(Update 4 Jan 17):

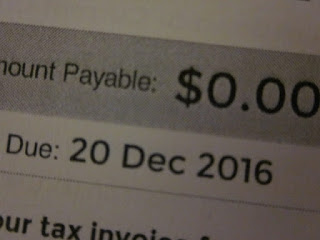

AK has denied SP Services some revenue! Happiness is a utility bill that looks like this.

All thanks to the really cool weather recently (and not the miserable reduction in electricity tariff).

-------------

Since having my own place once more, I have had discussions with friends on more domestic topics like the household utility bill. In all these discussions, I discovered that my utility bill is relatively low.

My consumption is below the national average for my house type, apparently.

What about my bill in dollar terms?

It has remained more or less the same compared to my utility bill a few years ago when I had my old place and stayed there for 4 years or so, $100 a month, give or take a few dollars. I think this is quite remarkable.

I absolutely cannot live without the air con being on at home. If I am home, the air con and air purifiers are on. Since I am home for many more hours now each day compared to a few years ago, the air con is on for many more hours per day too.

I also watch more TV now as I have more free time. I like watching the Travel Channel, HGTV, Discovery Channel, National Geographic and the History Channel.

I have a 40" Full HD LED TV now compared to the 26" LCD TV I had in my old place before I replaced it with a 32" LED a year before I sold the place. I think my many TV watching hours now should consume more electricity.

How is it that my utility bill has not gone up much?

I think it is fair to say that the air con probably consumes more electricity than other electrical appliances at home. So, the first thing to do is to make sure to insist on having the energy saving Invertor technology.

4 ticks, nothing less.

Then, I will usually set the air con temperature to 24 degrees centigrade. On a very warm day, maybe, 23 degrees centigrade.

The lower the temperature we set, the higher the energy consumption. So, 23 degrees centigrade is usually the lowest I would go.

I have a friend who sets the temperature to 18 degrees centigrade at home as the norm. That is freezing and sends the energy bill through the roof!

Well, since moving to my new place, I got acquainted with my new Invertor air con which has a neat dehumidifier function. This function removes moisture from the air.

Often, we feel warm because of the high humidity level in our climate. The human body is not able to cool itself as well in a humid environment. If we are able to lower the humidity level in a room, our body will feel cooler naturally.

If we set the air con to dehumidifier mode, it lowers the humidity level in the room to about 60%. This is much lower than the usual humidity level in Singapore.

What does the symbol look like?

A couple of water drops. Unfortunately, you won't find this mode in older air cons.

If you have Invertor air cons at home and if they are quite new, they should have the dehumidifier mode. If you cannot live without the air con on at home, try this mode. It should lower energy consumption and you should see some savings.

When I go to bed, I would switch the air con back to the regular mode, the one with the snow flake symbol.

This lowers the humidity level as well as the temperature in the room. 24 degrees centigrade, of course.

It keeps the room cool enough and I don't even need to use a blanket. Just need to wear socks to bed.

I hope I have not put anyone to sleep with this blog post. Zzzzzz.

Related posts:

1. Photos of AK's home.

2. What can we do to survive the haze?