This is going to be short blog in reply to a reader's question.

It is a question I get asked somewhat often.

Sharing the reply as a blog is probably a good idea as it would give me a blog to point to in future.

So, the reader wants to know why Top Up my Medisave Account (MA) when the money cannot be withdrawn?

So, the reader wants to know why Top Up my Medisave Account (MA) when the money cannot be withdrawn?

The reader is probably referring to the Basic Healthcare Sum (BHS) which has to be maintained in the MA once we turn 65.

Otherwise, of course, the BHS can be drawn upon for specific purposes.

For me, the objective of the MA is to have funds for medical expenses in case of hard times.

To be honest, I hope I don't ever have to do a withdrawal.

If I must draw upon the money in my MA, it means that I am very sick and experiencing financial hardship.

Anyway, the next thing I am going to say is something I have blogged about before.

Anyway, the next thing I am going to say is something I have blogged about before.

Having a maxed out MA also means that I get free medical insurance.

Want to know how?

See:

Since the reader's focus seems to be on CPF funds withdrawal at age 55, it should be interesting to note that any excess interest income generated by our MA will flow into our Special Account (SA) or into our Ordinary Account (OA) if our SA has hit the Full Retirement Sum (FRS.)

For me, it flows into my OA.

See:

Since the MA has the same interest rate of 4% as the SA, this mechanism makes it attractive as an additional income generator since money in the OA and SA can be withdrawn once we have set aside the FRS in our Retirement Account (RA) at age 55.

Some readers might also be interested in this blog:

If we can afford to do so, I believe that maxing out our MA is a good idea.

Max it out and let compound interest do its magic.

As usual, this is just me talking to myself, of course.

Recently published:

37 comments:

Dear AK

Would like your advice if the following is acceptable:

If my family member will be max out the 8K tax relief (7K to SA, 1K to MA), would I be getting additional tax relief by topping up another 2K to his MA. Which in turn will allow me to add another 2K of tax relief from my end (assuming I have not reached the cap of 8K as my SA is full)

I top up MA for the tax relief. Hehe!

Some people are not happy that their money is trapped in CPF MA. However if you intend to leave some money as your estate for your children,then it makes alot of sense (and dollars) by topping you your MA to the maximum.

Thanks, AK.

Appreciate your posting.

It remind me to top my $3000 cash to my Medisave before my salary credit in end Jan 2022.

I am 53 this year.

After topping up my medisave, as my SA has reached the maximum ceiling, all my CPF contribution that supposed to go into my Medisave will flow into my OA.

Best Regards

David

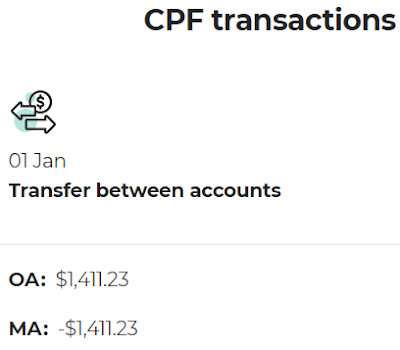

Hi AK. For excess to flow into OA, one needs to meet the $63K BHS For 2021. For $63K, 4% interest is $2.5K+. Why is the transfer amount only $1.4K+? Did I miss something?

Hi Delldine,

I believe that all CPF members are given Tax Relief for up to $8K Top Up to own MA/SA/RA and also $8K Top Up to loved ones' MA/SA/RA.

This means a total of $16,000 is eligible for Tax Relief per CPF member.

I explained it in this blog:

CPF Amendment Bill 2021 and AK talks to himself.

Of course, if you are still doubtful, best to give CPFB a call to clarify. :)

Hi Leonard,

Thanks for pointing this out! :D

I missed out this point on Tax Relief as it doesn't apply to me. ;p

Reference:

Income tax payable...?

Hi RambuTan,

Oh, that is a very good point too. :)

Using CPF to leave a more significant monetary legacy is a good idea. :D

Reference:

Generous monetary legacy for children.

Hi David,

Top Up MA soon is a good idea since you still have earned income.

A percentage of your monthly mandatory contributions will still flow to your SA.

So, you will see both OA and SA growing for the rest of the year but you are right that your OA will grow faster now that your MA is at the prevailing BHS. :)

Reference:

CPF SA is not a free lunch...

Hi Henry,

Yes, that is how the overflow from MA to OA works.

Some money from my MA was deducted for Incomeshield and for Eldershield last year.

Didn't fill the hole after. -.-

Must remember to fill the hole this year. ;p

Thanks AK.

The query in point is more about me topping up the remainder 2K into his MA, rather than him putting 7K to SA, 3K to MA, since he would only get max 8K tax relief. Hope my understanding is correct.

AK71 our Doyen of CPF, is 精打细算 when it comes to the intricacies of maximising CPF returns.

Nothing escapes his mastery.

Always listen to AK whenever he talks to himself.

Always !!

0;)

Hi Delldine,

Each CPF member is allowed tax relief for a max of $8K Top Up to own account and $8K Top Up to loved ones' accounts.

As long as we do not exceed these limits, there shouldn't be an issue getting tax relief.

So, in your example, he would top up 8K and get tax relief and you would top up 2K into his account and also get tax relief.

Of course, to be sure, you want to enquire with CPFB. :)

Hi Laurence,

You make me sound so penny pinching. LOL.

I have been a lot more easy going with money in recent years. :)

Hi AK, thanks for all the blogs in 2022, reminding all of us to do the necessary top ups, MA, SRS, HDB Refund, VC.

I can't find any blog from you regarding Matched Retirement Savings Scheme (MRSS). Do you think you can write abit it and encourage people to top up like our MA? I topped up my mum MRSS $600 in 2021 and she received the matching $600 on 7/1/22. Now for 2022, i did the same top up $600 and in January to maximise the power of compound.

Thanks for reading this.

https://www.cpf.gov.sg/member/growing-your-savings/saving-more-with-cpf/matching-grant-for-seniors-who-top-up

https://www.straitstimes.com/business/70000-cpf-members-to-get-40-million-in-matched-top-ups-to-their-retirement-accounts

HI AK,

There is an error in your post.

BHS stop increasing when we turn 65 years old. Not 55 years old. :-)

https://www.cpf.gov.sg/member/faq/healthcare-financing/basic-healthcare-sum/is-there-a-maximum-amount-that-i-can-save-in-my-ma

Thanks for your continued teachings and inspiration.

Regards,

Ed

Hi WongKen,

Thanks for the suggestion. :)

ASSI is more of a personal blog these days and I mostly talk to myself about stuff which I am interested in which usually means it has an impact on my life.

My mom did talk to me about Matched Retirement Savings Scheme (MRSS) because she was interested in doing it for her siblings but, unfortunately, they are too old to qualify.

You did a good thing. :D

I might sneak in a mention in future blogs, if I remember. ;)

Hi ED,

Well spotted!

Edited.

Thanks! :)

https://theindependent.sg/netizens-joke-forget-banks-cpf-is-the-safest-place-to-put-your-money-because-even-you-cant-withdraw/

Hi ngs,

LOL. ;p

Well, many still don't trust the CPF system. :)

Reference:

Why care about your CPF savings?

"If all else fails, I know I would still have the ultimate safety net which is my CPF savings."

Hi AK71, a very happy CNY to you and your family!

Happy cny ak

Good result from CLCT

Hi Rellangis,

Thank you.

Happy CNY to you too. :)

Hi SgFire,

Good CLCT!

Happy CNY!

Huat ah! :D

Hi AK,

I was lucky enough to find your blog few years ago and have learned a lot from you since then. Really appreciate the sharing of your investment wisdom, it has been very beneficial for many loyal readers like myself. Just want to take this opportunity to wish you a very Happy New Year, good luck and good health in the Tiger year!

Hans

Hi AK,

Wishing you & family a Happy + Healthy + Prosperous Year of Tiger.

祝您 新年快乐, 身体健康, 万事如意

Best Wishes

David

Hi Hans,

I am just talking to myself here in ASSI. ;p

Still, I am very glad that you have found this helpful. :)

Wishing you a very happy new year with good health and good fortune too! :D

Hi David,

Fortunately, I could read all those Chinese words. ;p

Kamsiah you plenty plenty! :)

Wishing you happy new year, good health and may all things go the way you want them to. :D

Hi AK. Wishing you a Happy New Year and wish you all the best if you try your luck on $16 million TOTO tonight. Wanted to ask you whether you be taking up the scrip dividend for Sabana Reit ? Thanks.

Hi AK,

Wishing you & family 新年快乐, 身体健康, 万事如意 and best of luck if you got buy this evening $16 million TOTO.

Like to ask for your opinion on Sabana Reit scrip dividend. Would you advice to take cash or scrip dividend.

Thanks.

Hi tcc,

Happy new year!

I didn't buy TOTO. ;p

Hope you won something. :)

As for Sabana REIT, unless it is a very compelling offer or I want to increase my investment in the REIT, I would take cash.

I do feel that Sabana REIT is worth more and I have blogged about this many times before.

However, as I have accumulated a relatively large position at 35 to 36c a unit, I am not looking to increase my investment at this time.

So, to take cash or scrip would depend on our circumstances and what we aim to achieve.

References:

1. 4Q 2020 passive income...

2. Largest REIT investments...

3. Sabana REIT's lesson...

Thanks AK for your valuable advice.

Hi tcc,

Alamak. Where AK gave advice?

Just talking to myself as usual. -.-"

hi tcc,

pls rmb ak shi fu is mental, he always talk to himself

Hi Yu,

Absolutely mental.

You are correct. (TmT)

Hi AK,

The future FRS amounts are finally released. Now its increasing at a rate of 3.5% as compared to 3% previously.

2022: $192000

2023: $198800

2024: $205800

2025: $213000

2026: $220400

2027: $228200

Lucky my CPF friends and I have listened to you talking to yourself and max our SA asap, compounding and forever outpacing the increases.

https://www.cpf.gov.sg/member/infohub/news/cpf-related-announcements/budget-highlights-2022

Hi WongKen,

Yeap! It is better to make the system work for us than for us to work for the system! ;p

References:

1. CPF SA outperformed...

2. Showing off CPF savings...

Post a Comment