This is going to be a quick blog post as I am feeling somewhat enervated this evening.

Capitaland is causing some people some concern. Is the price going to retreat further after touching a new low of $3.07? I believe questions like this are futile. Nobody knows the answer. TA is about probability after all.

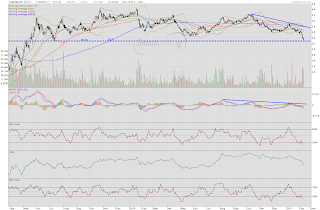

However, we can say that chances of a rebound, if not a reversal, are higher now. With a lower low in price, the MACD spots a higher low. Yes, we have a positive divergence. However, it does not mean that price could not go lower, mind you.

In the event that the positive divergence delivers the goods, look to the declining 50d and 100d MAs for resistance, currently at $3.28 and $3.37 respectively.

CapitaMalls Asia saw volume increasing significantly today with its previous low at $1.57 tested, forming a black candle in the process. It remains to be seen if $1.57 could hold up as support or, if a lower low were to form, whether the MACD could spot a higher low. Yes, looking out for a positive divergence.

Things look pretty dicey right now.

NOL is yet another counter which is spotting a positive divergence. Lower low in the share price but a higher low in the MACD. However, with such a persistent downtrend and with a narrow trading range, it could take a mammoth effort for share price to break resistance provided by the declining 50dMA in case of a reversal effort.

Let's see if the share price could open and close higher than $1.81 (today's high) in the next session. If successful, we could have a morning star setup, a three stick reversal pattern. That would be promising.