I got into Chinese tech in the middle of April this year.

I had no interest in Chinese tech for the longest time because I thought they were trading at crazy high prices.

There is also the fact that I am an ignoramus when it comes to tech stocks.

Sigh, the truth hurts.

Anyway, I forced myself to finally take an interest in the middle of April as the rapid and drastic multi months decline in Chinese tech stock prices made them looked like stuff which value investors might be interested in.

I was also fortunate because I could easily get exposure to Chinese tech stocks through an ETF listed in Singapore.

Fortunate because if I had to buy in the Hong Kong or U.S. stock exchanges, I probably wouldn't have bothered.

If you don't remember or missed that blog, see:

Investing in Alibaba and Tencent now.

Then, a few days later, after the unit price declined by around 10% from my initial purchase price, I doubled my investment in the ETF.

The plan was to buy again if the low of 15 March 22 should be tested.

The low was not tested and I did not add to my investment.

If you don't remember or missed that blog, see:

Buying more Chinese tech stocks today.

I changed my mind later in May because Nio had a secondary listing in Singapore.

Finally understanding that EVs are no longer a novelty but eventual replacement for ICE vehicles, I decided to get some exposure to Nio.

I bought some of Nio's common stock with an eye to accumulate on further weakness in price, specifically if the lows should be tested.

If you don't remember or missed that blog, see:

However, just before I published the blog, I discovered that Nio would be included in the Hang Seng Tech Index soon.

I decided there and then that it would be much easier to simply add to my investment in the ETF which I did.

My smallish position in the ETF accounts for just under 1% of my portfolio now.

Both of my tiny investments in Nio and Lion OCBC Securities Hang Seng Tech ETF are nicely in the black now.

The plan is to hold on to my investment in Nio because I want to see how high it could go especially if it is the next Tesla.

Anyway, it is a really small investment.

So, a small gamble.

As for the ETF, my average price is under 70 cents a unit and the plan now is to sell some if the unit price goes much higher from here.

As the ETF does not pay any dividends received to unit holders, the only way to make some money here is through capital gains.

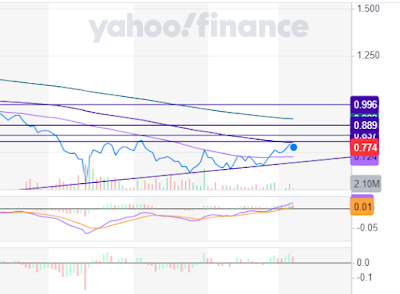

It has been a while since I did any trading and these are the possible levels I have identified:

|

| Zoomed in to see prices clearly. |

The longer term moving averages are still declining.

So, I am expecting layers of resistance as unit price tries to go higher.

It looks to me like the Hang Seng Tech ETF has bottomed and we can truly buy the dips now instead of buying the downtrend.

A relatively strong band of support should be at 70 cents to 72 cents a unit.

Related post:

Cut loss on Alibaba or buy more?

3 comments:

Sold one third of position at structural resistance which also coincides with the declining 100d MA at 80.3 cents a unit.

Hi AK,

Do you intend to buy on dips again, or just finish selling everything and end of story...

Thanks,

KK.

Hi KK,

I am adopting a trader's mentality with the ETF.

So, I am likely to buy if the unit price should test support once more.

Will have to remind myself not to get carried away.

Just for pocket money.

If I look at this like an investment for income, this trade has given me a "dividend yield" of 288% but it requires a bit more time and effort.

I have been too lazy to do a lot of trading for many years now.

Post a Comment