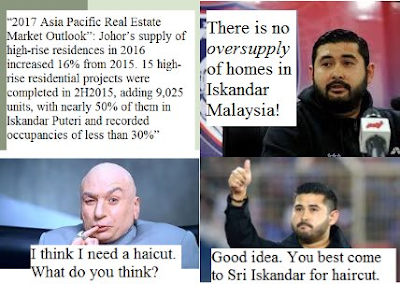

Singaporeans are pouring money into the Iskandar region in Johor, buying up real estate.

"Singaporeans make up 74 per cent of foreign home buyers in the Nusajaya township in Johor's Iskandar region, according to Malaysian property developer UEM Sunrise."

Read story: here.

(Added in November 2016.)

Anecdotal evidence shows that most are buying for investment, hoping to rent out their properties or to sell for a profit later on.

Few are entertaining the possibility of staying there.

I have spoken to friends in Malaysia and some of them stay in Johor.

They told me that the optimism is just scary and they really cannot see how Johor would have so many renters to rent from enthusiastic (and, in their words, naïve) Singaporean landlords.

One told me that he now stays in one of these new townships and the neighbourhood he is staying in is not even 50% occupied.

Yet, there are new neighbourhoods being constructed around his.

"This is not Kuala Lumpur. You Singaporeans are crazy."

I think people are optimistic about property in the Iskandar region because of the proximity to Singapore.

So, if anyone is thinking of buying a property there for investment, it makes sense to buy one that is close to the proposed link to Singapore's MRT line.

A train ride to Singapore's city centre then could take no more than 40 minutes assuming that there isn't a jam at the Customs checkpoints.

Am I interested?

Well, there are too many optimists amongst Singaporean buyers now.

I will wait until a time when they are mostly pessimists before looking.

I could miss the boat but it is of no consequence to me.

I rather miss it and still have my money than to join the crowd, buy in a mad flurry only to regret later on if I lose money.

(February 2014.)

|

| 2 February 2017 |

Disastrous property investments!