I was vested in E-pure when it was 20c a share thereabouts. This was back in early 2009.

I was convinced that China's drive to keep its economy humming in the wake of the Lehman Brothers crisis would benefit the water infrastructure businesses.

I was also heavily vested in Hyflux Water Trust at that time from 30c for the same reason.

Read related blog post here.

E-pure was a Chinese company and was likely to be favored over Hyflux in China while Hyflux Water Trust was a business trust with zero gearing treating water for Chinese industrial estates and had a yield of about 17% at a unit price of 30c.

I divested E-pure completely by the time it neared 60c a share and watched dumbfounded as the share price went on to form new highs, almost doubling from my sell price of close to 60c.

Hyflux Water Trust was, of course, privatised a few months ago.

Read related blog post here.

I have been wondering if I should re-invest in E-pure which has been renamed SoundGlobal for some time now.

It remained on my watchlist but I simply refused to buy any of its shares at prices higher than 60c.

That's just the memory effect working and, in this case, it seems to have paid off. Related post here.

I just told myself that if the price did not come down to more reasonable levels, there are always other investments out there.

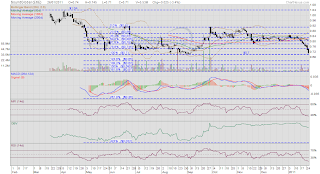

Since hitting a high of $1.04 on 7 April 2010, this counter has not formed a higher high. It is currently hugging the lower Bollinger band as it fast approaches the lows of early September 2010 at 70c a share.

The obvious difference is that the low of early September 2010 was part of a bottoming process and the MACD was getting ready for a bullish crossover with the signal line.

The MACD is now declining rapidly in negative territory as its distance with the signal line widens. This is very bearish.

Having said this, both the MFI and RSI are in oversold territories and 70c, being a low that was the price of a successful bottoming process could provide some support.

Whether it would hold up is another question. I would not speculate on the strength of the support here.

When to accumulate?

We want to look out for possible positive divergence between price and the momentum oscillators or volume.

We want to look out for the downtrend halting and clearer signs that price is breaking out of downtrend.

I like to use Fibo lines in such an instance to see how low price could go in case support breaks. Support is, of course, at 70c.

Looking at the chart, the three golden ratios are at 62c, 59.5c and 57c. Buy some at those levels?

I might if the other signs are encouraging.