It has been a while since I last published a blog like this.

I have been lazy.

So, what's new, right?

In my defense, I did publish a couple of blogs on my largest REIT investments.

For example:

Largest REIT investments updated.

Anyway, readers who have been following my blogs regularly probably will not get much out of this blog.

They would already have a rough idea how my investment portfolio has morphed in the last 2 years or so and also the reasons why.

For what it is worth, here is a quick update.

$500,000 or more:

CPF

Yes, I know that some will laugh at this.

It is OK because I am laughing too.

Laughter is good for our health.

So, laugh away, whatever the reason. ;p

See:

$1.1 million in CPF savings.

My CPF savings is the investment grade bond component of my portfolio.

It is my ultimate safety net.

From $350,000 to $499,999:

AIMS APAC REIT

IREIT Global

This bracket welcomes a new member, IREIT Global.

AIMS APAC REIT is my longest lasting top investment and has witnessed all the changes in my portfolio.

It sounds a bit spooky when I put it this way.

Absolutely free of cost for quite some time already, it is still generating good income for me.

I hope IREIT Global will be good to me in a similar fashion too.

Time will tell.

New readers might be interested in this blog:

AIMS APAC REIT or IREIT Global?

From $200,000 to $349,999:

ComfortDelgro

Centurion Corporation

DBS

OCBC

UOB

Wilmar International

ComfortDelgro is the weakest position in this bracket no thanks to the pandemic but even with the huge decline in its share price, the market value of my investment is still above $200,000.

I do expect things to improve from here.

See:

ComfortDelgro: AK replies to comments.

Centurion Corporation is a much larger investment for me today and it is close to being promoted to the next bracket.

I blogged about Centurion Corporation recently and if you don't remember, see:

1Q 2022 passive income.

Like ComfortDelgro, I expect things to improve from here for Centurion Corporation.

UOB is a new member in this bracket as I only became invested in the bank during the last bear market.

My investments in DBS, OCBC and UOB are very close to being promoted to the next bracket as their market values have ballooned.

I have not added to my positions since the last bear market.

So, this is mostly due to the higher prices of their common stock.

To reduce my reliance on REITs for income, building long positions in all three local banks has proven to be rewarding thus far and I hope it continues to be so.

See:

Higher dividends from DBS, OCBC and UOB.

Wilmar International is another new member in this bracket.

More accurately, it is a returning member.

Wilmar moves into this higher bracket mostly for the same reason as the banks.

Its share price has appreciated meaningfully.

Still undervalued even though its share price is much higher now, it could possibly go higher.

Of course, it could also stay undervalued.

From $100,000 to $199,999:

Sabana REIT

Sabana REIT is my one and only investment in this bracket now.

The REIT returned as one of my largest investments in late 2020 after the low ball offer by ESR REIT was rejected.

Having activist investors on my side is very reassuring.

I look forward to more value being unlocked.

See:

Sabana REIT to the rescue.

As promised, this is just a quick update.

OK, maybe, I will nag a little.

Remember, AK does not wear a coat.

So, no coattail to ride on.

Riding on coattails can be very dangerous especially if we do not have insurance. ;p

References:

1. Largest investments updated (4Q 2019).

2. Investing with some common sense.

Recently published:

Lying flat...

25 comments:

Thank you AK for publishing this self-talk update with the investment amount categories of each item within.

Only a portfolio that gives us peace of mind, and regular interest, dividend payouts with substantial amounts for our needs, allows us to choose whatever we want to do in life.

This is the most important lesson that I've learnt from your blogposts since you've started and I have also embarked on this passive income portfolio building from then till now, to be able to choose if I want to continue work or just go off course, to do what I want to do with my life, instead of subscribing to work slavery. Kam Xia Hamidah. =D

Hi AK,

I have been a long time "eavesdropper" of you "talking to yourself". Your blogposts are always a delight to read.

Your CPF numbers are very impressive and going by your saving trajectory you should attain 1M0A by 53/54 and 2M58.

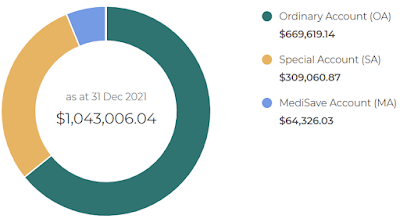

Would love to include your CPF tree in this collection (see attached link). If you dont mind that, please share your CPF Pie chart in your next blog post and I will "plant" your CPF Wealth Tree. https://t.me/Loo1M65/269873

Thanks your inspiring blog posts!!

Hi Unknown,

Not being shackled to our jobs is so important since not many of us are fortunate enough to love our jobs.

Even if we love our jobs now, things could change later on.

Having the ability to fire our boss is always a good thing. ;)

"Going off course" is not a bad thing if it is something we want to do and not an accident. ;p

Of course, it is never my way or the highway.

However, whatever we choose to do, it should give us peace of mind as that is really priceless.

After all, peace of mind is also why we want to be financially free. :)

Gambatte! :D

References:

1. To be a happy peasant.

2. Wage slaves should be fearful.

3. Freedom to enjoy life.

4. When can I quit my job?

5. Retirement adequacy 101.

Hi mysecretinvestment,

Thank you for breaking your silence.

Much appreciated.

Time to share your secret investment with us? ;p

The projections you have made for my CPF savings are eye popping! Wow! :D

I don't know when I will have another blog post because I could be pretty busy in Neverwinter and Genshin Impact as both are running events.

Real life is also going to be a bit crazy next week.

So, I will edit this blog to include my CPF pie chart after breakfast later. ;p

Hi AK:

Once again thank you for talking to yourself and we managed to eavesdrop.

Maybe you should include a new category : > $1M to house your CPF and hopefully some of your other holding will make it to this category in the years to come.

Cheers

TCC70

Hi tcc,

Aiyoh, I think it is very difficult lah.

I have been growing my wealth at a snail's pace in the last few years.

Although my passive income number is impressive to many people, much of it is not reinvested in equities.

See:

How much passive income is enough?

I used to be able to invest all of my passive income in equities when I was working.

Not having an earned income is one of the pitfalls of retirement. (TmT)

Not really complaining as I should have enough resources to be quite comfortable till the day I say bye bye to this world.

Crossing fingers. :)

Hi AK,

Thanks so much for so kindly providing your CPF pie chart.

I have duly "planted" your CPF Wealth Tree here : https://t.me/Loo1M65/273413

You have been an inspiration to many and hopefully having your Wealth Tree in our plot will encourage even more S'poreans to build up their CPF savings as a viable nest egg for their retirement.

To more good years!

Hi mysecretinvestment,

It looks like a fun project.

If it is able to inspire many more CPF members, I am glad.

The CPF is probably insufficient to provide most of us with a middle class lifestyle in retirement but as an ultimate safety net, for me, it is the best tool available. :)

Reference:

CPF can be our best friend...

Out of curiosity, clearly you are absolutely fine with concentrating most of your new REITS money in IREIT. Aims is already free. Why would you want to stay invested in Sabana when Aims is clearly a better buy than Sabana? Or switch to more IREIT instead?

Hi Blur Sotong,

Well, when I see a clear opportunity to make money, it is hard for me to ignore. ;p

Sabana REIT was very undervalued and ESR REIT was trying to get it for a song.

Fortunately, ESR REIT's attempt failed.

So, I used a big chunk of what was left in my war chest to scoop up Sabana REIT on the cheap.

Those purchases made in late 2020 and early 2021 have gone up by 30% in market value.

The distribution yield on cost is also relatively high.

As an investor for income, I have no reason to sell right now.

Although I like AIMS APAC REIT very much, I did not add to my investment in a big way during the last bear market because no matter how much I liked the REIT, I reminded myself that concentration risk is real.

So, I went ahead to build a bigger stake in IREIT Global instead.

I also like IREIT Global and it allows me to diversify my REIT holdings into office buildings and Europe which means reduced sectorial and geographical concentration risk.

Now, my investment in IREIT Global is about the same size as my investment in AIMS APAC REIT.

The same voice which cautioned me against increasing my investment in AIMS APAC REIT is making itself heard again but this time it includes IREIT Global. ;p

Sabana REIT is still undervalued today but just not as much as before and if it continues to generate a good income for me, I will stay invested. :)

You might be interested in this blog where I replied to a reader, csky, on why I did not buy more Sabaana REIT instead of IREIT Global?

Reply to reader in Jan 2021.

References:

1. IREIT Global 2019.

2. IREIT Global rights issue.

3. AIMS APAC REIT 2021.

Thanks for the detailed description of your thought process. Haha! It looks like you have the good kind of cash allocation problems.

Hi Blur Sotong,

Well, a first world problem is still a problem. (TmT)

Hi Ak

Didnt see cLct in the list. Are you still holding?

Hi SgFire,

Oh, yes, I still have CLCT.

It just isn't one of my largest investments.

Hi ASSI, thanks for sharing your portfolio and investment thoughts.

If my old brain remember correctly, you used to own QAF cause we all love free bread so much. Currently the price is at around 86 cents, you have not yalk about this stock much recently. My father love to eat bread and I am thinking of investing so he can eat for free. 😃 Thank you.

AK is our God of Dividend Stocks & Reits and our Idol !!!!! 0;)

Hi nch,

I still have QAF in my portfolio and I have been looking to add too.

Somewhat busy this week because of Qing Ming Festival.

Also, there is an ongoing event in Genshin Impact and a new event is coming in Neverwinter a few days from now.

So, I cannot promise I will blog about QAF. ;p

Hi Laurence,

Oh dear, simi god?

I am just trying not to make (too many) mistakes in my retirement.

Would be most tragic if I must be gainfully employed once more. -.-"

Hi ASSi, thank you for taking the time to blog about QAF, you just got a new fan after I shown my dad your blog and he is going to read your past posts over the years. It is good that he wants to know more about investing rather than thinking it is all a scam when it comes to investing. Hope our family can eat free bread for donkey years too. Take care.

Hi nch,

Alamak.

I just checked and there are almost 4,000 articles in ASSI. O_o

Maybe, just read those published in the last 3 or 4 years. (^m^)

Tell him AK is mental.

Read for fun can liao. ;p

Ah, ok, I found this one from 2013:

Investing in the stock market makes you a gambler.

Gambatte! :D

"Our newly listed Indian associate, Adani Wilmar Ltd, has done extremely well. From an IPO valuation of US$4 billion when it listed on 8 February 2022, its market capitalisation has increased by more than 3 times to above US$13 billion as at 28 April 2022.

"In addition, valuation for Shree Renuka Sugars Limited, our 62.5% owned Indian sugar subsidiary, has also gone up sharply from US$863 million on 31 December 2021 to US$1.6 billion as at 28 April 2022.

"Commodity prices have surged since the onset of the Russian and Ukraine conflict in February 2022. Contribution from our Russian and Ukrainian investments is not material but the sustained high commodity prices will benefit our Plantation and Sugar Milling segment in the coming months. However, the high commodity prices are also expected to impact margins in our Food Products segment.

"Our tropical oils operations will likely be affected by several changes in Indonesian government policies. Despite the tough environment, we are cautiously optimistic that performance for the rest of the year will be satisfactory."

Source:

https://media-wilmar.todayir.com/2022042917182166503508_en.pdf

IREIT Global has secured a lease extension of six years from its sole tenant at Bonn Campus in Germany for 100 per cent of the property starting from May 2023.

In a bourse filing on Tuesday (May 17), the manager said its revised lease with Deutsche Telekom's real estate leasing unit will now expire in April 2029.

Source:

https://www.straitstimes.com/business/companies-markets/ireit-secures-6-year-key-lease-extension-at-bonn-campus-property-in-germany

Hi AK.

Eurozone inflation accelerated to 9.1% in Aug. How will this affect ireits?

Thanks and hope you can talk to yourself.

Hi Rae,

Inflation generally means higher prices which also means higher asking rent.

So, inflation is generally a good thing for landlords as they ask tenants to pay higher rents.

As for IREIT Global, their asking rents are largely linked to the CPI.

So, the higher the CPI, the higher their asking rents.

The ECB is likely to increase interest rates to combat inflation which will also help to strengthen the EURO which would be good for DPU in S$ terms.

Of course, it would also mean higher interest rates on loans but IREIT Global has a very conservative gearing level and also a very high interest coverage ratio.

However, if Europe goes into a deep recession, then, things could get dicey for all Europe focused businesses.

"The European Central Bank is clearly awake to the threat of inflation. Thursday’s unanimous 75-basis point hike to its benchmark deposit rate is the largest in the ECB’s 24-year history. The era of negative rates is now firmly in the rear-view mirror. The bank’s forward guidance is dramatic: If necessary, more hikes will follow over the next few meetings into early next year."

The ECB Hikes Big to Fight Inflation and Bets on Optimism.

Post a Comment