In my last blog post, I said that I have already made a $4,000 Top Up to my Medisave Account.

That would help to generate more interest income to pay for my medical insurance.

4% risk free return is really not bad and gives me peace of mind.

Then, the next thing to ask is what about the rest of the year?

Regular readers would know that for many years, I was making voluntary contributions to my CPF account.

Every year, I would make sure to hit the Annual Contribution Limit allowed by the CPF.

That was especially when interest rates were very low.

Risk free and volatility free with reasonably attractive interest rates, the CPF is a great option to help us build a safety net in retirement funding.

However, in the past 2 years, some things changed.

Bond yields moved higher and I blogged about how buying Singapore Savings Bonds might be more attractive than making voluntary contributions to the CPF for some members.

It was certainly the case for me.

With my MA maxed out, more of the money from voluntary contributions would flow into the OA which pays 2.5% p.a.

End result is an average of 3.0% p.a. interest rate for my voluntary contributions.

So, I used the money meant for my CPF to buy Singapore Savings Bonds whenever the latter offered higher than 3% p.a. in ten year average yield.

Towards the end of last year, I did make a small voluntary contribution of $8,000 to my CPF account.

Why?

With Singapore Savings Bonds seeing lower than 3% in ten year average yields, the CPF was more attractive again.

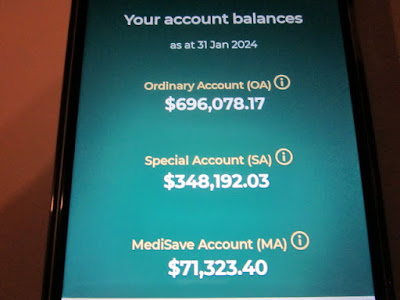

Today, I received a notice from CPF that the pie chart for my account is ready.

This,

1.2M53.

Such a mouthful.

So, with some help from higher yielding T-bills, the CPF OA money has grown faster.

Of course, the government did most of the heavy lifting to grow my CPF savings.

My CPF savings could have grown a lot more had I made a bigger and earlier voluntary contribution.

Of course, that would have been a silly thing to do as I could get higher returns from another similarly rated bond.

Why didn't I use the money for equities instead if I was attracted to higher returns?

I believe in having a meaningful allocation to risk free volatility free bonds.

Exchanging CPF savings for equities goes against this belief.

Especially for a person of my age, a meaningful risk free and volatility free component in my investment portfolio becomes even more important.

If the equities market should crash and we happen to need the money, people would appreciate this point much more.

To be fair, I have a substantial exposure to equities and do not need a greater exposure.

For people who have a much lower exposure to equities and have a lot of money in their CPF accounts, it could be different.

It is all about sizing allocation appropriately for our circumstances.

Anyway, in 2025, I am likely to resume voluntary contributions to my CPF account with Singapore Savings Bonds likely to continue the recent trend of offering lower than 3% in 10 year average yield.

So, the CPF pie would grow much bigger with both the government and myself doing some heavy lifting.

I am 53 and I will have full access to my CPF savings in 2 years from now.

3% p.a. for a 2 years AAA rated Singapore government bond is not bad at all.

If AK can talk to himself, so can you.

Related post:

CPF or SSB?