Quite a few things happened in 1Q 2022.

As the world continues to grapple with variants of COVID-19 with the latest being the Deltacron or the offspring of the Delta and Omicron variants, Russia decided to start a war.

Inflation which was already gaining steam was pushed higher.

The Fed increased interest rate and there will be more to come.

In an inflationary environment, we will see rising prices in commodities and we could see companies like Wilmar doing better.

In an environment of rising interest rates, we could see banks doing better.

Even REITs could do better and for those who missed my latest blogs on REITs, see:

Why AK invests in REITs?

Why AK invests in REITs?

and

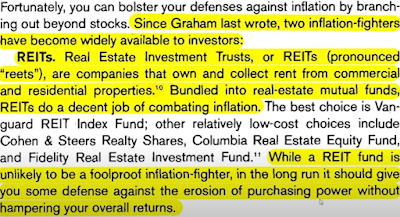

For those who are well read, guess where this passage came from?

Anyway, regular readers know that I didn't do much in the stock market last year.

I feel that, overall, my investment portfolio is in pretty good shape.

None of my investments which matters to me is keeping me up at night.

(Only Genshin Impact keeps me up at night now.)

Last year, I added to my investment in Sabana REIT in early 2021 and then added to my investment in Wilmar as its stock price sank in 3Q 2021.

Nothing else.

So, I didn't do much last year but what about this year so far?

Well, I thought I wouldn't be doing anything in 1Q 2022 because I rather liked how my investment portfolio looked.

As I did not buy much of anything in the stock market in more than a year, my cash pile has been growing at a steady pace which really isn't a bad thing.

However, towards the end of 1Q 2022, I decided to add to my investment in Centurion Corp.

My investment in Centurion Corp. was already very substantial and I really shouldn't be adding but I just couldn't resist it.

So, I guess AK doesn't have as much character as he thought he had. (TmT)

There is only a small handful of people who each has 1 million or more shares of Centurion Corp. and if I am not careful, I might join their ranks.

Prior to 1Q 2022, the last time I added to my investment in Centurion Corp. was in 2020.

I should say "the last few times" because looking at my records, there were multiple entries made at 32c a share in 2020.

Why couldn't I resist adding to my investment?

OK, I had a chat with my bowling ball and it had a few things to tell me.

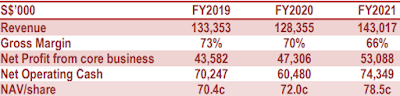

Centurion Corp. has weathered the pandemic well and has stayed profitable despite the challenges.

This speaks volumes.

Although it is just 0.5 cent per share, my bowling ball told me that they could have easily paid 2 cents per share.

Really?

See:

If we look at the numbers, net operating cash not only recovered but exceeded pre-pandemic level.

Centurion Corp. was paying 2 cents dividend per share prior to the pandemic.

Then, why only 0.5 cent dividend per share now?

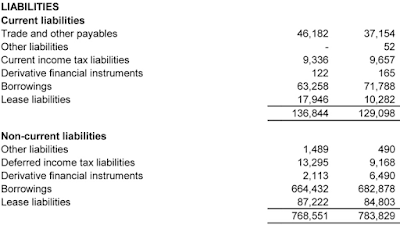

If I were to make a guess, they are probably being cautious which isn't a bad thing, especially if they plan on paying down debt in the face of rising interest rates.

Looking at their financial statement, Centurion Corp. reduced borrowings last year when dividends were suspended.

Of course, if they have identified new businesses which would generate more income but would like to draw on internal resources instead of debt, it isn't a bad idea either.

Centurion Corp. should pay a larger dividend to shareholders if they have no better use for the money on hand.

Centurion Corp. has recovered well and seems to be as valuable a company today as it was pre-pandemic.

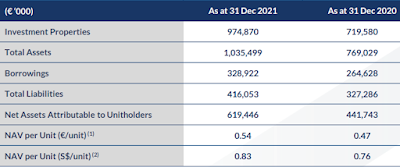

In fact, if we look at the NAV/share, it is much higher than it was pre-pandemic which suggests that Centurion Corp. is even more valuable today.

For the rest of the year, we could see Centurion Corp. doing better as Singapore eases border restrictions and more foreign workers return.

We can expect the occupancy of their dormitories for students in the UK, Australia and USA to do better for the rest of the year too.

Their student accommodation assets in the UK have already seen a big improvement in occupancy.

While the price of its stock languishes even as things improve, it seems like a good opportunity to increase my investment in Centurion Corp. and at a bigger discount to NAV too.

Centurion Corp. is undervalued but it could stay undervalued for a long time.

It might take a while but I like to think that patience will be rewarded.

"UOB Kay Hian analyst Adrian Loh has kept "buy" on Centurion with a higher target price of 45 cents from 43 cents previously." Source: The EDGE.

Now, time for my passive income numbers.

In 1Q 2022, the three largest income generators for me were:

1. IREIT Global

2. AIMS APAC REIT

3. Sabana REIT

Total passive income received in 1Q 2022:

S$ 40,697.68

S$ 40,697.68

In 1Q 2021, my passive income was $36,551.14 and that was some 48% higher than it was in 1Q 2020 due to larger investments made in Sabana REIT and IREIT Global.

So, the fact that 1Q 2022 passive income was some 11% higher than it was in 1Q 2021 makes me very happy and the bigger number is thanks to IREIT Global's stellar performance.

I like investing in good income generating assets.

I like investing in them especially if they are undervalued.

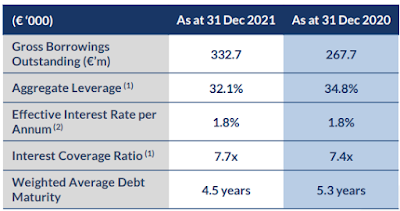

IREIT Global not only generates good income for me, the REIT is also financially strong which gives me peace of mind:

I have many blogs on IREIT Global and if you are interested, use the Search function at the top of the web version of my blog to find them.

There won't be any income distribution from IREIT Global and Sabana REIT in 2Q 2022 but DBS, OCBC and UOB should be paying dividends then.

It will be interesting to see if my passive income improves year on year in 2Q 2022 as the banks were still paying lower dividends in 2Q 2021.

1Q 2022 was filled with bad news and, for me, passive income was a bright spark amidst all the doom and gloom.

If we hold a relatively diversified investment portfolio of bona fide income producing assets, we should enjoy some peace of mind even as the world seems more than a bit messed up.

Hold some investment grade bonds too and regular readers know that the CPF does that for me.

I remind myself that I can only do what I feel is right as I keep my feet firmly on the ground and not chase the latest get rich quick ideas.

If I am able to grow my wealth slowly as a retiree who depends solely on passive income to meet all my financial obligations, I am happy.

Invest more.

Speculate less.

For sure, I do not have all the answers and I can only hope for the best.

That's all for now.

Till the next blog, stay safe.

References:

1. Russia invades Ukraine...

1. Russia invades Ukraine...

18 comments:

Hi AK. Happy April Fool Day.

Always looking forward to read your post and am happy for you that your 1st quarter dividend improve over 2021. With the 3 local bank dishing better dividend, am quite sure your 2nd quarter dividend will be equally impressive as compare to 2021.

Stay cool stay safe.

Dear AK

Lovely to hear from you and congratulations on your Q1 2022 returns- At over 12K per month, really inspiring

I hold the two REITS other than Sabana and I will be waiting to add the latter at at least 44c, if not lower

They have done well for me and although a EU recession might hurt IREIT, it will benefit a bit from persistent lower interest rates as a blessing in disguise

As regards our banks, a barbell approach of adding both banks plus REITS, has helped me throughout these years

They are efficient and natural counter hedges and the overall shareholder return is predominantly dividend with capital appreciation from the banks adding ti it

Of course, time helps compounding returns and I would rather prefer to regularly invest than hold cash in the current inflationary environment- that is just my preference

Best wishes

Garudadri

Hi tcc,

2Q 2021 suffered a big drop in passive income for me because of the missing contributions from Centurion Corp. and Accordia Golf Trust.

So, I am looking forward to an improvement in 2Q 2022. :)

Have a happy "foolish" day! :D

Hi garudadri,

We are all wired differently, of course. :)

It might be due to the emotional scars I have from my growing up years that unless I have some cash, I would feel insecure. -.-"

I also like to be able to go shopping with a bigger cash hoard whenever Mr. Market suffers a depression and I did that during the Global Financial Crisis and, more recently, the pandemic induced bear market.

Well, peace of mind is priceless and knowing what works for us is more important. :)

Reference:

Are stock prices coming down?

Any comments with regards to the following:

VOTE AGAINST RESOLUTIONS 3, 4 AND 5 AT SABANA’S 26 APRIL 2022 AGM AND INCREASE THE VALUE OF SABANA’S UNIT PRICE

Hi ngs,

We are having a discussion on this in the comments section of the following blog:

How to invest in REITs?

Welcome. ;)

Dear AK,

If you increase your shares in Centurion Corp further, you may be able to sit in their boardroom and ensure they put good use of their cash stash. =)

Warmest Suggestion. ;D

Hi Unknown,

Alamak, that sounds like work and that is something I would probably want to avoid at all cost.

I do not think that having 1 million shares would be enough to qualify for a seat though.

Anyway, I will try my best not to hit that number.

Promise. ;)

Dear AK

Do you have any thoughts on Nanofilm? It has come down to close to its IPO price.

Cheers

Mei

Hi Mei,

Nope, first time I have heard of it. ;p

Hi AK,

It's only natural for your shares to cross a certain threshold as your overall networth increase. In fact, you need to come up with a new category $350k-$500k :p

Thanks for the updates, Q2 will be a bumper quarter of dividends!

-Wei

Hi Wei,

To be honest, I don't keep track of my net worth at all.

I have a vague of idea of where it is at but that's it.

There are bloggers who track this number but not me.

I suppose I am more interested in cash flow than the balance sheet. ;p

As for a new category of $350 - $500K, I think I have always had such a category.

It is there in my past blogs on "largest investments."

For example:

Largest investments updated 4Q 2019.

Haven't done a blog like that recently but regular readers would have an idea how my portfolio has morphed.

Lazy AK. ;p

Do you feel that Centurion chairman pay is excessive?

Hi Blur Sotong,

As a minority shareholder and an investor for income, I would like the management and directors to be paid as little as possible.

So, all of them are paid too much in my eyes. ;p

If we feel this way as minority shareholders, wouldn't the majority shareholders who also happened to be the chairmans, feel this even stronger? The directors' pay relative to their profits are over rated. Considering further that they already would have gotten the lion share of the first dividends payout since covid19. I have no problems that CEO gets his fair deserves as he was leading at the helm through the tough times in the pandemic and he got a pay cut. But don't know what the chairmans were doing during the difficult times. When my centurion shares turn green, will get out. Well run company but may not be looking out for the little man's interest.

Hi Blur Sotong,

I agree that most of the time, it is every man for himself. :)

My motivation for investing in Centurion Corporation is for income and as long as they pay a meaningful dividend again, I am happy to stay invested.

I see a DPS of 1.5c to 2.0c a year as reasonable as that would allow them to retain a big chunk of earnings to grow the business or to reduce debt.

Centurion Corporation is a bit like the Singapore Government.

Such highly paid ministers for such a small country but as long as they get the job done, maybe, it is OK to close one eye.

Alamak, now, I scared I get invited to lim kopi. ;p

Reference:

Added Centurion to my portfolio.

"In a bourse filing, the property management company said that the decision to sell its US asset portfolio within the Centurion US Student Housing Fund was made following a strategic review of its accommodation portfolio. Centurion expects the move to enhance shareholder value as part of an ongoing drive to rationalise its portfolio of assets."

Reference:

Centurion to begin sale process of US asset portfolio.

"... the lease with GMG Generalmietgesellschaft mbH (“GMG”), the sole tenant at Bonn Campus, has been extended by 12 months based on the current rental rates.

"Under the existing lease agreement, GMG will need to notify IREIT if it intends to terminate its entire lease at Bonn Campus by 16 April 2022, being one year before its lease expiry on 16 April 2023.

"As GMG did not provide any such notification by 16 April 2022, the lease is automatically extended by 12 months in accordance with the lease agreement and will now expire on 16 April 2024."

Reference:

IREIT Global announcement.

Post a Comment