As REITs will always be relevant to the income investor, I have been thinking of how best to increase my investment in REITs again in an environment of increasing interest rates and I decided I should choose REITs which have a better plan or chance to improve their income.

Hedging interest rate risk is very well and good but this only kicks the can down the road because sooner or later, higher interest rates will hit home.

So, having the ability to increase income is still key as to whether a REIT will do well with interest rates increasing over time.

Very importantly, I also decided that it is probably a good idea to diversify more geographically and to reduce my portfolio's reliance on Singapore.

Remember I said this in a recent blog post on Sabana REIT?

However, things will get even more challenging for REITs from here on with interest rates expected to rise further. Industrial REITs here are facing an oversupply of space and a malaise in demand. (Source: History with Sabana REIT and current thoughts.)

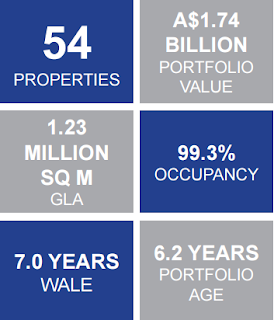

So, although I like AIMS AMP Capital Industrial REIT (AA REIT), for example, last month, I decided to initiate a position at 92.5c a unit in Frasers L&I Trust (FLT) which owns logistics and industrial properties in Australia.

The IPO price was 89c a unit and, to be honest, I was waiting for the price to come down from there before buying some.

This was because although there are many things to like about FLT, the distribution yield was on the low side for an industrial REIT.

Unfortunately, the decline I had hoped for did not happen.

So, although FLT's distribution yield of 7+% doesn't seem very attractive when compared to AA REIT's 8+%, I decided that there are enough positive factors such as relatively low gearing and a portfolio of mostly freehold properties in Australia for me to invest in the REIT.

|

| (30 November 2016) |

Other than FLT, I have another new investment in my portfolio.

Again, this has a portfolio of real estate outside of Singapore.

Some readers might remember that I have been waiting for a chance to get into CapitaMall Trust (CMT).

I remember I spent quite a bit of time blogging about it once upon a time: here.

However, from then till now, CMT's unit price did not decline enough to be persuasive, I feel.

Translation: AK is "giam siap" and wants to buy at a much lower price.

What?

You need a translation for "giam siap"?

I blur.

After much consideration, I accepted the offer from Mr. Market to invest in Capita Retail China Trust (CRCT) instead, paying $1.40 a unit.

Just a few months ago in September 2016, CRCT hit a high of $1.66 a unit.

Why the big decline in unit price?

It was probably due to a 10.6% drop in DPU, year on year.

A new tax in Beijing and a weaker RMB were the reasons. NAV also declined by almost 12% to $1.56 per unit.

Offering a higher yield than CMT even now and having ownership of a portfolio of shopping malls in a market with arguably more room for growth (in terms of organised retail activity) than Singapore's, I decided CRCT is probably worth investing in.

After all, a 10.6% decline in DPU doesn't warrant an almost 15.6% decline in unit price unless we are expecting a more severe decline in DPU.

In fact, I think that DPU should recover somewhat as CRCT's non-Beijing malls could pick up the slack over the course of the year.

Having said this, I am reminded of a longer term risk, that land lease in China is typically 50 years and that could explain why Mr. Market demands a higher distribution yield for a retail REIT in China compared to one in Singapore.

I do not know if, like in Hong Kong, land lease could be renewed easily. This is one risk to bear in mind if we choose to invest in CRCT.

|

| (September 2016.) |

This arrangement is similar to Lippo Malls' and I blogged about it before (See blog: here).

A decline in RMB against the S$ could see both gearing and interest expense affected in a bad way.

Although I have said that CRCT would likely see income increasing over time, this is going to be a gradual process.

So, to be prudent, I am keeping my investment in CRCT relatively small.

|

| CRCT's 4Q2016 results. |

Annualising the DPU gives me a distribution yield of 6.75%.

Again, why did I choose to invest in FLT and CRCT in an environment of rising interest rate which would impact their cost of doing business eventually?

You blur?

I also blur.

Xizhimen Beijing. Just next to the train station.