This is my first passive income update for 2023.

I will talk a bit about what has happened in the fixed income space first.

As expected, the latest 6 months T-bill auction closed with a higher cut-off yield of 3.85% per annum compared to the previous issuance which had a "shockingly low" cut-off yield of 3.65%.

A couple of weeks ago, I produced a video which shared my thoughts on what a further interest rate hike by the Fed would mean for certain assets.

You can watch or listen to it here:

The latest Singapore Savings Bonds offer which closed on Wednesday was oversubscribed.

A higher 10 year average yield of 3.15% per annum attracted Mr. Market's attention, no doubt.

3% per annum 10 year average yield, I believe, is the threshold to watch.

The Singapore Savings Bonds which were undersubscribed earlier in the year offered lower 10 year average yields of 2.97% and 2.9%.

As long as the 10 year average yield is above 3% per annum, it makes more sense to me to put money in Singapore Savings Bond than to do voluntary contribution to my CPF account.

See:

CPF or Singapore Savings Bond?

A week ago, I shared my updated fixed income strategy and if you missed it, read it here:

My application for the latest Singapore Savings Bond with $16,000 of money which would have been earmarked for CPF voluntary contribution in 2024 was fully allotted.

After this, I would have another $22,000 from future dividends to deploy to either Singapore Savings Bond or CPF for the rest of the year.

Total amount of money to be deployed this way in 2023 is $38,000.

Not to rehash too much, I am providing links to two blogs about changes to my portfolio in the months of January and February here:

1. Changes to portfolio in January 2023.

2. Changes to portfolio in February 2023.

In March, I put more money to work in 6 months T-bills.

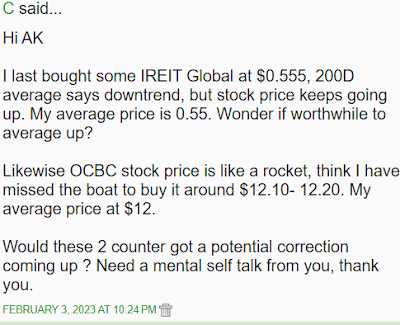

I also added to my investment in OCBC as the price of its common stock sank below $12 at one point.

So, how much did I receive in passive income in 1Q 2023?

$41,563.36

I am quite pleased with this although it increased year on year by only 2%.

In 1Q 2022, my passive income was $40,697.68.

Back in 1Q 2022, my investment in IREIT Global was a star performer.

Income received from IREIT Global in 1Q 2023 declined 11.5%, year on year.

A combination of higher operating expenses and the cessation of its sole tenant in its Darmstadt asset dealt a double whammy.

However, readers who have been following my blogs on IREIT Global would understand why I remain invested.

I like investing in bona fide income generating businesses with strong balance sheets.

I like them even more if I am able to get them at a discount to their true value.

To me, IREIT Global fits the bill.

See:

IREIT Global: Buying more?

Pertaining to this idea, if you do not follow my YouTube channel, you might want to watch or listen to this video which I released recently:

As IREIT Global contributed the lion's share of passive income a year ago, I was expecting passive income in 1Q 2023 to see a decline.

So, you can imagine why I am pleasantly surprised to see it increasing 2% year on year instead.

I must have done something right along the way.

What did I do differently?

I gave it some thought and decided that I have only done things which I would have usually done.

I have been putting more money to work in income producing assets.

My investments in Sabana REIT and IREIT Global are larger now than they were a year ago.

That mitigated the reductions in their DPU.

I received some income from T-bills in 1Q 2023.

I didn't have this a year ago.

So, I have been saving more money with the belief that cash is not trash and that it has become a relatively rewarding asset class to hold.

Then, all else being equal, income from some investments actually increased, year on year.

Higher income received from some of my larger investments in 1Q 2023, year on year, made an impact.

The following deserve mention:

1. Ascott Trust

2. AIMS APAC REIT

3. CapitaLand China Trust

You might want to watch or listen to a YouTube video I produced on AIMS APAC REIT here:

CapitaLand China Trust's much higher DPU was surprising because I remember reading somewhere that their DPU reduced.

I checked and apparently, there was a 2 cents per unit entitlement declared.

If not for this, DPU would have been much lower at 1.4 cents instead of 3.4 cents.

OK, they give, I take.

If things do not improve significantly from here and if I do not put more money to work, then, year on year, I could see a decline in passive income in 1Q 2024.

Of course, what I receive in passive income for the whole year is more important than what I receive in a single quarter.

If 1Q 2024 should turn in a lower amount of passive income, hopefully, 2Q and 3Q in 2024 could help make up for it.

In the same vein, I am looking forward to passive income in 2Q and 3Q this year as, for me, their numbers are usually much bigger compared to what 1Q and 4Q bring to the table.

Having said this, my portfolio's 1Q 2023's performance is not too bad.

It is the result of putting more money to work and also the higher income generated by a few of my investments.

To be honest, it definitely benefitted from a splash of luck too.

It is important to remind myself that luck is unreliable and we should always be prepared for crises.

Pertaining to this point, you might be interested in this YouTube video I released recently:

Finally, an update on "Evening with AK and friends 2023."

I received a message from Kenji a few days ago that 80% of the tickets were sold.

At the time, there were about 60 tickets left.

So, if you were unsure if you could make it on 10 May, you might want to make a note on your calendar.

Some tickets might still be available closer to the event date and you could get your ticket then.

Ticketing link: HERE.

Till the next blog, remember, financial freedom is not a dream.

Investing in bona fide income generating assets, especially if they are undervalued by Mr. Market, will help us along the way.

Watch or listen to this latest video on how AK is getting free money for life from Hock Lian Seng:

Hope you like most of my YouTube videos so far.

Literally, it is eavesdropping on AK talking to himself.

Remember to subscribe to my YouTube channel if you want timely notifications.

In closing, I should remind myself that what I have done as an investor is nothing amazing.

Just plodding along.

Unless severely disadvantaged, anyone can do it!

If AK can do it, so can you!

Related post:

1Q 2022 passive income.