cash pile and, if they do not have better use for the money, paying more generous dividends to shareholders cannot be a bad idea.

Technically, ComfortDelgro is now testing immediate resistance at $1.20 which is provided by a declining 50 days moving average.

If this resistance should be broken, there is a chance that the declining 200 days exponential moving average which is currently at $1.30 could be tested next.

There are multiple resistance levels and although analysts covering ComfortDelgro seem to believe that the worst is over with most having mouth watering target prices for ComfortDelgro's common stock, it could take quite a while before we see those levels.

That is from a technical analysis perspective, of course.

Fundamentally, ComfortDelgro should see a gradual improvement in earnings as we continue to see a return to pre COVID-19 pandemic norms.

So, from this perspective, to expect a mean reversion to happen sometime in the future isn't unreasonable.

Still, we want to stay grounded in our expectations.

If we are investing for growth, at this point, it seems that ComfortDelgro is probably a poor choice but as an investment for income, ComfortDelgro is probably still able to pull its own weight in any investment portfolio.

I am not going to hold my breath if I am looking for massive capital gains here, for sure.

Instead, I will celebrate the higher than expected dividend for now.

Reference:

Add CDG or the banks?

Posted by AK71 at 8:01 AM 1 comments

Labels:

ComfortDelgro,

investment,

TA

Good news from UOB and OCBC!

When DBS declared a special dividend, I wondered if UOB and OCBC would do the same.

Unfortunately, there is no special dividend from UOB and OCBC.

However, they did declare higher final dividends!

|

| Source: UOB. |

UOB increased their final dividend by 15c or 25%.

This isn't too shabby since it is very close to a 50% payout ratio.

We can probably expect this to be the norm in future as it isn't a special dividend and, thus, unlikely to be a one off event.

As for OCBC, they hiked their final dividend by 12c!

While it is lower than UOB's 15c hike in absolute terms, it is much higher in percentage terms.

An increase of 12c from 28c to 40c is an almost 43% hike!

I am so stunned like vegetable!

OCBC is not only one of my largest investments.

OCBC is my largest investment in equities.

My investment in OCBC is much larger than my investment in UOB.

So, my passive income in the form of a final dividend from OCBC is going to be very much larger this year compared to last year.

This is especially when I increased the size of my investment in OCBC many times in 2H 2022.

Although my war chest was rather depleted, I was able to do this by reducing my investments in Centurion Corp. and ComfortDelgro which were both underperforming.

In my blog on Wilmar's record dividend, I said I was feeling a little giddy.

I think it just got worse.

Want evidence?

See the new photo of AK below.

Alamak!

I slapped myself hard and reminded myself that the higher dividends from our local lenders will go some way to filling shortfalls from Sabana REIT, CapitaLand China Trust and IREIT Global this year.

Still early days, to avoid possible disappointment, I am keeping expectations low with regards to full year passive income for 2023.

After all, I cannot dictate how much my investments should pay me.

I will continue to exercise prudence when it comes to expenses as, generally, this is something I have considerable control over.

However, to be honest, I am feeling more sanguine about this year's passive income now.

Whether the year would end on a high note for me as an investor for income should become clearer in another 6 months or so from now.

Till then, I just have to be patient and wait.

"Wall Street makes its money on activity. You make your money on inactivity."To fellow UOB and OCBC shareholders, congratulations! Huat ah!

References:

1. Reallocation of resources.

2. DBS, OCBC and UOB.

3. DBS: Special dividend.

4. 4Q 2022 passive income.

5. Largest investments (4Q 2022.)

Posted by AK71 at 8:00 AM 16 comments

Labels:

DBS,

investment,

OCBC,

passive income,

UOB