Long time regular readers of ASSI know why AK was able to do much better on the investment front in 2022.

It wasn't only because AK avoided the highly speculative maze of cryptocurrencies and the high growth, zero dividends high tech space.

AK reallocated resources to enlarge an already relatively large exposure to our local banking sector in his investment portfolio.

Investments in DBS, OCBC and UOB did most of the heavy lifting in my portfolio in 2022, raising my full year passive income above the $200,000 mark.

In 2023, for various reasons, income generated from my investments in REITs as a group will likely take a hit as most have reported lower income distributions.

IREIT Global, Sabana REIT, CapitaLand China Trust and Frasers Logistics Trust have reported lower income distributions while AIMS APAC REIT and Ascott Residence Trust have reported higher income distributions.

With higher dividends declared by DBS, OCBC and UOB, I am hopeful that they, in the worst case scenario, would be enough to offset the weaker performance of REITs in my portfolio.

Not hoping for an increase in passive income, year on year, I would be happy to see passive income in 2023 staying the same as the year before.

March is the first month of the year in which I receive more meaningful sums of passive income.

I have quite a few more bills to pay this month as I have offered to pay more recurring expenses for my parents.

The recurring expenses to be added to the list are motor insurance and road tax for the family car.

I must pay for my own car's motor insurance and road tax this month too.

Those are the big ticket items this month, which, thankfully, occur only once a year.

Still, I would have some money left to invest with and, as I shared in an earlier blog, I plan to apply for the Singapore Savings Bond offered this month.

I plan to set aside $10K for that.

Then, with whatever money is left from passive income received in March, I had planned to get some 6 months T-bills as short term yields remain elevated and, therefore, relatively attractive for the income investor.

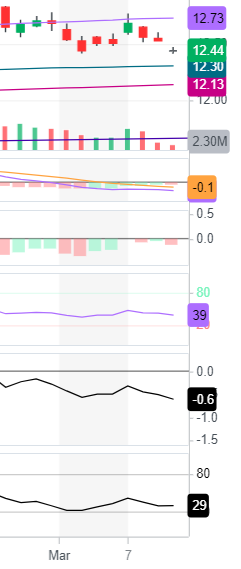

However, when I took a look at the charts of DBS, OCBC and UOB today, they look pretty bad in a good way, if you know what I mean.

For DBS, it is currently testing an important long term support and if it should break, the eventual target could be $32.00 and, if that should happen, I might buy more.

If I wasn't already substantially invested in DBS, the current level seems like a good place to get a foot in, especially with a bumper dividend on the way.

For OCBC, I see a positive divergence as the MFI, a momentum oscillator, seems to be forming a higher low as the stock price forms a lower low.

This suggests to me that smart money is still accumulating even as the stock price stays above long term supports provided by the 200 days moving averages.

This could change, of course, and if the longer term supports should break, which seems unlikely in the near term, I would be interested to increase exposure at under $12 a share.

UOB, unlike OCBC, does not have a positive divergence and the stock price breaking a long term support is, therefore, not surprising.

Still, another long term support, the 200 days moving average is at $28.48 and, with momentum staying negative, we could see that tested.

If that should happen, if I didn't already have a significant exposure, I could get some although I would prefer to buy only when I see a positive divergence.

Fundamentally, all three local lenders are well capitalized and well run.

It now looks like Mr. Market could possibly offer me lower prices to increase my exposure to all three local lenders in the not too distant future.

So, instead of putting all the excess money from my passive income in March into T-bills, I might hold more cash instead, just in case.

For readers who have not visited my blog in a while, I published a blog yesterday regarding "Evening with AK and friends 2023."

You might want to take a look if you are interested in attending.

See:

Evening with AK and friends.

Have a good weekend!

Related posts:

1. T-bills and March strategy.

2. March dividends and SSB.

3. Give parents enough money?

4. UOB and OCBC final dividends.

5. DBS special dividend.

6. Largest investments updated.