I have been asked this question in various forms by various people over the years.

"How much cash are you holding now?"

However, like how I have always sidestepped questions regarding my net worth and the size of my investment portfolio, I have habitually sidestepped the question.

I have published a blog post in the past to explain why.

See:

My investment philosophy or my investment portfolio?

So, this blog post is going to be the first time since I started blogging in 2009 where I share some specific numbers.

Why the change of heart?

This is because of what someone told me not too long ago.

It would help readers have some kind of yardstick for themselves in their decision making process.

I am always mindful of the fact that all our circumstances are different.

So, there is nothing sacrosanct about what I am about to reveal.

We do what our circumstances allow.

Of course, we could push ourselves to do more and we should but how much to push, that depends on our threshold for pain.

1. War Chest

I have said again and again that is it important to have a war chest.

When opportunity knocks, we want to have the resources to take advantage of the opportunity.

For me, such an opportunity usually takes the form of market pessimism.

Like Buffett said before, be greedy when others are fearful.

It is harder to do well when everyone is feeling optimistic and chasing prices higher.

Then, how much should we have in our war chest?

I get asked this so often.

There really is no magic number or percentage.

It depends on Mr. Market.

When Mr. Market is feeling optimistic, my war chest continues to grow in size.

When Mr. Market feels pessimistic, my war chest could be totally empty.

During the Global Financial Crisis, I emptied my war chest and I have blogged about this before.

What about now?

At the moment, I have about $200K in my war chest.

As I do not have a lavish lifestyle and because my passive income exceeds my expenses, this sum is likely to grow.

The money is stored stored in my T-bill ladder.

See:

So, how to grow our war chest?

Basically, just spend less than we make, either actively or passively.

Want to grow it faster?

Become a better saver.

2. Emergency Fund

Of course, when we talk about cash on hand, we have to talk about emergency fund.

How much do I have in my emergency fund now?

About $250K.

This amount has stayed the same for a while now.

It gets adjusted upwards from time to time to account for inflation and other changes in life.

An emergency fund is important because if all else fails, we have near money we can rely on.

The last time I made an adjustment to my emergency fund was when I decided that I needed $48,000 a year myself and I should give my parents $48,000 a year too, directly or indirectly.

That's a total of about $100,000 in expenses.

I like to keep an emergency fund that would cover at least 24 months of expenses.

So, I have overcompensated.

The good thing is that I have a good size safety net and I wouldn't have to tinker with it for many years to come.

See:

Passive income and updating my budget.

At this point, I must say that it is important to build a meaningful emergency fund first before ever investing any money in risk assets which includes stocks and properties.

I made a related video on this topic:

Of course, while building an emergency fund, our war chest would go hungry but only in the meantime.

If you are wondering how large your emergency fund should be, you might want to eavesdrop on AK here:

How large should an emergency fund be?

Where do I store my emergency fund?

In fixed deposits.

This is because fixed deposits pay higher interest and they are easier to break than T-bills.

At the moment, $100K of my emergency fund is in the UOB ONE Account because that is really near money and makes 5% p.a.

Of course, come 1 May, I would have to try and bump this number up to $150K as UOB ONE would be cutting the maximum interest rate to 4% p.a. on the first $150K.

3. Float

What is a float.

Well, it is just money floating in my savings accounts which I can use on a daily basis.

I try to have about $20,000 floating at any one time.

This is not because I need all the money on a daily basis but really because I am just mental.

There is no rational reason for this apart from the fact that I feel safe having at least this much which I can use to pay anyone or for anything while leaving my emergency fund intact.

Any excess money, I should be using to strengthen my T-bill ladder.

However, by now, it is obvious that AK cares more about having peace of mind and feeling comfortable than maximizing returns.

Like I always say, I am fine being approximately right.

What I want to avoid is being absolutely wrong.

My float is currently closer to $50,000 than $20,000.

Bad AK! Bad AK!

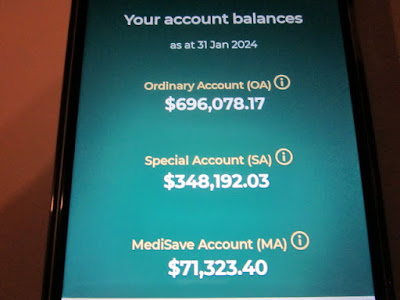

4. CPF

I know some will remind me about my CPF savings which is, of course, pretty substantial.

Most of the money in my CPF account will become cash when I turn 55 in another couple of years.

That would be when my CPF account becomes a savings account because I would be able to withdraw the money whenever I want.

I can see my war chest becoming much larger because of this.

Of course, I could also continue to treat my CPF savings as the bond component of my portfolio which can be used to invest in other risk free and volatility free instruments like T-bills.

Thus, the bond component of my investment portfolio would remain intact.

I will decide what to do when the time comes.

OK, I am feeling a bit breathless now.

Time to stop talking to myself.

So, how much cash am I holding?

If AK can do it, so can you!