Sabana REIT was trading at a huge discount to NAV when I increased my investment significantly at the end of 2020 and the start of 2021.

Today, it is still trading at a 13.5% discount to NAV.

If we think a 3.1 cent DPU is sustainable, then, at 45c a unit, we are looking at a distribution yield of 6.89% which isn't too bad.

It isn't too bad because we could see DPU increasing in the not too distant future as Sabana REIT's portfolio is under rented.

Of course, there is a possibility that the portfolio could remain under rented.

However, I have a feeling that things are more likely to improve.

I like to see what insiders are doing and I find it very interesting that Donald Han, Sabana REIT's CEO, bought 100,000 units at 45c a unit in late April.

Being under rented means that Sabana REIT does not have to depend too heavily on acquisitions to grow its income.

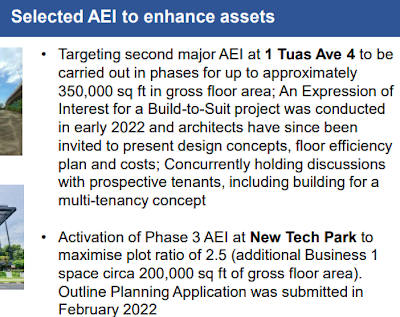

From their presentation dated 21 May 2022, this could give income a boost:

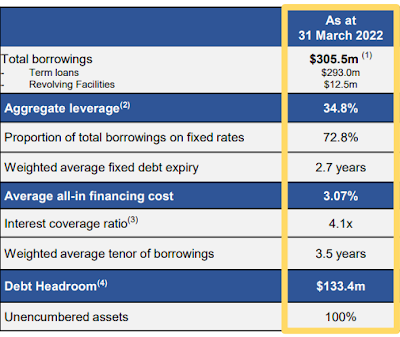

Sabana REIT's financials are relatively strong and this is important as peace of mind is priceless.

It is very fortunate that Sabana REIT did not fall prey to the low ball offer by ESR REIT.

A gem in the rough that is still in the process of being polished, I hope that Sabana REIT will shine brighter in my portfolio.

Of course, whether Mr. Market agrees or not is something else.

If Mr. Market agrees, then, we should see Sabana REIT trading closer to its NAV of 52 cents per unit in time to come.

My bowling ball that thinks it is a crystal ball says a unit price of 48 cents or even 49 cents would not be unreasonable.

The information shared in this blog is taken from Sabana REIT's latest presentation dated 21 May 2022.

See complete slides: HERE.

Having positive vibes about Sabana REIT has nothing to do with the $20 shopping vouchers they sent to me.

Honest!

I hardly leave home but I guess I will make a trip to look look see see.

Recently published:

1. CLCT: Another largest investment.

2. FLT: Another largest investment.

Related post:

Sabana REIT's lesson.