I have always liked industrial S-REITs.

Long time readers would remember blogs like this:

Office REITs versus Industrial REITs.

Of course, although it has dropped the word "retail" from its name, it still has shopping centers in its portfolio.

Industrial REITs having much higher distribution yields made the decision to invest heavily in them easier too.

We will always need all kinds of warehouses and with e-commerce being so entrenched, they are even more in demand.

Business parks fit a niche demand for where office space in the CBD is considered too expensive.

Together with all other types of industrial buildings, they are pretty difficult to disrupt as a class.

In fact, they are more likely to be disrupters or friends of disrupters than victims of disruption.

Of course, on hindsight, we also see how resilient industrial S-REITs can be in a pandemic setting.

I have the following in my portfolio:

1. AIMS APAC REIT

2. Sabana REIT

3. Frasers Logistics Trust

4. Capitaland China Trust

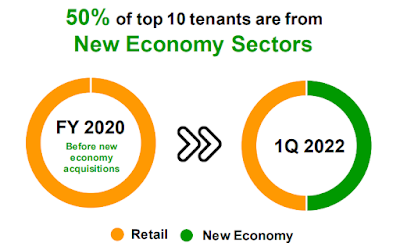

Yes, it is a bit strange to see Capitaland China Trust in this list because it was Capitaland Retail China Trust before.

Of course, although it has dropped the word "retail" from its name, it still has shopping centers in its portfolio.

It is more of a hybrid now.

|

| Source: Presentation 26 April 2022 |

I have been adding to Capitaland China Trust at around $1.10 a unit.

I don't think that the lockdowns in China can go on forever.

So, the pessimism will lift at some point.

The initial plan was to have the investment similar in size to my investment in Frasers Logistics Trust which is one of my larger smaller investments.

However, I am now thinking of making my investment in Capitaland China Trust similar in size to my investment in Sabana REIT which is one of my largest investments albeit the smallest in the club.

Maybe, I am feeling a little sorry for Sabana REIT being all alone in the lowest bracket in my list of largest investments.

Capitaland China Trust is trading at a big discount to NAV.

Its NAV is about $1.50 a unit.

Capitaland China Trust also offers a relatively high distribution yield.

If a DPU of 9c continues to be paid, at $1.10 a unit, that is a distribution yield of almost 8.2% which sufficiently compensates for any negative vibes Mr. Market might have.

Yes, I think that we will look back at this episode in history as just negative vibes.

It is like how Mr. Market was feeling very negative about Sabana REIT when ESR REIT made the low ball takeover offer.

It was because of that episode that I was able to accumulate aggressively at around 35 cents a share which brought my investment in Sabana REIT back into my list of largest investments at the end of 2020.

The distribution yield for that investment based on my cost is almost 9%.

Pulling another rabbit out of the hat with Capitaland China Trust, perhaps?

Your guess is as good as mine, of course.

Recently published:

AIMS APAC REIT: Gearing too high?

AIMS APAC REIT: Gearing too high?

Related posts:

1. Reallocate as interest rate rises.

1. Reallocate as interest rate rises.